Is giving a supplementary credit card to a family member in S’pore a good idea? We find out.

Through the highs and lows of life.

These are my parents.

Photo by Ilyda Chua

Photo by Ilyda Chua

They’re pretty great.

But one thing they’re not so great at is paying their bills on time.

Paperwork, I’ve learnt over the past 28 years, is their enemy.

As the oldest child and de facto administrator of the family, I decided to help them out a bit by getting them a supplementary credit card.

Supplementary cards are secondary cards issued under a person’s credit card account.

They’re useful because they allow you to share your credit card benefits and perks with your loved ones who might not be eligible for a credit card — which is so in my parents’ case, since they’re working part-time now and may not have met certain criteria, like the minimum employment period or annual income.

In my case, I was particularly interested in how all the expenses of both the primary and supplementary cardholders would get combined into one joint bill.

This meant several benefits.

For one, it meant that I, as the primary cardholder, could keep track of the household expenses and make sure all our bills are paid on time.

Plus, I’d get extra cashback from their spending.

After a quick discussion (we agreed that I would merely help to organise the bill-paying, not actually pay for all their expenses), we set out on this little experiment.

Makan

I’ve been using the UOB One credit card for a while now. It’s been a good fit for me, and I thought it would work well for my parents too.

I must say that when I handed them the card, they looked a little too excited.

The same evening, I got a call. “Eh, we’re at Din Tai Fung. Want to join?” my dad asked.

My parents love celebrating special occasions. A new card, apparently, had been cause enough for celebration that they had decided to eschew their usual hawker-centre-fare for a weekday restaurant dinner.

Photo by Ilyda Chua

Photo by Ilyda Chua

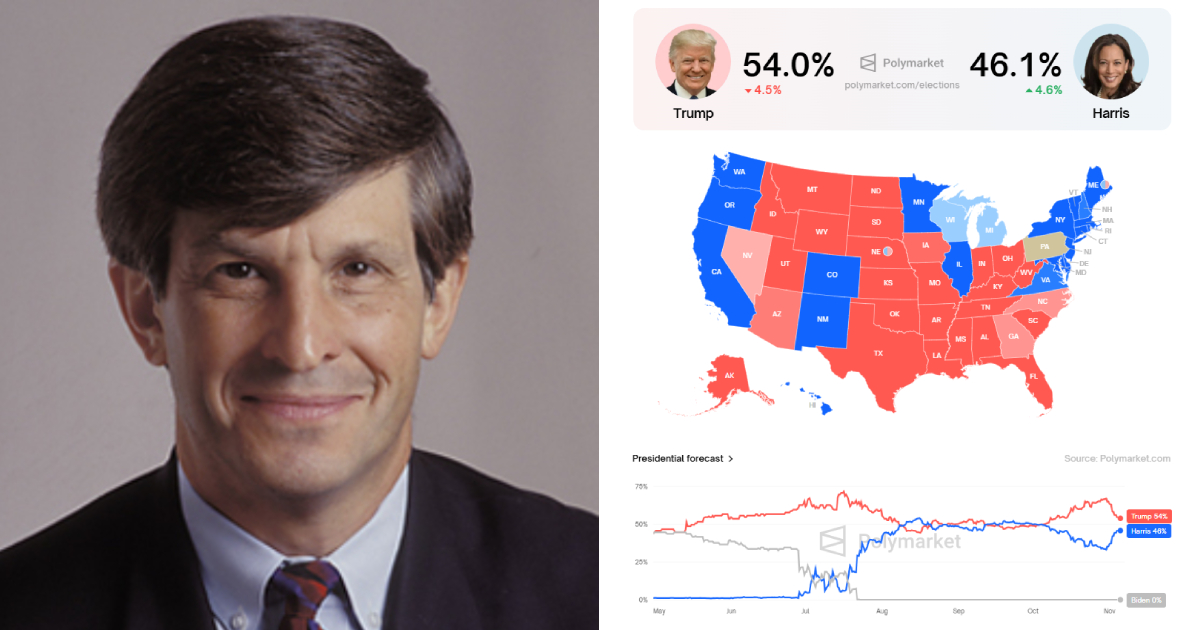

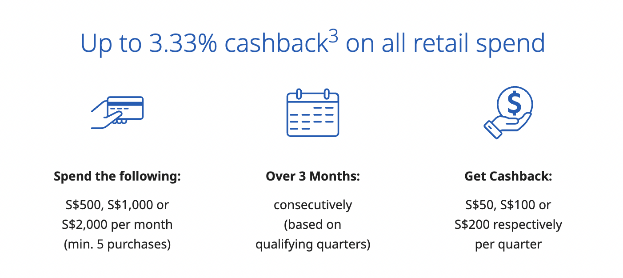

On the bright side, by charging their dinner to their brand-new UOB One Supplementary Card, they were also able to tap on its fairly generous cashback of up to 3.33 per cent cashback on all retail spend.

This also meant more cashback for me as the primary cardholder.

This is how it works:

To be fair, there is a minimum spend.

But with six members of the family, we have enough special occasions that it wouldn’t be tough to hit that figure most months, even with daily expenses aside.

Regardless, I gave them stern instructions that today’s higher-than-usual expenditure should not become too common an occurrence.

Photo by Ilyda Chua

Photo by Ilyda Chua

Oh well. At least they invited me too.

Grocery shopping

After dinner, they informed me that they needed to stock up on groceries.

With my brother as designated cart-pusher/bag-carrier, they set out on their weekly grocery shopping.

Gif by Ilyda Chua

Gif by Ilyda Chua

They were excited to find out that we could get up to 10 per cent cashback with the UOB One card at Cold Storage, CS Fresh, and Giant supermarkets.

“So can we buy avocados?” my mum asked. (Apparently, she really likes avocados.)

I was a little wary, because my mum is a chronic over-buyer and over-feeder, as is typical of The Asian Mum.

Fortunately, this week’s haul wasn’t too extensive.

Instead of buying more junk food, my parents appeared to think the up to 10 per cent cashback meant they could use the savings to purchase higher-quality foods instead.

Photo by Ilyda Chua

Photo by Ilyda Chua

The final grocery basket was in fact pretty healthy, with tomatoes, apples, whole-wheat cereal and yes, avocadoes.

Probably for the better, since I’ve been trying to lose a little weight.

Tragedy strikes

Unfortunately, shortly after our outing, my mum had a fall and fractured her foot.

This was just two days before my brother’s wedding, to make things worse.

Photo by Ilyda Chua

Photo by Ilyda Chua

With her foot in a cast, there was no way she could get to the wedding by squeezing in the family car.

She was left with little choice but to book Grab rides throughout the day.

(Okay, she probably could’ve hobbled her way through public transportation, but she would undoubtedly have been very salty about it.)

To accommodate her cast and long dress, we decided to book a larger six-seater Grab.

It would ordinarily have been pretty expensive, but just like with CS Fresh, we managed to get up to 10 per cent cashback by charging the ride directly to the UOB One card (excludes wallet top-ups).

Jumi, our Japanese Spitz, was not invited to the wedding. Photo from Ilyda Chua

Jumi, our Japanese Spitz, was not invited to the wedding. Photo from Ilyda Chua

While I was initially nervous — I’ve had a few bumpy Grab rides that would not have been fracture-friendly — our drivers were wonderfully understanding and patient.

One even chatted with her the whole journey, offering advice on how to deal with fractures.

The result: my mum was able to make it safely around to both the solemnisation and dinner, with nothing more strenuous than a bit of aggressive hopping.

Photo by Ilyda Chua

Photo by Ilyda Chua

Photo by Ilyda Chua

Photo by Ilyda Chua

A happy ending, in more ways than one.

Reflections

Full discretion: I was a little apprehensive about giving the supplementary card to my parents.

Yes, it would’ve been really convenient. I would be able to earn more cashback, and extend the benefits I’d been experiencing to them, too.

But I also had some misgivings. What if they lost it? Or what if it got stolen? Would I have to foot the bill?

Ultimately, however, it was also an exercise in trust.

I still remember how when I was in primary school, my mum lent me her precious digital camera for a field trip. I, being the flighty and distractible kid I was, ended up losing it.

She still reminds me of this every now and then (usually with an overture along the lines of how she will never ever find one as good as it again).

But it’s never stopped either of my parents from entrusting me with responsibilities, valuables, and yes, money — all these years while growing up.

There are risks to every decision, and consequences to every action. But my parents took a chance on me; I don’t think I’ll regret taking a chance on them, too.

UOB Visa Credit Cards

If you’re in the market for a new credit card, there are a few ongoing promotions, both for primary and supplementary UOB Visa cards.

New-to-UOB credit card customers can get attractive welcome offers (including a free AirPods Pro and AirTag (2 units) worth S$439) when you sign up with selected UOB Visa cards. There are also different UOB cards to suit different lifestyles; you can get more information here.

If you’re applying for a UOB Visa supplementary card for your loved ones, spend S$2,500 within the first two months of supplementary card approval to receive a HomePod mini, worth S$140.25 (applicable to the first 100 customers per calendar month). More information here.

Writing this UOB-sponsored article allowed this writer to hang out with her parents for a bit. That’s pretty cool.

MORE STORIES