YouTrip users can now transfer funds back to bank account

There is also a new top-up option and security features.

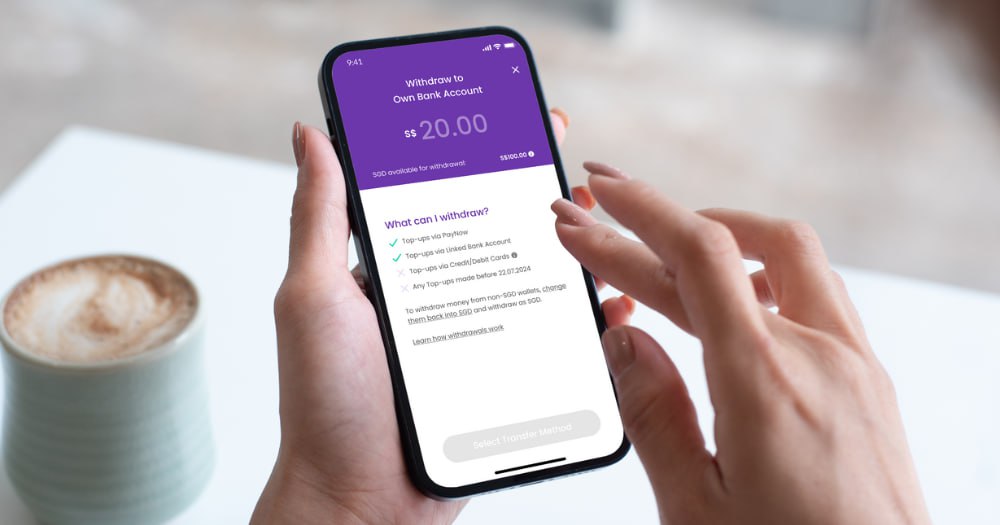

If you are a YouTrip user, you will be glad to know that you can now transfer funds back to your bank account.

Users were previously unable to.

This is amongst the slew of new features that YouTrip has announced on Jul. 23, 2024.

YouTrip users will receive invitations to experience the new features in phases progressively over the next few days, the release stated.

Transferring funds back to bank account

New funds can now be withdrawn back into users' bank accounts through the user’s mobile number or NRIC number tied to the YouTrip account.

This is one of the highly requested features by users, YouTrip said.

Withdrawals are available to all new top-ups made through PayNow or the newly introduced "Linked Bank Account" method, starting from Jul. 22, 2024.

However, only funds in the Singapore dollar wallet can be withdrawn.

If you want to withdraw funds from other currency wallets, you will have to convert them back to Singapore dollars to do so.

Funds that are withdrawable back to bank accounts will be reflected as the "transferable balance".

Users can perform up to 10 free withdrawals per calendar month.

Linked bank account option

YouTrip has also introduced a new top-up method called "Linked Bank Account" where you can link your bank account directly for wallet top-ups.

This new option follows the existing suite of fee-free methods such as PayNow, Mastercard, and Visa (Debit).

You will only be required to key in your bank information and complete the authentication process once to enjoy the convenience of topping up your YouTrip account moving forward.

Heightened security

There will also be new security safeguards, YouTrip announced.

Users will have the option to set top-up limits and an expiry date after which the bank account linkage will be invalidated.

To further strengthen security controls, funds can only be withdrawn back into the PayNow account tied to the user’s YouTrip registered mobile number or NRIC.

This measure prevents fraudulent transfers in the event of account takeover attempts, YouTrip stated.

Increased limits

The new features come after YouTrip’s increased limits earlier in January 2024, where it raised its limits to S$20,000 for wallet hold and S$100,000 annual spending, which previously were S$5,000 and S$30,000, respectively.

Top photo via YouTrip

MORE STORIES