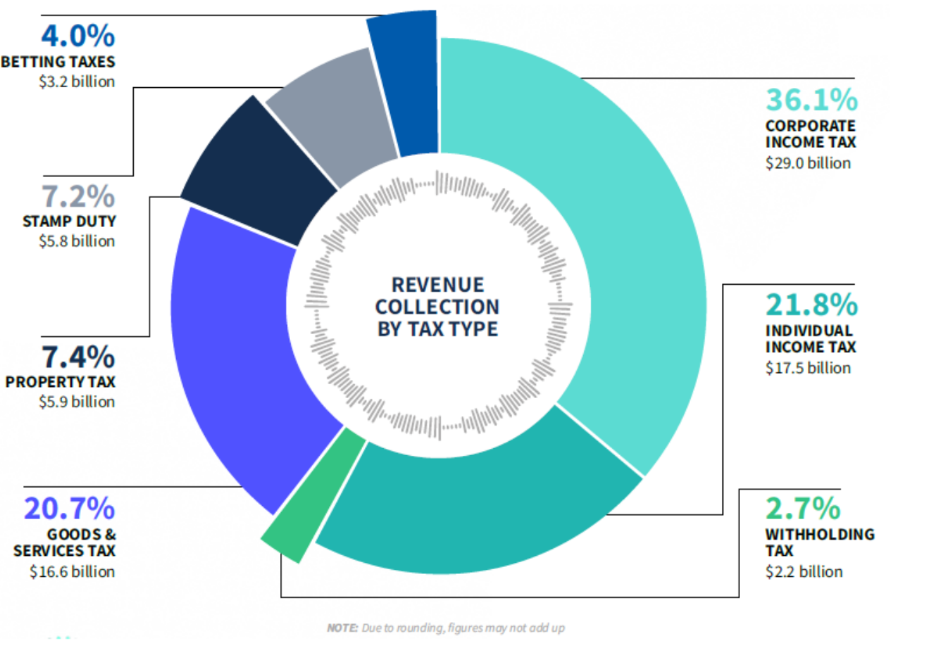

IRAS collected S$80.3 billion total tax revenue, 20.7% of it came from GST

Corporate income tax contributed the largest share, at 36.1 per cent.

The Inland Revenue Authority of Singapore (IRAS) collected a total of S$80.3 billion in tax revenue for the 2023/24 financial year (FY).

This is 17 per cent higher than the amount collected in FY2022/23.

According to a press release by the IRAS, this increase reflects the strong economic growth and nominal wage growth in Singapore in 2022.

The total revenue collected also represents about 77.6 per cent of the Singapore government’s operating revenue and 11.9 per cent of Singapore’s gross domestic product.

Breakdown of tax revenue collected

Corporate income tax

Corporate income tax (CIT) contributed the largest of IRAS' revenue collection.

At S$29 billion, it represents 36.1 per cent of all revenue collected.

This figure increased by 25.6 per cent from S$23.1 billion from the previous year due to strong corporate earnings.

Individual income tax

This was followed by individual income tax (IIT) at 21.8 per cent, or S$17.5 billion.

It was an increase of S$2 billion on account of higher wages and an increase in the number of taxpayers.

GST

Meanwhile, the Goods & Services Tax (GST) accounted for the third largest share of IRAS’ revenue collected at 20.7 per cent or S$16.6 billion.

This marked an increase of S$2.6 billion due to higher consumer spending and the increase in the GST rate.

Property tax

Property tax accounted for 7.4 per cent, or S$5.9 billion of the revenue collection, while stamp duty collection - which fell by S$0.1 billion due to lower property transaction volume - accounted for 7.2 per cent, or S$5.8 billion, of the revenue collection.

Image by IRAS

Image by IRAS

IRAS also noted that the arrears rate for income tax, GST and property tax has remained low at 0.64 per cent.

About S$2.3 billion processed in grants to help workers and businesses

The IRAS also said that it processed about S$2.3 billion of disbursements to more than 131,000 businesses, supporting businesses, workers and jobs.

The grants processed come under various schemes, with the major ones being the Progressive Wage Credit Scheme (PWCS), Senior Employment Credit (SEC) and Jobs Growth Incentive (JGI).

S$1.67 billion was processed under the enhanced PWCS to provide transitional wage support for over 81,000 employers, with higher government co-funding for lower-wage workers.

Meanwhile, S$311 million was disbursed under the SEC to over 82,000 employers who hired Singaporean workers, helping them to adjust to cost increases arising from the higher retirement and re-employment ages.

As for the JGI scheme, S$177 million was disbursed under it to support over 21,000 businesses with local hiring.

S$857 million recovered from taxpayers who refused to comply

The IRAS also said that while tax compliance remains high in Singapore, the IRAS took action against a "small minority" of taxpayers who refuse to comply and pay their fair share of taxes.

In total, IRAS audited and investigated 9,590 cases in FY2023/24, recovering about S$857 million in taxes and penalties.

IRAS added that the taxes collected will be used to fund essential services for Singapore's community, grow its economy, enhance the living environment, and support social development programmes to improve the lives of Singaporeans.

Top photo via Pixabay

MORE STORIES