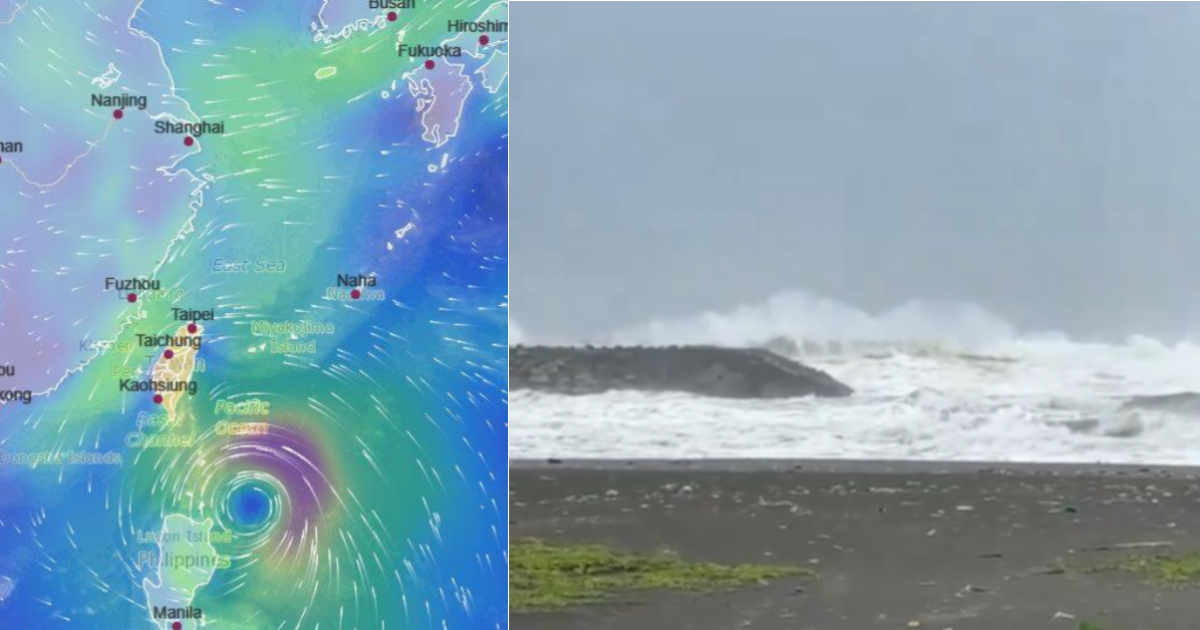

'Market dynamics' can cause resale market bubble if not careful: Desmond Lee on cooling measures

He said that while record HDB resale prices make up a very small proportion of transactions, they capture the public's attention.

Minister for National Development Desmond Lee spoke about measures the Singapore government unveiled on Aug. 19, 2024, to cool the HDB resale market and provide more support to lower-to-middle-income first-time home buyers.

To further stabilise the HDB resale market and encourage flat buyers to borrow prudently, the Loan-to-Value (LTV) limit for HDB loans will be lowered from 80 per cent to 75 per cent with effect from Aug. 20, 2024.

As Prime Minister (PM) Lawrence Wong announced in the National Day Rally 2024, the government will also increase the Enhanced CPF Housing Grant (EHG) quantum for both new and resale flats.

To further support first-time home buyers, the maximum quantum of EHG grants will be increased to S$120,000 for families and S$60,000 for singles.

Lee also clarified that the measures will not be applied retrospectively to past sales exercises.

"This means that flat buyers who planned their finances based on old rules and for flats in past sales exercises will not be affected by the new rules," Lee clarified.

Cooling resale prices

Resale flats remain affordable for the vast majority of home buyers, with 8 in 10 first-timer families who collected the keys to their resale flats in 2023 used 25 per cent or less of their monthly household income to service their HDB housing loan.

This means they can service their monthly loan instalments with their monthly CPF contributions, with little to no cash outlay.

Lee also addressed concerns about record HDB resale prices that have recently made the headlines:

"In recent months, record HDB resale prices have frequently made the headlines, but HDB flats with very high resale prices make up a very small proportion of all transactions but capture the public attention."

Lee said that such transactions make up only 0.5% of all four-room or smaller flats transacted in the last two years. He added:

"But the problem is that this has caused Singaporeans to be concerned about the affordability of resale flats as a whole, flat sellers who are reading such news raise their expectations of how much the flat could bring, while flat buyers become anxious to secure flats before prices get higher.

If not careful, such market dynamics can cause the resale market to run out of line with economic fundamentals and cause a bubble."

Support for lower-to-middle income

Lee also highlighted increased support provided by HDB to lower-to-middle-income buyers.

He also noted that the enhanced grants are means-tested and progressive, with the increase tiered so that lower-income buyers will receive more support.

"This will ensure that those in need will receive more help without inadvertently driving up a wider range of the market," Lee said.

Lee also highlighted the October 2024 BTO exercise, with HDB offering 8,500 flats across 15 projects under the new flat classification, with additional subsidies for Plus and Prime flats.

"The government remains committed to providing a diverse range of affordable housing options to all Singaporeans," Lee said.

Top photo from HDB & Tharun Suresh.

MORE STORIES