HDB flats & 90% of private residences home owners to get one-off property tax rebate in 2025

The government is also raising the annual value thresholds for property tax.

The government will provide a one-off property tax rebate of 20 per cent for all owner-occupied HDB flats and 15 per cent, capped at S$1,000, for all owner-occupied private residential properties.

The government will provide a one-off property tax rebate of 20 per cent for all owner-occupied HDB flats and 15 per cent, capped at S$1,000, for all owner-occupied private residential properties.

In a joint statement on Nov. 29, 2024, the Ministry of Finance (MOF) and Inland Revenue Authority of Singapore (IRAS) said all owner-occupied HDB flats and 90 per cent of owner-occupied private residential properties will therefore see a lower property tax in 2025.

This will help to mitigate cost-of-living concerns.

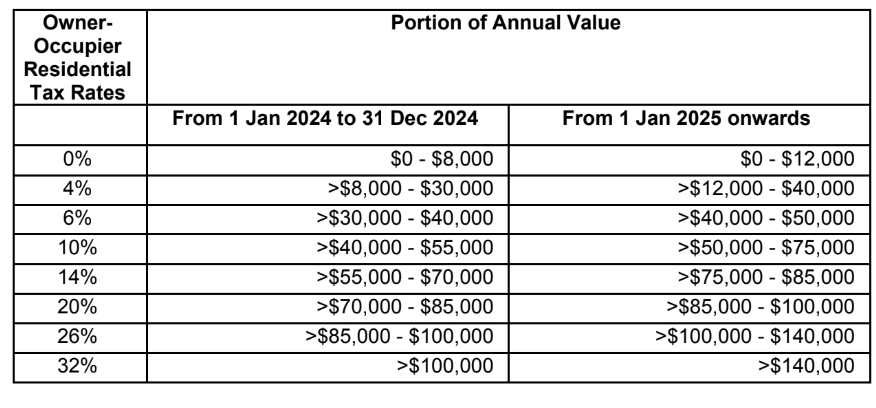

Annual value thresholds for property tax to be raised from Jan. 1, 2025

In addition to the rebate, all annual value thresholds of the owner-occupied residential property tax rates will be raised with effect from Jan. 1, 2025.

Screenshot from MOF and IRAS

Screenshot from MOF and IRAS

This means all one-room and two-room owner-occupied HDB flats will be exempted from property tax.

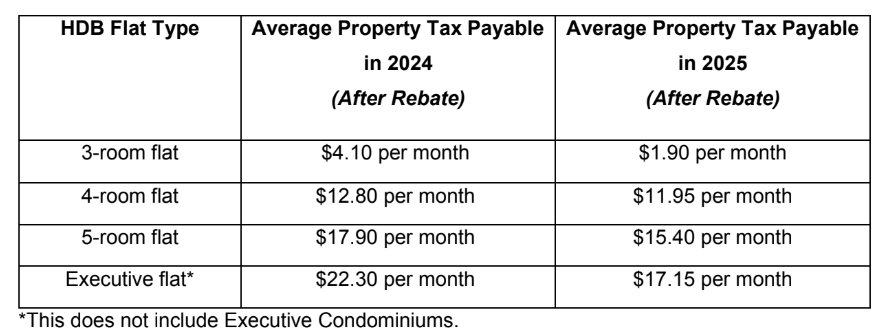

Meanwhile, the average property tax owners of the other flats will pay for 2025 are as follows:

Screenshot from MOF and IRAS

Screenshot from MOF and IRAS

MOF also raising annual value threshold for social support schemes

MOF also said in another press release that it is increasing the annual value threshold that is used across social support schemes to provide continued support to Singaporeans, effective Jan. 1, 2025.

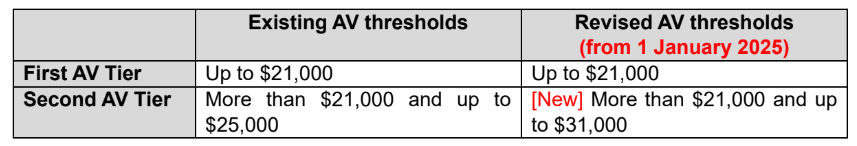

Social support schemes currently provide benefits based on two annual value tiers: the initial tier of up to S$21,000 and the second tier of more than S$21,000 and up to S$25,000.

Such schemes include the GST Voucher scheme, MediShield Life premium subsidies, and the Workfare Income Supplement scheme.

Individuals living in properties with lower annual values receive more support.

As for an individual or household’s eligibility for social support schemes in a given year, it is determined by the preceding year’s annual value.

In order to determine an individual’s or household’s eligibility for the first or second tier of 2025 benefits, the household’s or individual’s 2024 annual value will be used.

HDB added that the first annual value tier of up to S$21,000 remains unchanged and will continue to cover all HDB flats.

With the revised second annual value tier of up to S$31,000, more than three in four residential properties, including lower-value private properties, can be eligible for social benefits.

Screenshot from MOF

Screenshot from MOF

This means more than 1 million residential properties, which includes both HDBs and private properties, will be covered, the ministry added.

Top photo via Canva

MORE STORIES