ADVERTISEMENT

Citibank to close last S'pore branch in Jurong East on Oct. 12, 2024

Operations will end at 12pm on Oct. 12.

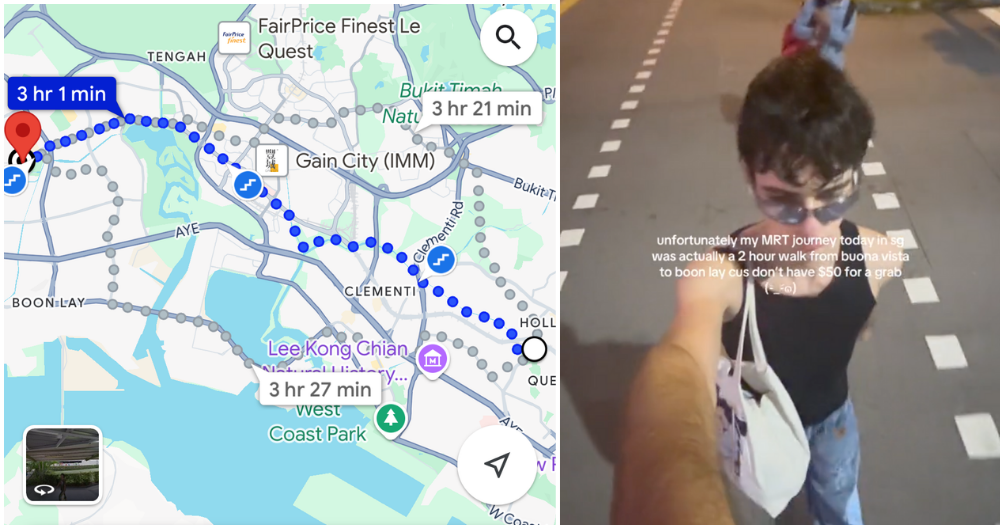

American bank Citibank will close its Jurong East branch at the CPF Jurong Building permanently at 12pm on Oct. 12, 2024.

The branch is the bank's last branch in Singapore, according to Citibank's website.

Citibank's customers looking for in-person services, such as opening and closing bank accounts, can visit Citi's three wealth management centres at Orchard, Parkway Parade, and One Holland Village.

An email sent by Citibank to its customers stated that the decision came after increased adoption of digital, online, and self-service platforms for banking activities, reported The Straits Times.

The bank's chief executive officer (CEO) Brendan Carney also told ST in 2023 that it planned to close its branches where simple transactions, such as depositing cash, were carried out.

As of 2019, Citibank had 15 such branches in Singapore.

ATMs at branch no longer available

Following the branch closure, all automated teller machines (ATMs), cash deposit machines, and express cheque deposit services at Citibank's Jurong East branch will no longer be available, said the bank in a notice on its website.

Screenshot via Citibank Singapore

Screenshot via Citibank Singapore

Customers of the bank can access the services performed at the branch via digital, live chat, and in-person channels.

They can also visit Citi's Wealth Centres located at Orchard, Parkway Parade, and One Holland Village for selected services that need to be performed in person.

Customers can find out more about the Wealth Centres here and the full list of services available here.

Citibank statement

In response to Mothership's queries, a Citi Singapore spokesperson said the closure of Citibank's Jurong East branch is in line with its "business strategy to evolve [its] physical locations from transactional branches to three wealth management centres".

"At the same time, we have invested in our digital banking infrastructure so that nearly all daily transactions can now be done on the Citi mobile app," read the statement.

"To help our valued customers with this transition, we will provide support at our three wealth management centres for a range of in-person services," said the spokesperson.

These services include joint and junior account opening and closure, account closure for the deceased, and client attestation for Lasting Power of Attorney.

Singapore one of Citi's global wealth hubs

The spokesperson emphasised that Singapore is one of Citi's four global wealth hubs, and the company remains "firmly focused on serving the thriving affluent segment here".

"We operate a future-ready hybrid service model for wealth management in Singapore, with day-to-day transactions done digitally and physical locations being designed for wealth management conversations," read the statement.

According to the spokesperson, more than 80 per cent of regular transitions are now conducted on the Citi mobile app and via its website.

Only around 2 per cent of transitions are done in person at its Jurong East branch.

In Singapore since 1902

According to its website, Citibank set up its first branch in Singapore 122 years ago in 1902 in present-day Raffles Place.

It was also "the first American bank to set up a branch" on the island.

Today, Citibank is one of the largest foreign banks and a major credit card issuer in Singapore.

ST reported that around S$1 in every S$5 card spending in Singapore is paid with a Citi product.

By 2025, the bank also planned to increase its assets managed in Singapore by threefold and enlarge its wealth client base by 2.5 times.

Top image via Google Maps

ADVERTISEMENT

ADVERTISEMENT

MORE STORIES