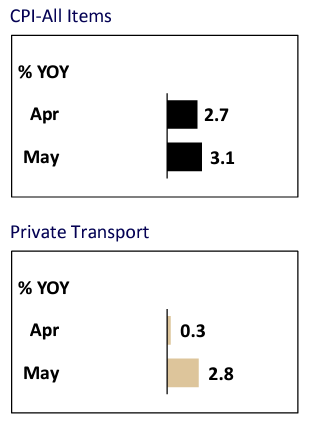

S'pore's core inflation stays at 3.1% for May 2024, 3 months in a row

Core inflation has been projected to moderate before a more noticeable decrease for the rest 2024.

Singapore's core inflation for May 2024 was 3.1 per cent on a year-on-year basis, remaining unchanged from April and March.

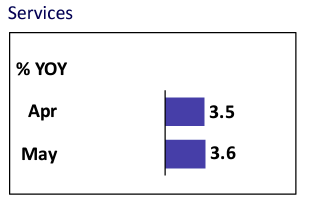

An increase in services inflation was offset by lower inflation in electricity and gas, and retail and other goods, the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) said in a joint press release.

On a month-on-month basis, core inflation increased slightly by 0.1 per cent in May.

Core inflation does not include private transport and accommodation.

Service inflation due to increase in holiday expenses and lower decline in airfares

The press release highlighted that the increase in services was by 0.1 per cent on a year-on-year basis, on the back of a larger increase in holiday expenses and a lower decline in airfares.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

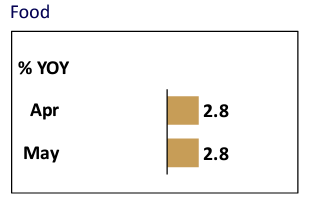

Meanwhile, food inflation remained "broadly" unchanged at 2.8 per cent, reflecting stable food services inflation, even as non-cooked food inflation registered a "modest" increase.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

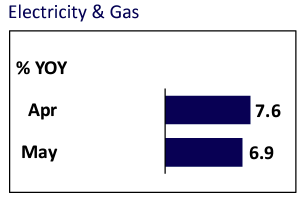

Electricity and gas inflation fell from 7.6 to 6.9 per cent

Electricity and gas inflation fell by 0.7 per cent on account of a smaller increase in electricity and gas prices.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

Meanwhile, the inflation for retail and other goods decreased by 0.1 per cent due to a slower pace of increase in prices of personal effects, as well as alcoholic beverages and tobacco.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

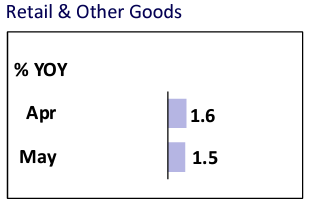

Headline inflation driven by private transport inflation

As for the consumer price index, also known as all items inflation or headline inflation, it increased to 3.1 per cent in May on a year-on-year basis, from 2.7 per cent in April.

The press release added that this had been driven by higher private transport inflation.

On a month-on-month basis, the consumer price index increased by 0.7 per cent.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

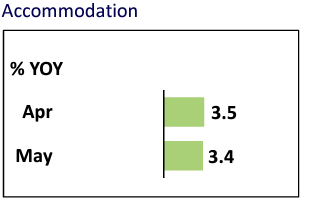

Meanwhile, the inflation for accommodation fell slightly by 0.1 per cent due to smaller increases in housing rents.

Screenshot via MTI & MAS

Screenshot via MTI & MAS

Core inflation expected to stick on "gradual moderating trend" before greater decrease in Q4 2024

MAS and MTI added that core inflation is expected to stay on a "gradual moderating trend" for the rest of 2024, before there is a more discernible decrease in the last quarter of 2024, as the pressure on import costs continue to decline and tightness in the domestic labour market eases.

The press release added that the global prices of energy and most food commodities have remained relatively stable in recent months.

In addition, the costs of Singapore’s imported intermediate and final manufactured goods have also continued to decline.

Inflation for services associated with overseas travel has remained "firm" but should moderate further over the course of 2024 as the supply for air transport and hospitality sectors worldwide is gradually restored.

Meanwhile, the gradual strengthening of the Singapore dollar trade-weighted exchange rate should continue to temper Singapore’s imported inflation in the months ahead, MAS and MTI highlighted.

Within Singapore, the increases in unit labour costs have slowed in tandem with the cooling labour market.

Nonetheless, businesses are likely to continue passing through the earlier increases in labour and other business costs to consumer prices, but a reduced pace, the press release said.

As for inflation in private transport, it is expected to moderate from 2023 amidst the larger projected Certificate of Entitlement (COE) supply for 2024.

The inflation for accommodation should also continue to ease as the supply of housing units available for rental increases over the course of the year.

Headline and core inflation expected to average 2.5 to 3.5 per cent for 2024

For 2024 as a whole, both headline and core inflation are projected to average 2.5 to 3.5 per cent.

If the transitory effects of the 1 per cent increase in the Goods and Services Tax (GST) rate to 9 per cent is excluded, headline and core inflation are expected to come in at 1.5 to 2.5 per cent.

MAS and MTI cautioned that risks to the inflation outlook still remain, however.

Such risks include new geopolitical shocks, adverse weather events and further transportation disruptions around the world, which could put upward pressure on global energy and food commodity prices, as well as shipping costs.

Domestically, a stronger-than-expected labour market could also lead to a re-acceleration in wage growth.

Conversely, an unexpected weakening in the global economy could induce a greater easing of cost and price pressures.

Top photo by Mothership

MORE STORIES