Temasek reports S$44 billion in sustainable living investments in 1st ever sustainability report

Going green.

As part of its commitment to sustainability, state investment arm Temasek has launched its inaugural Sustainability Report on Jul. 9, in conjunction with its annual review for the financial year.

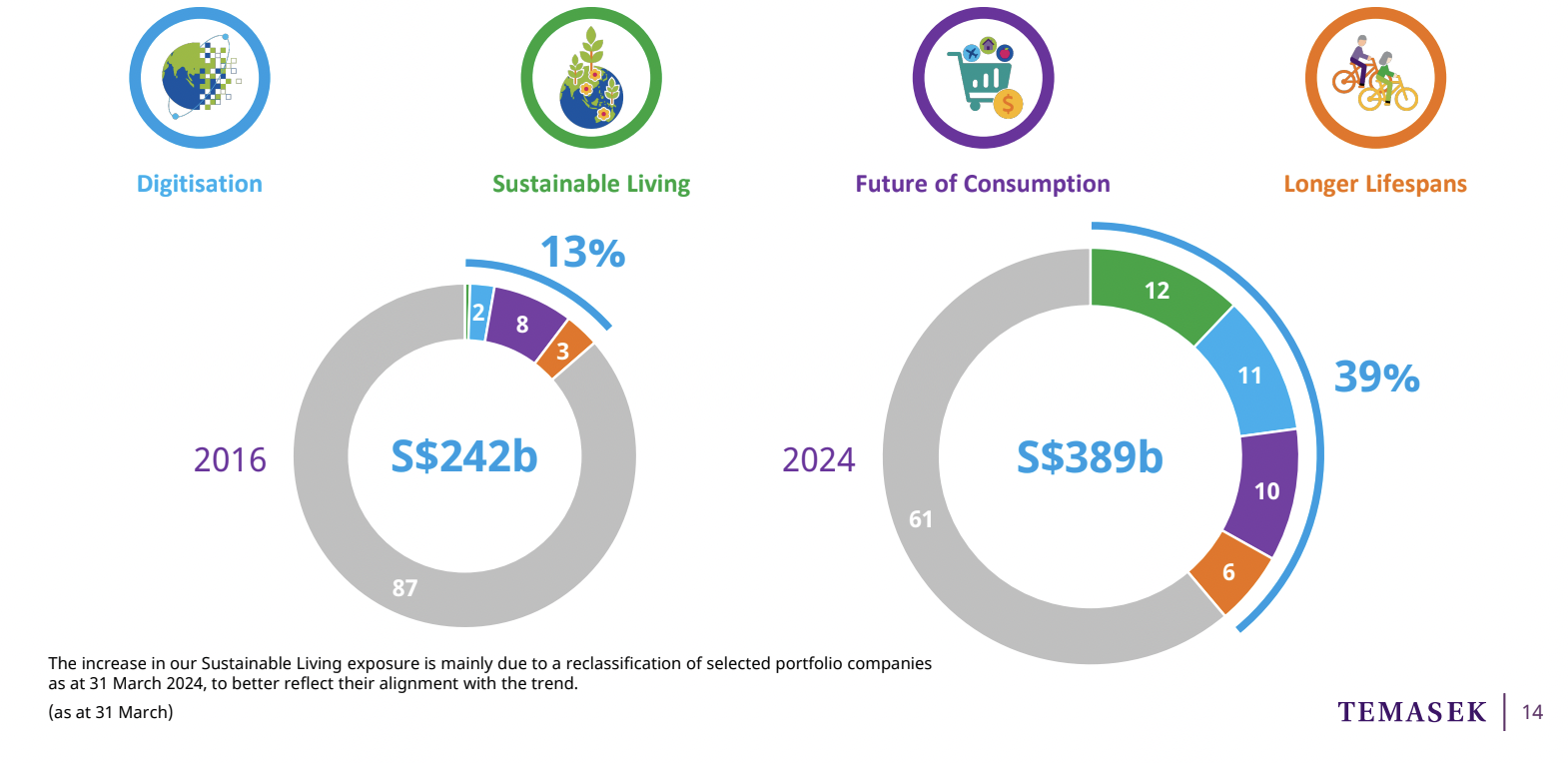

This is the first time Temasek has disclosed the value of its sustainability investments.

The report shared Temasek's sustainability goals, practices and performances, and revealed that its portfolio value in "sustainable living" totalled S$44 billion as of Mar. 31, 2024, with S$3 billion deployed in the past year.

Such investments refer to those in sectors such as food, water, waste, energy, materials, clean transport, and built environment, whose "products and services seek to fulfil environmental and social objectives, as well as those that will benefit from sustainability tailwinds."

Of this S$44 billion figure, S$38 billion were investments in businesses with sustainable products and services.

Meanwhile, S$6 billion were "climate transition" investments in high-emitting sectors looking to transition their products and services to more sustainable ones.

While S$44 billion remains a small part of Temasek's portfolio, Temasek stated that this portion is also its "fastest-growing".

Image from Temasek

Image from Temasek

Raising its internal carbon pricing

The ramp-up on sustainability comes as Temasek continues on its decarbonisation journey.

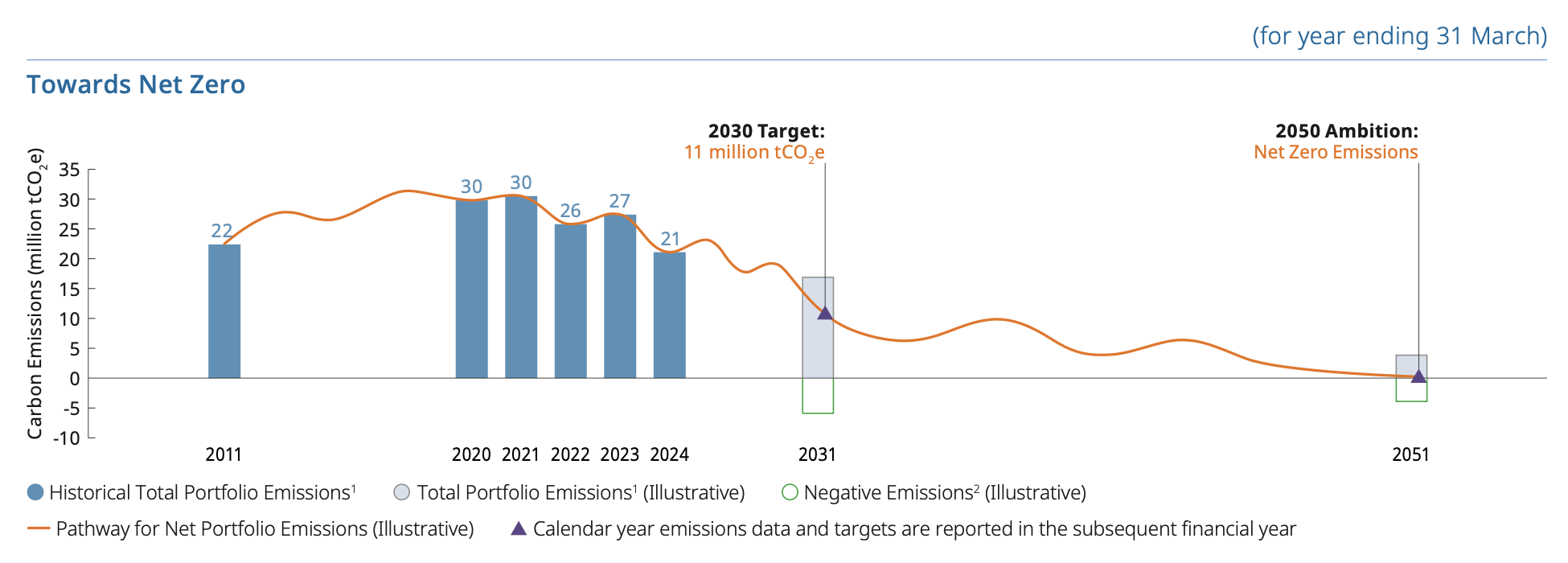

It previously shared that it aims to halve its 2010 net portfolio carbon emissions by 2030, and achieve net zero by 2050.

It has been carbon neutral since 2020.

Since Apr. 1, 2024, Temasek has also raised its internal carbon price to US$65 (S$87.71) per tCO2e (per tonne of carbon dioxide equivalent).

It previously raised its internal carbon price to US$50 (S$67.47) in 2022, and is aiming to raise it to US$100 (S$140.77) by the end of the decade.

This internal carbon price helps the company "better assess the potential climate impact, thereby enabling a greater focus on the long-term climate resilience of our portfolio", Temasek said.

The firm added that the price also encourages "climate-aligned decisions and behaviour among their employees".

Looking to the future

The launch of the inaugural sustainability report is in line with Temasek's commitment to embed sustainability at the core of everything it does, the firm said.

It noted that half of the Global Gross Domestic Product (GDP) is moderately or highly dependent on nature, according to a 2023 report by PWC.

In view of this, Temasek has developed a sustainability strategy that aims to deliver "sustainable returns over the long term".

Examples of its investments include in electric vehicle and renewable energy companies.

Through its partnerships, it hopes to "invest in the energy transition and scale next-generation climate solutions", Temasek said.

Temasek shared that from 2023, its total portfolio emissions decreased by six million tCO2e over the past year.

It aims to lower its total portfolio emissions to 11 million tCO2e by 2030.

Image from Temasek

Image from Temasek

Temasek attributed the overall decrease in emissions the past year to its portfolio company, Sembcorp Industries, which recently sold its stake in Sembcorp Energy India (SEIL).

SEIL operates two coal-fired plants in India, and this move will reduce Sembcorp's emissions by over 37 per cent, reported The Straits Times.

However, Temasek admitted that its drop in emissions have also been moderated by an increase in emissions generated by Singapore Airlines as global air travel resumed after the pandemic.

"As we continue stepping up efforts to encourage decarbonisation across our portfolio and to invest in less carbon-intensive businesses, we expect a non-linear decline in portfolio emissions over time," it added in its report.

Walking the walk

Furthermore, by sharing its goals, practices and performance in the annual report, Temasek aims to "foster trust and engage in meaningful dialogue on the topic with stakeholders".

For instance, it has engaged with its portfolio's top five contributors to emissions — Singapore Airlines, Sembcorp Industries, Olam Group, PSA International and ST Telemedia — to help them in their decarbonisation efforts, as well as set climate transition plans and targets.

These five businesses contributed to around 80 per cent of Temasek's total portfolio emissions.

SIA, for instance, has set targets for a transition towards sustainable aviation fuel (SAF), and as of last September has completed a 20-month pilot and is looking to further deploy SAF in its operations.

Currently, SIA and Scoot aim to replace five per cent of their total fuel consumption with SAF by 2030.

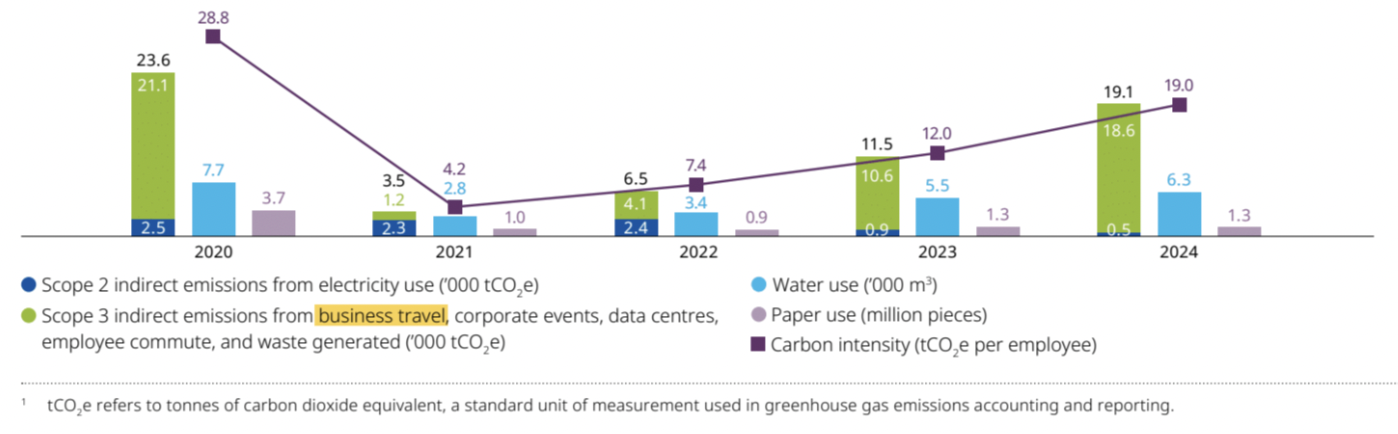

The report also covers Temasek's own journey towards sustainability.

Over the past year, it has seen an increase in emissions from business travel — driven largely by the resumption of related business activities post-pandemic.

At the same time, it saw a reduction in emissions from electricity use, largely due to its UK and India offices procuring electricity from renewable sources, and its Singapore office obtaining renewable energy certificates.

Here's a look at its five-year environmental footprint:

Image from Temasek

Image from Temasek

Nevertheless, Temasek shared that its emissions have remained below pre-pandemic levels, and it will continue to work towards further reducing its operational emissions.

"Beyond advancing sustainability through our investments and engagement with our portfolio companies, we recognise sustainability starts within Temasek as an institution," said Lim Ming Pey, deputy chief corporate officer of Temasek.

"While our emission footprint is largely driven by our portfolio, as an investor, we recognise the important role we have in setting an example for our portfolio companies."

Top image from Temasek

MORE STORIES