I kaypoh-ed my colleagues' lifestyle in S’pore & found out how much they could save with this credit card

From single and living at home to earning the bread for a family of five.

Ever get to the end of the month and wonder where your pay cheque went?

Well, welcome to the club. It seems like there’s no activity more fun than spending money and no activity duller than saving it.

Or maybe you’re not the kind to splurge on luxuries and wants, only loosening the purse strings for the things you need.

Either way, a little extra money saved is always a good thing.

As a perennially helpful and contributing colleague, I decided that I would come to the financial aid of my co-workers.

This would be achieved by analysing their monthly spending habits and estimating how much money they could save by using the Citi SMRT Card.

Thankfully, for someone as terrible at math as I am, I don’t have to do the savings* calculations myself.

Citi has kindly created a calculator on their website for this very purpose. You can find it here.

Ashley - Single and saving

The one thing that comes to mind when I think about my colleague Ashley is how much she loves to save money; the woman is frugality personified.

“Most weekends I just chill at home,” she told me, resulting in a lack of spending on all the dumb things I might be tempted to splash cash at whenever I’m out and about.

The 29-year-old still lives with her parents, and thus doesn’t spend much on groceries (most months she doesn’t spend on groceries at all).

However, she does enjoy occasionally — “very occasionally,” she stresses — splurging a bit on clothes and skincare products.

Image by PMV Chamara via Unsplash

Image by PMV Chamara via Unsplash

When she does go shopping, it’s almost always done online.

And of course, as a single woman in the prime of her life, Ashley goes on dates. And when she does, taxis or ride-hailing services are sometimes called into action.

Though most of the time, public transportation will suffice.

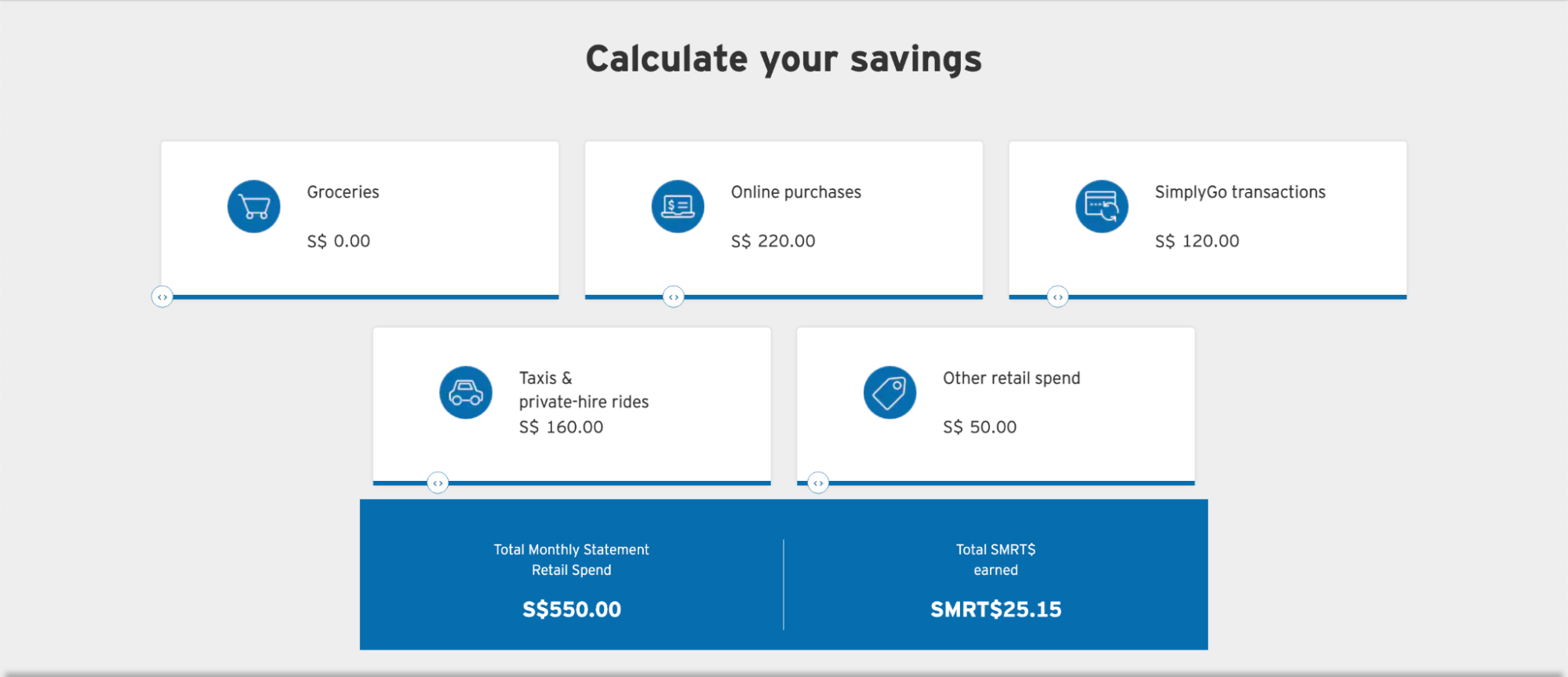

All-in-all her monthly spend on the categories of online purchases, public transport, and taxis and private hires comes to about S$550, which is over the S$500 minimal spending required to qualify for her 5 per cent savings*.

It’s realised in SMRT$25, which can be redeemed for either cash rebates or shopping vouchers.

Ilyda - Married and adulting

Ilyda is in that phase of millennial life called adulting — you’re married, have your own home, and are now beginning to question how your parents afforded everything.

When work gets busy for her husband and her, they’ll order in. But other times, she’ll cook.

Image by Kevin McCutcheon via Unsplash

Image by Kevin McCutcheon via Unsplash

And for that, appliances are needed.

“I just bought a half-boiled egg maker online,” she said, with the hubris of a millennial throwing away decades of wisdom compiled by our ancestors on how to efficiently boil an egg in a pot.

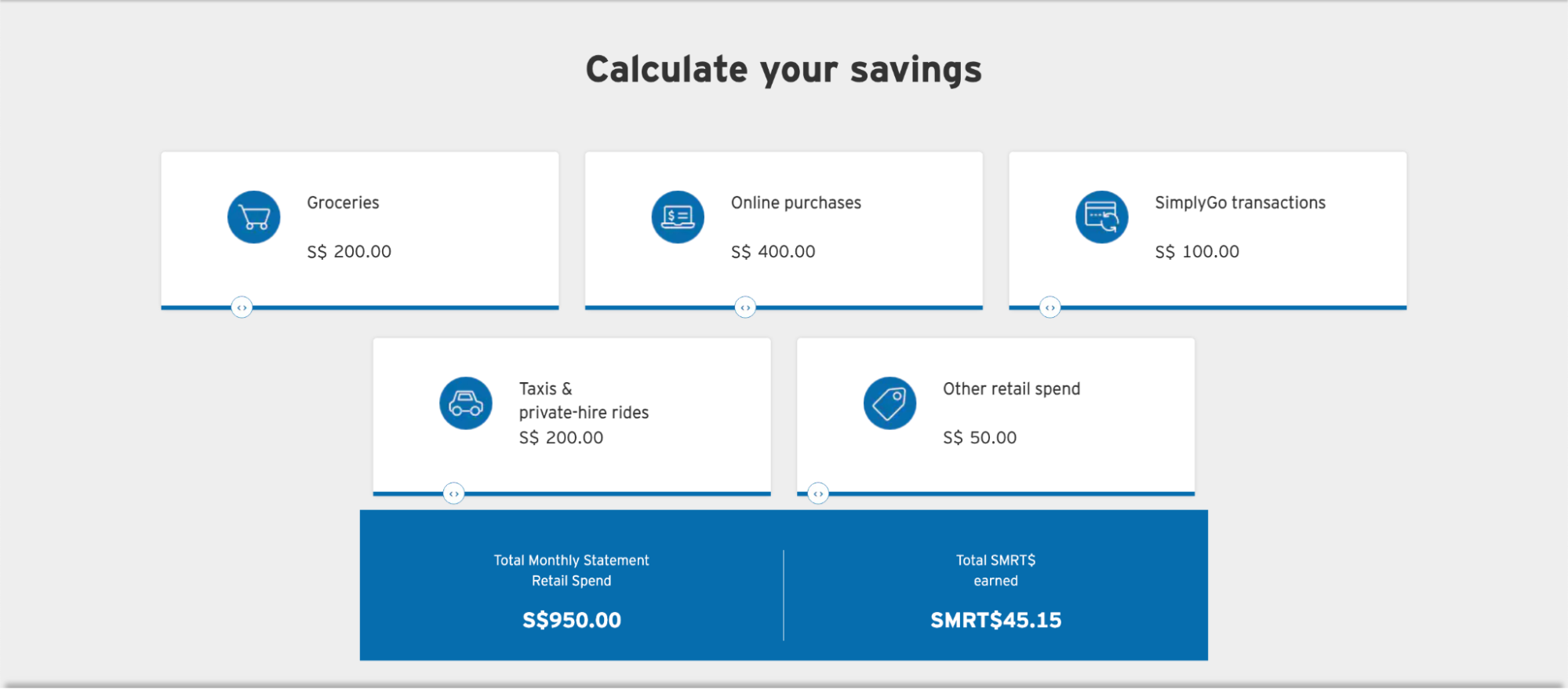

Unsurprisingly, building a household of her own represents an increase in expenses as compared to an adult still living with their parents; Ilyda’s monthly retail spend comes to about S$950.

And given how her spending is spread across categories eligible for 5 per cent savings* on the Citi SMRT Card, Ilyda can look forward to SMRT$45.15 each month.

Shawn - Father of three who are growing

With three boys aged two to eight, my colleague Shawn could do with the extra cash rebates and vouchers the Citi SMRT Card offers.

While Shawn doesn’t take much public transportation or taxis, the savings he makes there is balanced out by the cost of driving his own vehicle.

Growing boys are sure to need toys and books to hold their attention which Shawn and his wife often purchase from online and physical stores.

Image by Jerry Wang via Unsplash

Image by Jerry Wang via Unsplash

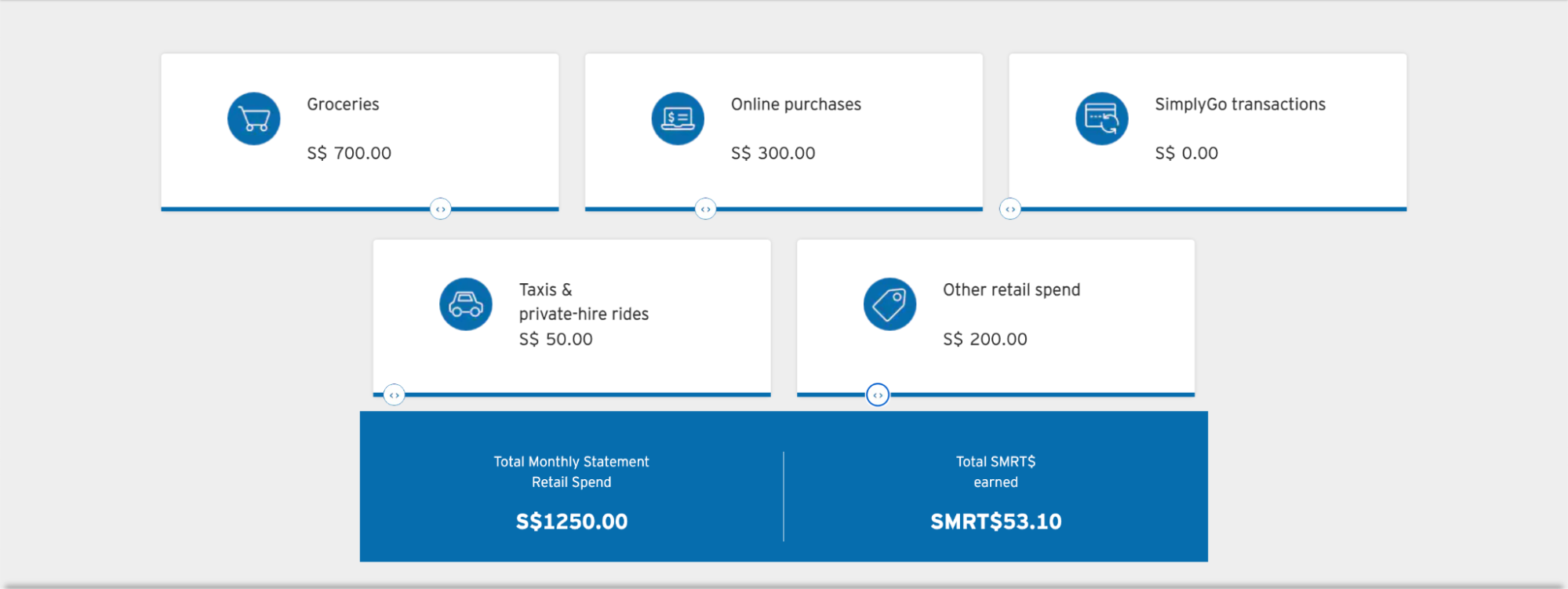

The couple also spend up to S$700 a month on groceries to feed their family of five and maintain their household.

Thankfully, the Citi SMRT Card counts purchases made at grocery stores as contribution to qualifying spend, making it rewarding and convenient to use.

By spending about S$1,250 on qualifying retail shopping each month, Shawn’s family stands to earn SMRT$53.10, which will undoubtedly come in handy the next time they go grocery shopping.

Citi SMRT Card

So whether you can’t stop spending or just love saving, if you find yourself forking out upwards of S$500 a month on groceries, online shopping, taxis, private-hires and public transportation, the Citi SMRT Card might be a suitable card for you.

With a basic fee of S$196.20 inclusive of 9 per cent GST (first two years waived), and a minimum income requirement of S$30,000 for locals and permanent residents, it’s very accessible too.

Citi SMRT Cardmembers get 5 per cent savings* monthly, when they meet the S$500 qualifying retail spend per statement month.

On top of that, there is no monthly or quarterly cap set for the awarding categories.

The SMRT$ earned is capped at SMRT$600 within the card anniversary year, which is excellent for purchasing big-ticket items.

If you’re curious to find out how much you can save by using the Citi SMRT Card, try out their calculator here.

You can enjoy an exclusive welcome gift of S$300 cash back^ when you successfully apply for a Citi SMRT Card. Apply here.

*^T&Cs apply.

This article was sponsored by the Citi SMRT Card.

Top image from Canva and Citi

MORE STORIES