Owner of Joo Chiat restaurant hits back after claims of 'overpriced' food & GST charges without showing registration number

The customer had received a receipt without a GST registration number.

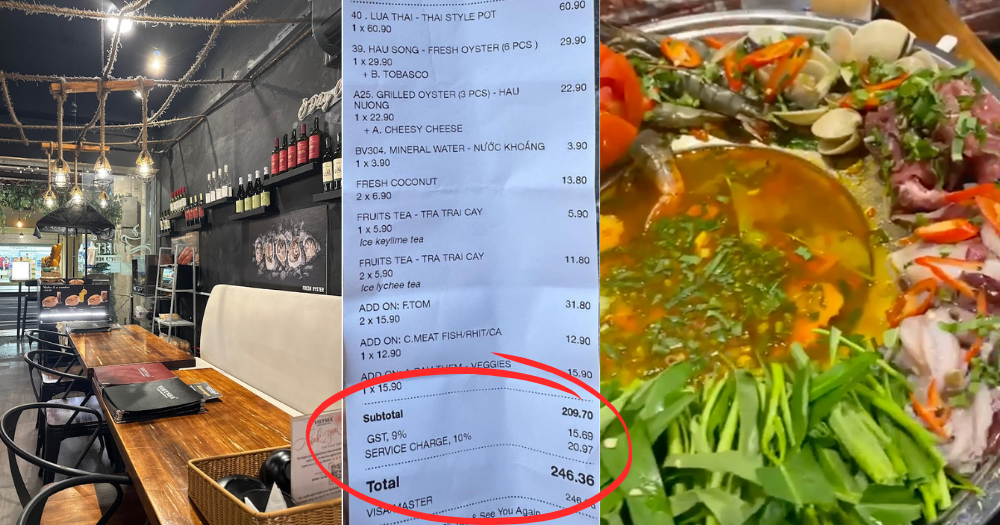

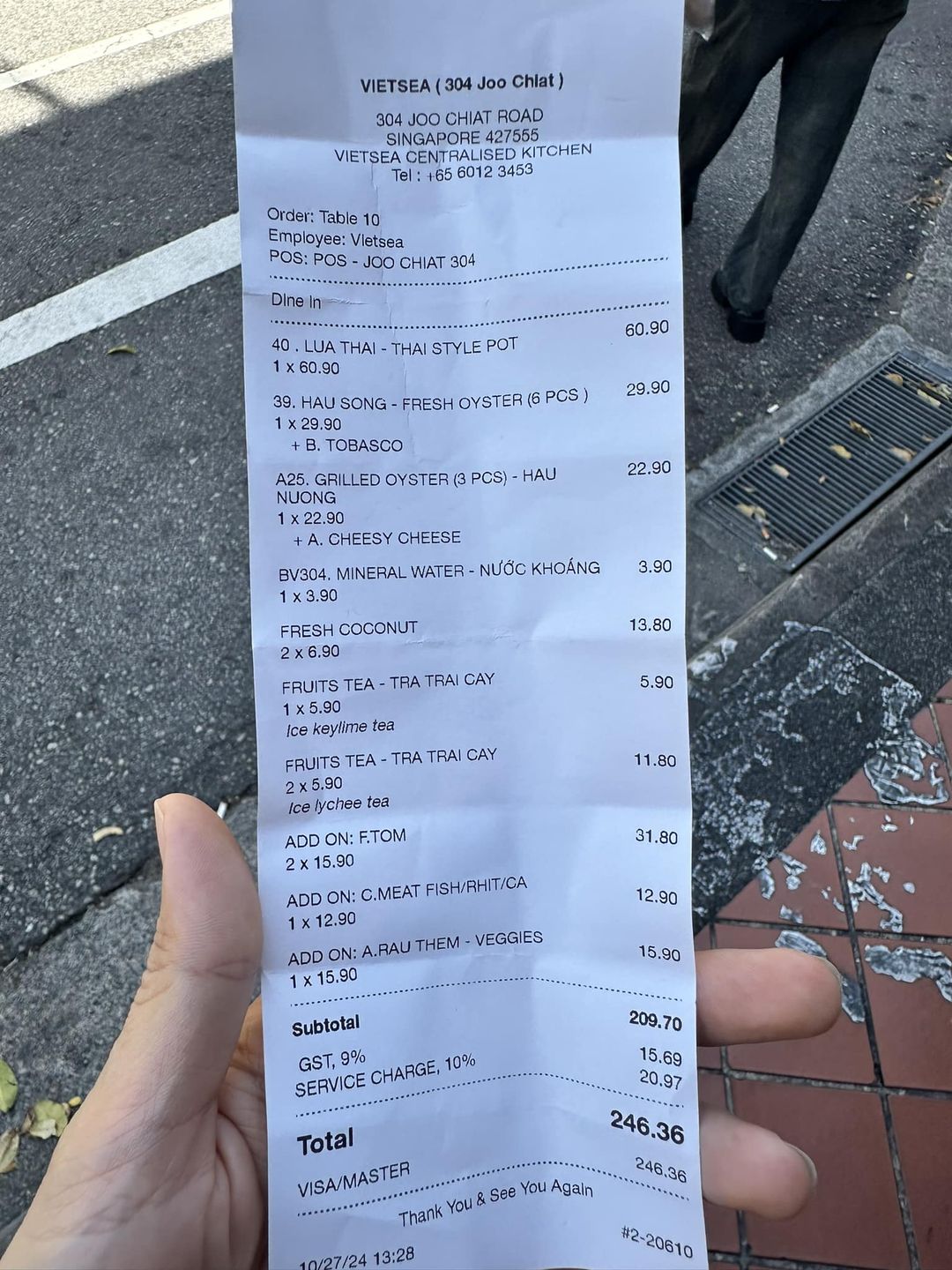

After dinner at a Vietnamese restaurant in Joo Chiat on Oct. 27, a woman noticed something unusual about her bill.

She was so "shocked" that she stopped by the roadside to snap a picture of the receipt and type out a Facebook post about it.

Two things stood out to her: the "extremely high prices" of the dishes and the lack of a GST registration number.

Image via Hoàng Mỹ Tiên Lena/Facebook

Image via Hoàng Mỹ Tiên Lena/Facebook

The restaurant, Vietsea, had issued a receipt only stating the restaurant's name, address, and telephone number in its header.

The amount indicated as 9 per cent GST, S$15.69, appears to have been wrongly calculated as well.

The owner has since come forward to provide her point of view on the matter.

"Heavily overpriced"

Speaking to Mothership, the customer shared that she had dined with four other adults.

It had been her first time visiting the restaurant.

She said that while the prices were displayed on the menu, she was still appalled when the total bill (S$246.36) stared back at her from the receipt.

Calling "basic" dishes like the Thai hotpot "heavily overpriced", she added that special dishes like the grilled oysters with cheese were also "unreasonably expensive compared to typical spending expectations".

Image via Hoàng Mỹ Tiên Lena/Facebook

Image via Hoàng Mỹ Tiên Lena/Facebook

According to the prices before GST and service charge on her receipt, the hotpot, meant for four to five people, was priced at S$60.90.

"When the dish was served, the portion was very small," the diner told Mothership, explaining that the group decided to order additional items.

Order of fresh and grilled oysters cost S$29.90 and S$22.90 respectively, while add-on meat and fish cost S$12.90.

The customer highlighted that a plate of vegetables cost S$15.90, and said this was "an exorbitant price for a regular serving of vegetables".

However, the customer said she did not check the prices on the menu for these additional orders.

Where is the GST registration number?

What really made her uncomfortable, however, was the fact that she'd had to pay GST, despite a lack of a GST registration number on the receipt.

She said this raised doubts about whether the restaurant was being transparent in collecting tax.

"When I raised this issue, the restaurant not only failed to address it but also responded rudely, even threatening me on my personal Facebook page," the customer said.

She later filed an online report with the Inland Revenue Authority of Singapore (IRAS).

Owner says POS machine was spoilt

According to the owner of the restaurant, the restaurant's point of sale (POS) system had been experiencing an "error", and that they had switched to another system temporarily.

She told Mothership that the staff had not input the number into the temporary machine, hence the lack of it on the receipt.

As for the calculation of GST, the owner said it was due to GST on the drinks not being added — also due to the restaurant's staff not having set up the temporary POS properly.

The issues have since been "settled", the owner said.

The owner also shot back at the customer with a slew of posts on her personal Facebook account, insisting that the customer presented "untrue information" about the eatery.

She added that she had lodged a police report.

Restaurant is GST-registered: IRAS

In response to Mothership's queries, IRAS said that the restaurant is a business operating under the company, El Globaltrade, which is GST-registered.

GST-registered businesses in Singapore must display their GST registration number on all invoices and receipts, according to IRAS.

GST-registered businesses are also required to show GST-inclusive prices on all price displays to the public, though an exception is made for hotels and F&B establishments that impose service charge.

This exception is so they do not need to have separate price lists for dine-in and take-away items, or to re-compute prices whenever the establishment reduces or waives the service charge, according to IRAS.

As for companies that are required to register, but fail to do so, IRAS warns that this may result in a fine of S$10,000 and a penalty of 10 per cent of the tax owed.

Following the customer's initial post, several people tried to verify whether the business was GST-registered, using UEN numbers found online.

However, they used the UEN numbers for other companies, and ended up thinking that the restaurant was indeed not GST registered.

There were also negative reviews made on Google.

Top images via Hoàng Mỹ Tiên Lena/Facebook and Google Maps

MORE STORIES