S$200-S$600 cash disbursement credited for some S'poreans on Dec. 3, 2024

Assurance Package money in for some.

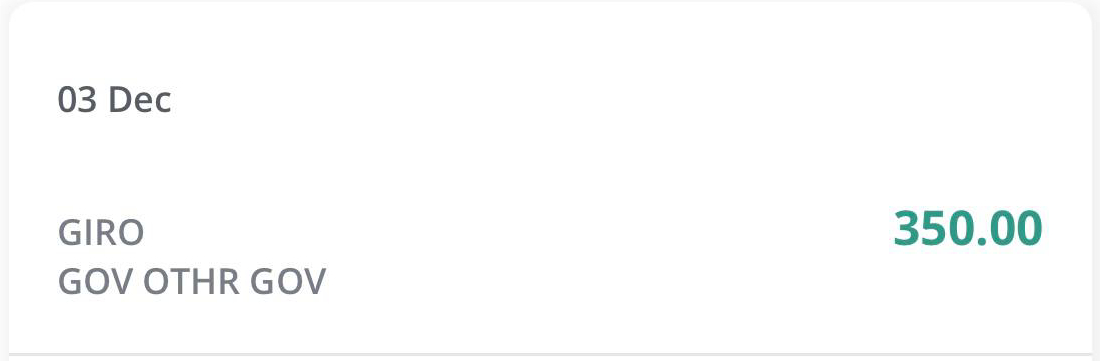

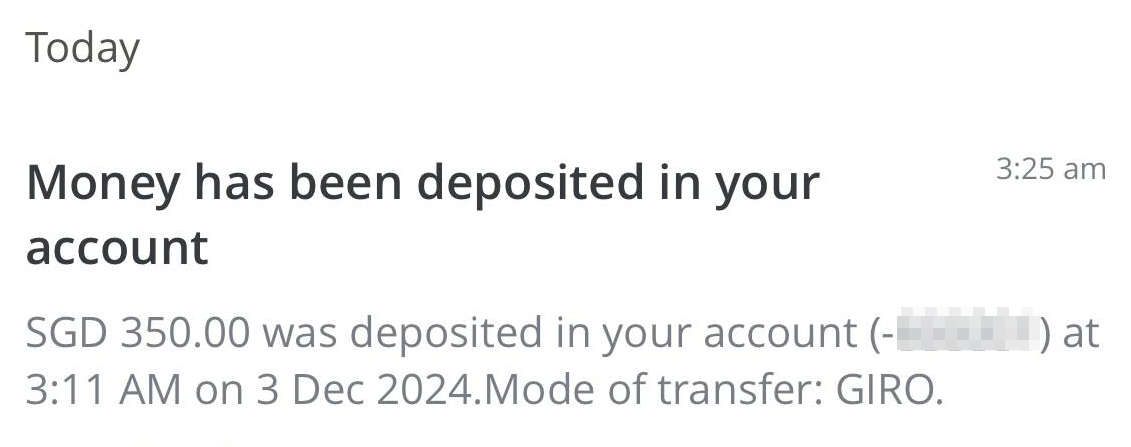

Some Singaporeans aged 21 and above have received a cash disbursement of between S$200 and S$600 on Dec. 3, 2024.

The payment credited to Singaporeans is part of an enhancement to the Assurance Package that was announced at Budget 2024.

One eligible recipient, who is an OCBC bank customer, received the payment on Dec. 3, 2024.

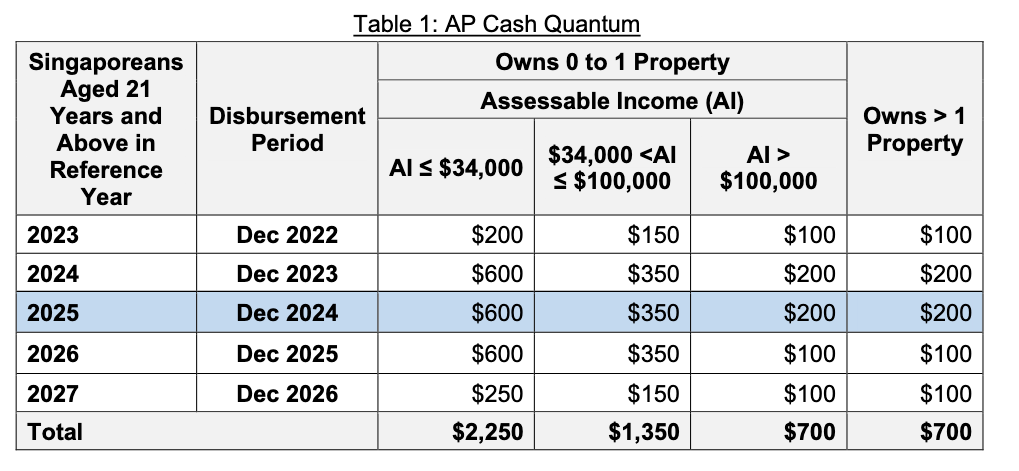

How much to expect?

The quantum varies depending on one's assessable income and number of properties owned.

As part of the enhancement, Singaporean adults will receive cash payouts each December from 2022 to 2026.

The payout is meant to alleviate cost-of-living pressures for Singaporean households and provide more support for lower- to middle-income families.

Cash payout to be credited from Dec. 5

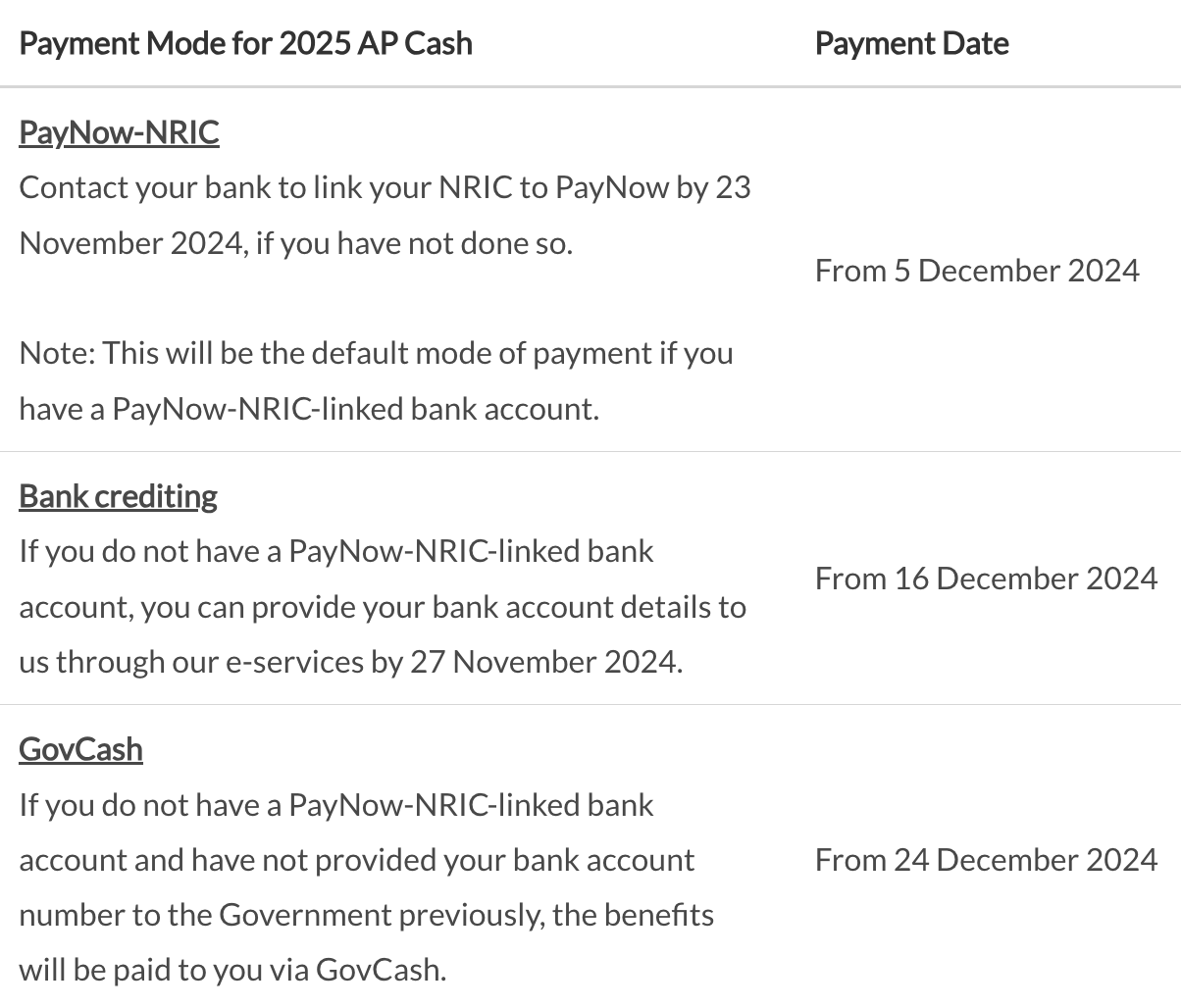

It was previously announced that those who have linked their National Registration Identity Card (NRIC) to PayNow will receive their Assurance Package cash payout from Dec. 5, if they linked their NRIC to PayNow by Nov. 23.

Citizens without PayNow-NRIC linked bank accounts but have a DBS/POSB, OCBC, or UOB bank account, would receive the cash benefits via GIRO from Dec. 16 if they provided their bank account information at the govbenefits website by Nov. 27.

The other way of receiving the payout is via GovCash, from Dec. 24.

Cash benefits received via GovCash can be accessed via the LifeSG app, or by keying in an 8-digit Payment Reference Number (PRN) mailed to the recipients at OCBC ATMs.

Screenshot via govbenefits website.

Other benefits

Eligible Singaporeans will also receive other benefits in December.

These include:

- a one-time MediSave top-up of S$300 to S$500 for Singaporeans born in 1974 to 2003 (inclusive)

- a one-time MediSave top-up of S$1,250 or S$2,000 for Singaporeans born in 1973 or earlier

- a one-time retirement savings bonus of S$1,000 or S$1,500 in their CPF for Singaporeans born in 1973 or earlier

Singaporeans can check their eligibility for these benefits on the govbenefits website.

Top photo via Unsplash

MORE STORIES