Enhanced CPF Housing Grant of up to S$80,000 to be increased to help S'poreans further afford housing

The government is also looking at decreasing BTO waiting times.

Prime Minister Lawrence Wong announced in his 2024 National Day Rally speech that the government will increase the Enhanced CPF Housing Grant, especially for lower-income couples, to help them buy their first homes.

Currently, first-time home buyers can get up to S$80,000 under the grant.

More details will be announced later by Minister for National Development Desmond Lee, shared PM Wong.

"This is my assurance to all young Singaporeans: once you start work and wish to settle down, we will make sure that there is a HDB flat that is within your budget, in every region.

We will always keep public housing in Singapore affordable for you!"

BTO waiting time to be shortened

PM Wong also spoke about the various ways the government is tackling the issues of housing in Singapore.

PM Wong said that the waiting times for most build-to-order (BTO) projects are currently around four years.

The government aims to shorten the waiting period by building ahead of demand, he said.

"So over time, more BTO projects will have waiting times of less than three years," he added.

New classification of HDB flats

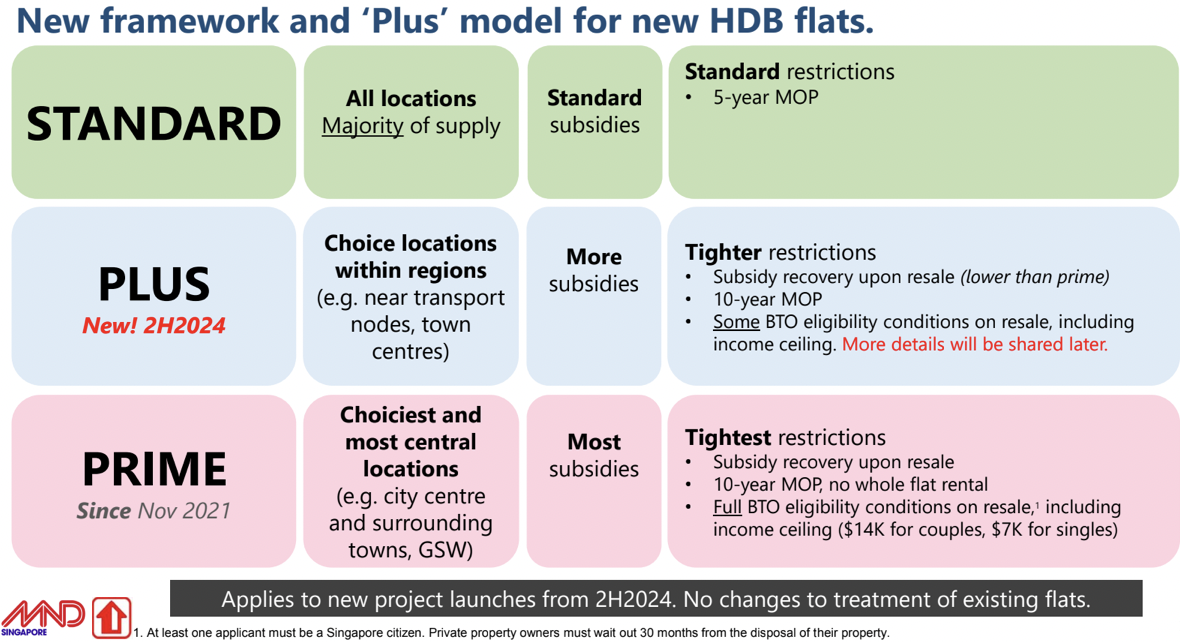

PM Wong also spoke about the new Housing & Development Board classification of Standard, Plus, and Prime flats.

The new framework was previously announced during 2023’s National Day Rally by former Prime Minister Lee Hsien Loong.

Image by MND

Image by MND

The first batch of BTO units under this new framework will be launched in October, including projects in many towns like Sengkang, Bayshore, and Kallang/Whampoa, PM Wong said.

He gave a “sneak preview” of how the sales exercise would look like for potential buyers.

Example 1: Young couple looking to buy a 4-room flat

A resale flat in the Bayshore area is quite expensive, PM Wong pointed out.

However, the 4-room BTO flat in the Bayshore Vista project will be sold as a Plus flat at a lower price of S$580,000.

With a combined income of S$7,000, the couple will receive an Enhanced CPF Housing Grant of S$25,000 and a 25-year HDB loan.

PM Wong said they will be able to service their mortgage mostly with their CPF savings and with minimal cash outlay.

Example 2: Couple with lower income looking to buy a 3-room flat

The couple can try for a unit at Sengkang – Fernvale Sails, a standard BTO flat that will cost about S$300,000, PM Wong said.

With an income of S$4,000, they will enjoy a higher grant of S$55,000 and also get a 25-year HDB loan.

PM Wong said they can finance the mortgage entirely with their CPF with zero cash outlay.

Prices of HDB

PM Wong said that the high prices of housing arose from Covid-19 and the disruption caused to the construction industry.

Supply of new residential units slowed down, and so prices went up, he explained.

The government has since implemented a series of cooling measures to help stabilise the market and has also been ramping up supply.

The Ministry of National Development (MND) had previously committed to launching 100,000 new flats from 2021 to 2025.

By December, they will exceed 80,000 units, and will deliver all 100,000 units as promised by next year, PM Wong said.

These efforts are starting to stabilise the property market, he added.

The government is also tracking the prices of housing closely, especially how they move in relation to incomes.

The House Price-to-Income ratio for the median price of 4-room HDB resale flats after grants was 4.8 in 2014.

This means the price of a resale flat was nearly five times the annual income.

While it came down over the years to below 4, Covid-19 struck, and the ratio spiked up, reaching 5.

Currently, it has gone down.

While it has become slightly better, it is still higher than the pre-Covid-19 years, PM Wong noted.

He said that the government is pressing on with efforts to make flats more affordable.

Top photo from Canva

MORE STORIES