S'porean couple, 33 & 34, who sold branded goods on livestream, fined S$849,000 for evading GST

They had under-declared imported goods which their customers had ordered.

A Singaporean couple has been fined a combined S$849,000 for fraudulently evading the Goods and Services Tax (GST) by suppressing the values of imported goods and omitting freight charges in the import declarations made to customs.

They had each pleaded guilty to 11 charges of fraudulent evasion of GST amounting to S$67,810.

Another 13 charges of fraudulent evasion of GST amounting to about S$24,105 and 25 charges of causing incorrect declarations to be made, by not including the freight charges amounting to about S$4,172 in the import declarations, were taken into consideration during the sentencing.

According to a press release by Singapore customs, Rayson Loo, aged 33, was fined S$453,000, while his wife, Wang Siew Chin, 34, was fined S$396,000.

Couple were involved in selling overseas good via livestream

Wang is the director of a fashion products retailer, Vanity Closet SG, while Loo is the manager.

The main business of Vanity Closet involved conducting livestream sales of branded goods from overseas retail outlets through its Facebook page.

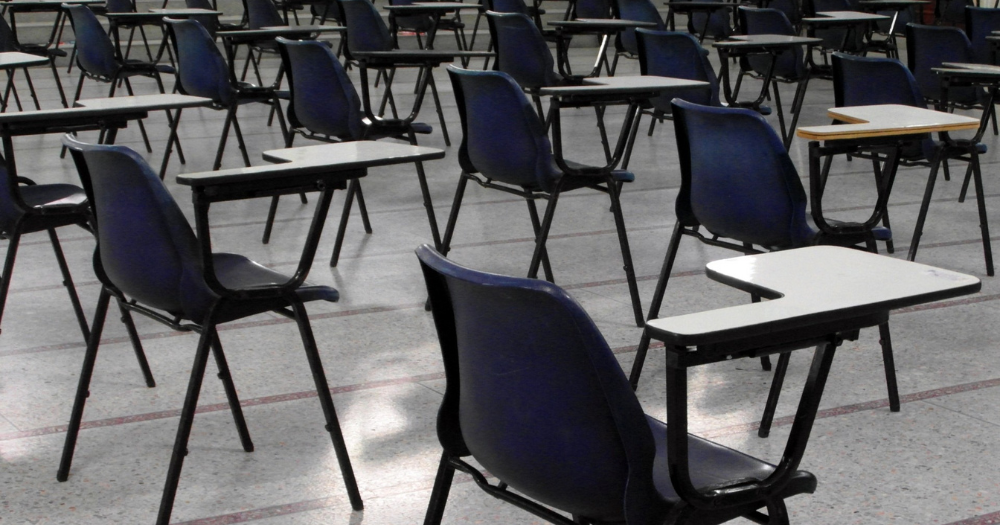

Branded goods found at Vanity Closet’s premises. Photo courtesy of Singapore Customs

Branded goods found at Vanity Closet’s premises. Photo courtesy of Singapore Customs

Wang would source and promote branded goods via live streaming, while Loo would arrange to ship the goods to Singapore.

In January 2022, Singapore Customs checked Vanity Closet’s shipments imported in 2021 and found discrepancies between the actual values of the goods and the values declared to customs.

Investigations revealed that Wang, Loo and their employees would travel to the U.S. and the UK to visit retail outlets selling branded goods and conduct live streaming on Vanity Closet’s Facebook page.

At the end of the livestreaming session, they would purchase the goods ordered by their customers and ship them to Singapore via air.

Loo would create invoices with values much lower than the actual values and submit the false invoices to freight forwarders, who then declared the suppressed values to customs.

This led to GST underpayments and even non-payment in cases where the declared values were less than S$400.

49 shipments made with false import values

Between August 2021 and January 2023, Vanity Closet imported 49 shipments into Singapore.

Of these, 24 shipments had been declared with suppressed import values and did not include freight costs.

For the remaining 25 shipments, the freight costs were omitted in the import values declared.

Any person who is in any way involved in fraudulent evasion of, or attempt to fraudulently evade, any duty or GST, they are liable upon conviction to a fine of up to 20 times the amount of duty and GST evaded and/or imprisonment for up to two years.

As for any person who makes any declaration which is untrue, incorrect or incomplete, they are liable on conviction to a fine not exceeding S$10,000, or the equivalent of the amount of the customs duty, excise duty or tax payable, whichever is the greater amount, or a jail term of up to 12 months, or both.

Members of the public who have information on smuggling activities or evasion of duty or GST can report it here.

Top photo via SG Customs

MORE STORIES