S'pore oil tycoon OK Lim, 82, sentenced to 17.5 years' jail for cheating offences

At one point, the disgraced oil tycoon purportedly owed 23 banks a total of S$5.5 billion.

Lim Oon Kuin, 82, who is the founder of collapsed oil trading firm Hin Leong Trading, was sentenced to 17.5 years' jail over a cheating case involving at least S$150 million.

OK Lim, as he is also known, faced more than 100 charges, but was convicted of two charges of cheating the Hongkong and Shanghai Banking Corporation (HSBC) and one count of abetting forgery.

The deputy public prosecutors Christopher Ong, Kelvin Chong and Foo Shi Hao had sought 20 years' jail for the two chargers, with the maximum sentence of 10 years to be meted out for each charge.

No weight should be given to Lim's age or his plethora of medical conditions – which include anxiety, depression, insomnia, a large prostate, asthma, coronary artery disease and cerebral vascular disease with cognitive impairment – given the severity of his offences, it was argued.

The prosecution previously argued that Lim's actions undermined the confidence and reputation of Singapore's oil trading industry, pointing to the amount of money cheated and losses incurred by financial institutions.

Lim is represented by a team from Davinder Singh Chambers.

He will appeal against the sentence, his lawyers said.

The team had asked for a jail term of seven years, CNA and Bloomberg reported.

About the trial

Lim's trial began in April 2023.

Principal District Judge Toh Han Li had ruled on the judgement that Lim had directed his staff to prepare falsified documents that showed the company having entered into two fraudulent transactions in March 2020.

The documents were then submitted to HSBC, which led them to lend Hin Leong S$150 million in loans to complete the transactions.

At that time, Lim owned 75 per cent of Hin Leong's shares, and was the managing director.

He played a significant role in the transactions, as the staff needed to seek his approval for the trades.

Background

Hin Leong Group was founded by Singapore billionaire Lim Oon Kuin in 1963.

Lim was Singapore's 18th richest man in 2019 according to Forbes with a net worth of US$1.65 billion (S$2.35 billion).

His downfall began in April 2020 when Hin Leong filed for bankruptcy, citing debts of S$5.5 billion.

Lim admitted to directing his company to hide losses of over S$1.14 billion over several years by manipulating accounts and overstating the company's profitability.

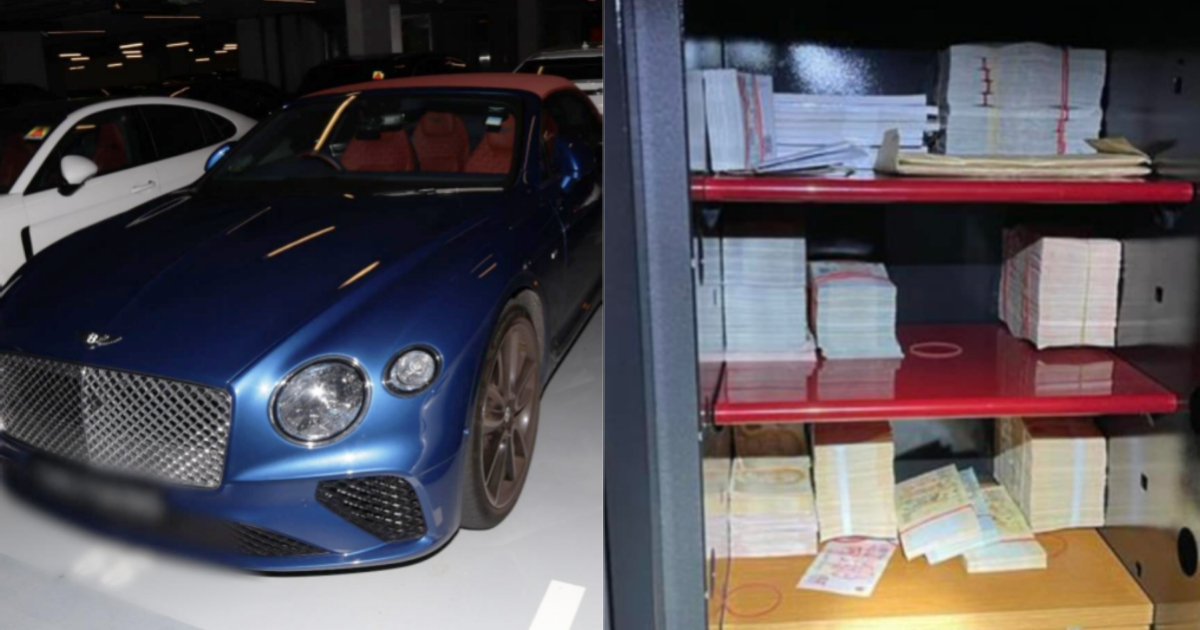

He also falsified documents, including fake invoices and forged contracts, to secure bank loans for financing oil trades.

Hin Leong collapsed under the weight of the global oil price crash in 2020, following the impacts of the Covid-19 pandemic.

At one point, the amount of debts purportedly owed to 23 banks ballooned to S$5.5 billion.

Lim faced multiple criminal charges, including cheating and forgery, and for misrepresenting the company’s finances to banks to obtain trade financing.

His personal assets, including a good class bungalow in Second Avenue, were frozen in order to recoup his debts.

Related stories

Top photo via Forbes and Hin Leong

MORE STORIES