At least S$385.6 million lost to scams in 1st half of 2024, up 24.6% from same period in 2023

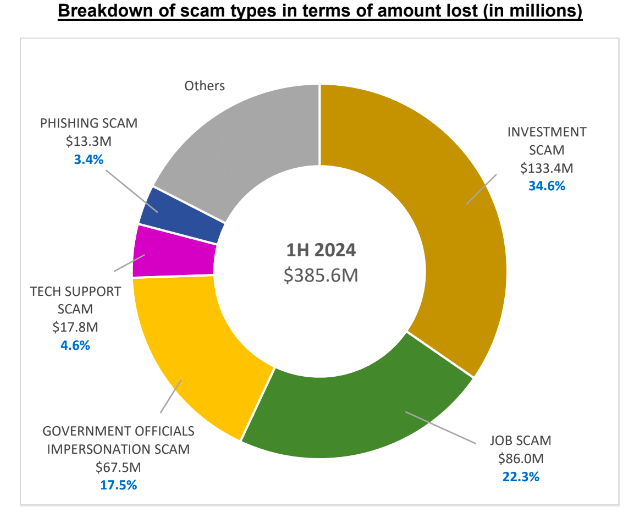

In terms of the total amount lost, investment scams were the most serious, with S$133.4 million lost.

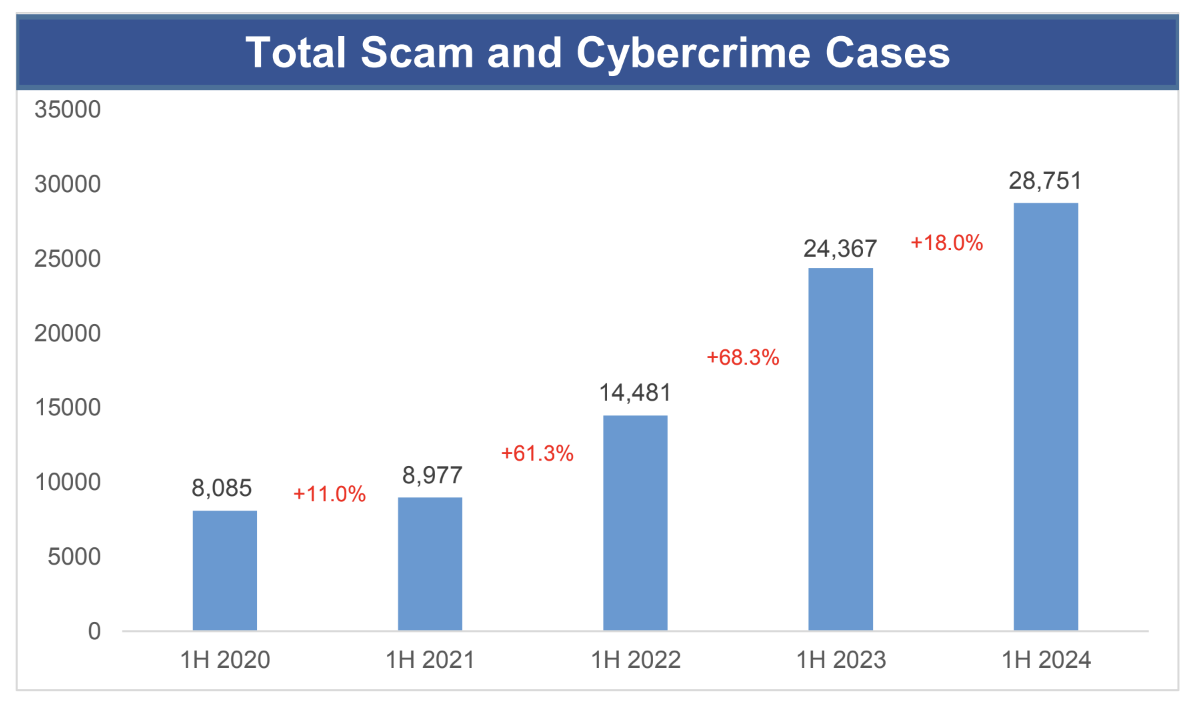

From January to June 2024, the number of scam and cybercrime cases increased by 18 per cent to 28,751 cases, compared to 24,367 cases in the same period in 2023.

Screenshot via SPF.

Screenshot via SPF.

According to a press release by the Singapore Police Force (SPF), 92.5 per cent or 26,587 of these cases were scams, representing an increase of 16.3 per cent from 22,583 cases in the same period last year.

The total amount lost for the first half of 2024 to scams was at least S$385.6 million, an increase of 24.6 per cent from at least S$309.4 million in the same period in 2023.

The SPF added that overall, the average amount lost per scam case for all reported scam cases has increased, by about 7.1 per cent to S$14,503 in the first half of 2024, from S$13,541 in the first half of 2023.

In addition, 59.8 per cent of scams cases in the first half of 2024 have losses less than or equal to S$2,000.

Majority of scams involved self-effected transfers

The SPF pointed out that 86 per cent of the scams involved mostly self-effected transfers which may be a result of deception and social engineering involving an array of complex scam methods.

In most of these cases, the scammers did not gain direct control of the victims' accounts but manipulated the victims into performing the monetary transactions instead.

Out of S$385.6 million lost, S$133.4 million was due to investment scams

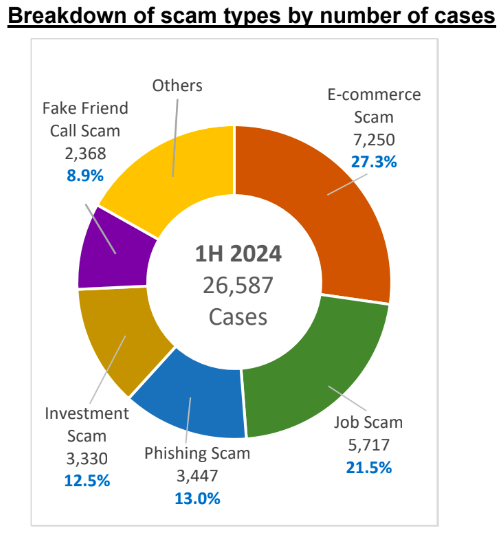

The SPF noted that in terms of the number of scam cases, e-commerce scams, job scams and phishing scams were the top three scam types in the first half of 2024.

Screenshot via SPF.

Screenshot via SPF.

However, in terms of the total amount lost, investment scams, job scams and government officials impersonation scams were the top three scam types in the first half of 2024.

Out of the S$385.6 million lost, the largest proportion, at S$133.4 million, was lost to investment scams, followed by S$86 million to job scams and S$67.5 million to scams involving the impersonation of government officials.

Screenshot via SPF.

Screenshot via SPF.

The SPF also said that government officials impersonation scams had the highest average losses at

about S$116,534 per case, followed by investment scams at about S$40,080 per case.

The majority of investment scam victims were aged 30 to 49, with 44.7 per cent of victims for this scam type being from that age group.

Telegram, Facebook and WhatsApp were also the most common platforms used by investment scammers to contact potential victims.

The majority of job scam victims were also aged 30 to 49 — with 44 per cent of job scam victims being from that age group.

As for scams involving the impersonation of government officials, the biggest proportion of victims were those aged 65 and above, comprising 28.9 per cent of victims for this scam type.

Phone calls and WhatsApp were the most common channels used by government officials impersonation scammers to contact potential victims.

Majority of scam victims below 50, but average amount lost by elderly was highest

The SPF added that while 74.2 per cent of scam victims were youths, young adults and adults aged below

50 in the first half of 2024, the average amount lost per elderly victim aged 65 and above was the highest.

The SPF noted that this is a concern as the elderly may potentially lose their entire life savings to scams and are unlikely to recover financially.

Among the elderly, who make up 7.2 per cent of all scam victims, 24.4 per cent of elderly victims fell prey to fake friend call scams, while 19.5 per cent fell prey to investment scams and 14.6 per cent fell prey to phishing scams.

Scammers also tend to reach out to the elderly via phone calls, WhatsApp and Facebook.

What are some of the anti-scam measures being taken?

According to the SPF, the police's Anti-Scam Command (ASCom) has expanded its partnerships to more

than 110 institutions, including financial institutions, card security groups, fintech companies, cryptocurrency houses, remittance service providers, and overseas law enforcement agencies from countries such as Hong Kong, Malaysia and Australia.

This is to facilitate the freezing of accounts and recovery of funds to mitigate victim losses.

ASCom is also collaborating e-commerce platforms such as Carousell, Shopee and other online platforms to take down scam-related online monikers and advertisements.

ASCom has also been working with banks such as OCBC, UOB and DBS in automating information-sharing, information-processing and mass distribution of SMS alerts to scam victims.

Through three joint operations in the first half of 2024, more than 46,400 SMSes were sent to alert

more than 33,600 victims.

This proactive victim-centric approach averted over $204 million of potential losses, the SPF added.

Meanwhile, banks have implemented a suite of measures to make it harder for for scammers to perform unauthorised transactions.

These include the progressive removal of the use of One-Time Passwords (OTP) for logging into bank accounts to reduce the risk of phishing, and the offer of a Money Lock feature that allows customers to

set aside funds that cannot be digitally accessed.

MHA to consider empowering the police to restrict transactions of bank victims

In addition, the Ministry of Home Affairs (MHA) is also studying measures to better protect scam victims, particularly those who do not believe they are being scammed.

These could be victims of love scams or investment scams who have invested their emotions or a significant amounts of money, making it difficult for them to extricate themselves from the situation.

The SPF said that MHA is specifically considering empowering police officers to restrict the banking transactions of scam victims and targets of ongoing scams, if there is reasonable belief that they will make money transfers to scammers.

The restriction will be time-limited, as the intent is to give the police time to convince the victims that they are being scammed.

MHA intends to conduct public consultations on these proposals and said more details will be released when ready.

Top image via Canva

MORE STORIES