Mum, 56 & son, 26, charged over lying to IRAS about 99-to-1 property purchase, 1st such prosecution here

They bought a condominium unit in Canberra.

A mother and her son have been charged in Singapore for lying about a "99-to-1" property purchase arrangement used by some here to avoid the additional buyer's stamp duty (ABSD).

They are the first to be prosecuted in the wake of an Inland Revenue Authority of Singapore (IRAS) audit into the two-step, 99-to-1 property transactions.

IRAS suspects the transaction the duo entered into was set up to avoid ABSD.

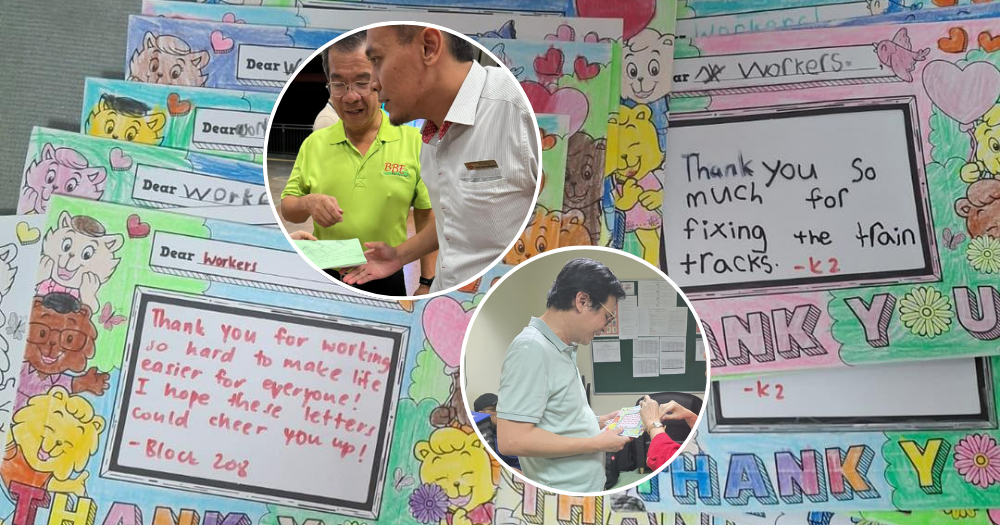

Bought a condo unit in Canberra

Tan Kai Wen Keith, 26, had bought a condominium unit in Canberra in his name on Sep. 24, 2021.

He then sold a 1 per cent share to his mother, Ng Chiew Yen, 56.

A transaction of this kind, carried out in two steps, allows one party who already owns another property to still be eligible to jointly apply for a home loan while avoiding paying additional taxes.

Structured this way, ABSD is payable only on the 1 per cent share of the property.

If it was a joint purchase, ABSD is applicable to the full value of the property.

Charge sheets obtained by Mothership showed that the property is located at 49 Canberra Drive, which is the address of The Watergardens at Canberra, an upcoming development.

Slapped with 5 charges each

The duo were each slapped with five charges under the Stamp Duties Act for conspiring to provide misleading information to IRAS.

IRAS began auditing the related transactions in 2023.

The taxman then sought information from the son via email, questioning why he did not jointly purchase the property with his mother from the start.

Tan allegedly said he had bought the property in a haste, with the understanding that his family would financially support him.

He is also accused of lying that he had to add his mother as a joint owner to secure a loan when his family could not support him financially.

Tan is also accused of providing IRAS with misleading information via incomplete WhatsApp messages.

The two will return to court in October.

If convicted of providing false and misleading information to IRAS, they could be jailed for up to two years, fined up to S$10,000, or both.

In the event of tax avoidance, IRAS said it will recover the rightful amount of stamp duty from buyers, with a possibility of a surcharge of 50 per cent of the additional duty payable to be imposed.

Voluntary disclosure

There is no statutory time limit for stamp duty audits.

Purchasers who entered into a two-step 99-to-1 property purchase arrangements should voluntarily disclose their arrangements to IRAS, the authority said.

IRAS is prepared to consider such cases "more favourably", depending on the circumstances, it was added.

Top photo via Google Maps

MORE STORIES