S’pore govt lowers HDB loan limits from 80% to 75%, increase grants for lower-income flat buyers

The loan-to-value limit for HDB will be lowered to 75 per cent with immediate effect from Aug. 20, 2024.

The Singapore government has announced a set of measures to cool the HDB resale market, and to provide more support to lower-to-middle income first-time home buyers.

According to a joint press release by Ministry of National Development (MND) and Housing and Development Board (HDB) on Aug. 19, the Loan-to-Value (LTV) limit for HDB loans will be lowered from 80 per cent to 75 per cent with effect from Aug. 20, 2024.

This brings the LTV limit for HDB loans in line with loans granted by financial institutions, which remains at 75 per cent.

Increased Enhanced CPF Housing Grant (EHG)

As Prime Minister (PM) Lawrence Wong announced in the National Day Rally 2024, the government will increase the Enhanced CPF Housing Grant (EHG) quantum for both new and resale flats to support first-time home buyers.

The EHG will be increased as follows:

- By up to S$40,000 for eligible first-timer families, from the current maximum grant amount of S$80,000 to S$120,000; and

- By up to S$20,000 for eligible first-timer singles, from the current maximum grant

amount of S$40,000 to S$60,000

Given the sustained, strong, broad-based demand for HDB resale flats, these measures will help cool the market and encourage prudent borrowing, thus making housing more affordable for lower-to-middle income first-time home buyers.

This is the fourth round of cooling measures since April 2023.

Lowered LTV for HDB housing loans

The government closely monitors the HDB resale market.

Earlier rounds of cooling measures and the ramped-up Build-To-Order (BTO) flat supply have helped to moderate the increase of HDB resale prices, according to the statement.

HDB resale prices have risen by more than four per cent in the first half of 2024, driven by strong demand and some supply tightness, as fewer flats reached their Minimum Occupation Period (MOP).

To further stabilise the HDB resale market and encourage flat buyers to borrow prudently, the LTV limit for HDB housing loans will be lowered by 5 percentage points from 80 per cent to 75 per cent.

The revised HDB LTV limit will apply to complete resale applications that are received by HDB on or after Aug. 20, and BTO applications for the October 2024 BTO exercise onwards.

However, the LTV limit for loans granted by financial institutions remains unchanged at 75 per cent.

First-time home buyers, especially lower-income households, will be less affected by the lower LTV limit as they receive significant housing grants.

The government will also provide further support to lower-to-middle income first-time home buyers by enhancing the EHG.

Increased EHG for first-time buyers

Introduced in September 2019, the EHG is a means-tested grant that provides additional support for lower-to-middle income households buying new or resale flats as their first home.

Currently, eligible first-timer families and singles buying a flat can receive up to S$80,000 and S$40,000 in EHG, respectively.

The EHG amount is tiered based on household income, with no restrictions on flat type and location.

To further support first-time home buyers, the maximum quantum of EHG grants will be increased to S$120,000 for families, and S$60,000 for singles.

Depending on the monthly household income, the increase will range from S$5,000 to S$40,000 for families and from S$2,500 to S$20,000 for singles, with higher increases for lower-income households who require more support.

Providing affordable and accessible public housing

In the October 2024 BTO exercise, HDB will offer 8,500 flats across 15 projects under the new flat classification, with additional subsidies for Plus and Prime flats.

"With the planned supply of about 19,600 BTO flats in 2024, we are on track to offer 100,000 flats from 2021 to 2025," MND and HDB said.

Resale flats remain affordable for the vast majority of home buyers, with 8 in 10 first-timer families who collected the keys to their resale flats in 2023 used 25 per cent or less of their monthly household income to service their HDB housing loan.

This means they can service their monthly loan instalments with their monthly CPF contributions, with little to no cash outlay.

HDB flats that are sold at very high prices make up only a very small minority of total resale transactions.

The government said it remains committed to keep public housing affordable and accessible for Singaporeans by continuing to monitor the property market closely and adjust policies as necessary to foster a stable and sustainable property market.

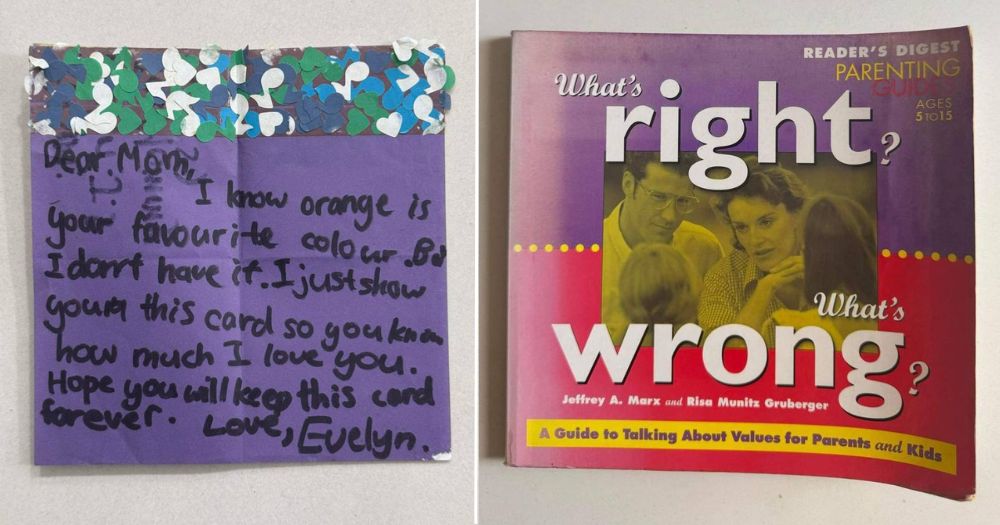

Top photo via Housing & Development Board/Facebook

MORE STORIES