SPF warns of recent rise in government official impersonation scams, with at least S$120 million lost in 2024

Almost doubled compared to cases in the same period in 2023.

At least 1,100 cases of scams featuring the impersonation of banks and government officials were reported from January to October 2024.

A joint press release by the Singapore Police Force (SPF) and the Monetary Authority of Singapore (MAS) on Nov. 30 said total losses from these scams have amounted to at least S$120 million.

This is almost double the at least 680 cases reported in the same period in 2023, with total losses from those cases amounting to at least S$67 million.

How victims are scammed

SPF and MAS said victims would receive an unsolicited call from a scammer impersonating a bank officer, typically from DBS, OCBC, UOB, or Standard Chartered Bank.

The victim would either be told that a credit card has been issued under their name, or that there were suspicious or fraudulent transactions detected in their bank account.

When the victim denies knowledge of such transactions, the scammer would then transfer the call to a second scammer who would impersonate a government official from SPF or MAS.

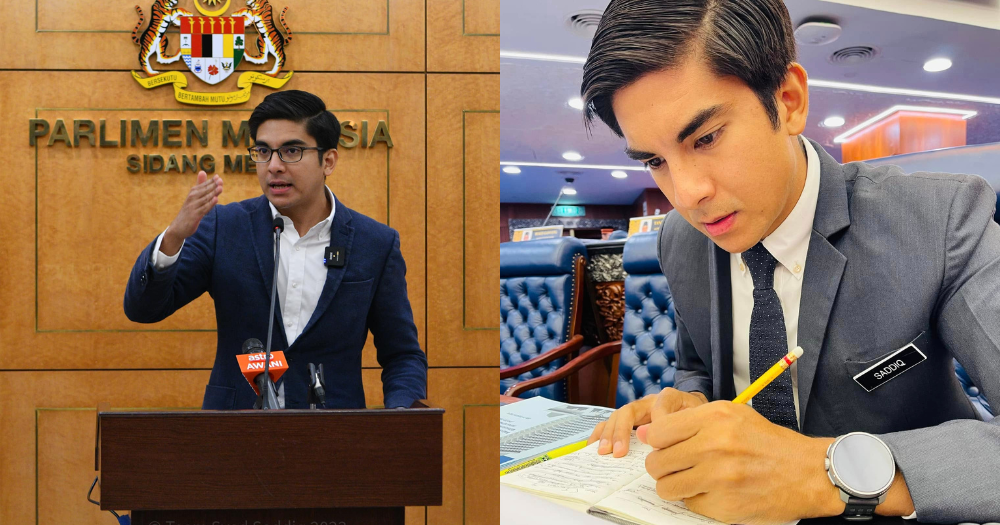

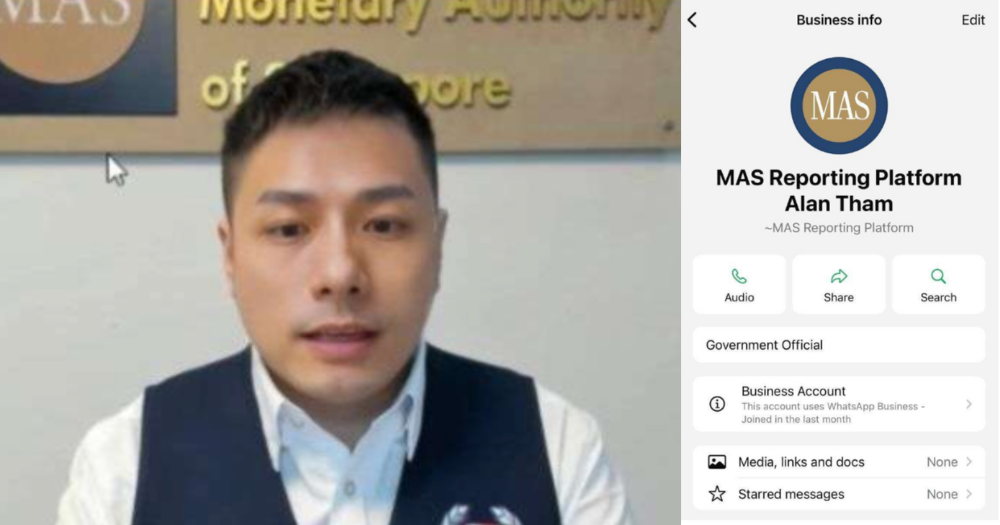

In some cases, scammers would video call the victim dressed as SPF or MAS officers with fake badges, against a backdrop with the agency’s logo.

Example of fake SPF/MAS officer. Photo courtesy of SPF and MAS.

Example of fake SPF/MAS officer. Photo courtesy of SPF and MAS.

The scammer may then communicate with the victim through messaging apps such as WhatsApp, where they may provide fake warrant cards or fake official documents to lend credence to their deceit.

The scammer would then accuse the victim of being involved in criminal activities such as money laundering.

The victim would be requested to transfer their money to "safety accounts", with the scammers claiming that these accounts were designated by the government to assist in investigations.

Victims realised they were scammed when they sought verification of the status of their cases with the banks or SPF, or when the scammers would become uncontactable.

Banks will not transfer calls to any party outside the bank

MAS said banks will not transfer calls to any party outside the bank, such as the police or government officials.

Members of the public are also advised to adopt precautionary measures to safeguard against scams, such as using the ScamShield app and website, and enabling two-factor authentication (2FA) or Multifactor Authentication for online accounts.

They are also advised to tell the authorities, family, and friends when they encounter scams.

Those with information relating to scams, or who are in doubt, can call the police hotline at 1800-255-0000, or submit a report online.

More information on scams can be found on the ScamShield website or via the ScamShield Helpline, 1799.

Top image via SPF and MAS

MORE STORIES