It’s not at all unusual for someone I’m interviewing to interrupt the conversation because they need to take a call.

I don’t mind at all. The interviewee will be more at ease if they can take a minute or two to answer the call, perhaps agree to call back later, and get back to what we were talking about.

“Sorry ah,” says my interviewee, Richard Tan, when he gets off the phone. “In an emergency, they will look for me,” he explains.

“Was that an emergency?” I ask Tan, puzzled at how calm he looks.

“It was,” he says coolly.

“I'm grateful I have a good team of people. One call only, they know what to do already,” he adds.

The call makes sense now. About 15 seconds of stoic silence as he listened to the person on the other end, 10 seconds of him issuing concise instructions on who to call and where they are likely to be found, before putting down the phone.

Tan remarks that others have asked why he doesn’t carry files or documents with him, and says his response is often, “it’s all inside here,” laughing as he points at his head, which is crowned with greying hair.

One can imagine the depth of experience the 69-year-old Tan carries with him. It’s not just the fact that he’s older than most of his colleagues, but also the fact that he’s been a steady employee at OCBC bank since 1975, having joined right after his National Service.

That’s 48 years with the same employer, a feat not many can match.

Currency is key

The key to Tan’s long career? Perhaps it is his drive to keep himself relevant to the job, even as he gets older.

In this time, Tan has had to navigate a lot of change — not just in the physical environment around OCBC Centre.

Many of Tan’s batchmates and former colleagues have since retired or moved on to different roles in life.

Asked if he still keeps in touch with them, he points to the challenges of maintaining relationships while holding a full-time job.

But there’s a deeper reason why Tan mostly keeps up with his current, much younger colleagues: His older connections tend to be more keen on talking about the past.

This means that some of his ex-colleagues have started to get stuck in what he describes as “a kind of time capsule”, with many letting their knowledge grow out of date.

Of course, Tan sees things differently.

“In life, you always want to move on,” he explains.

“Like a fast train, you know? Move, move, move, move, move."

How ATMs became his life's work

Tan has held various roles in OCBC since joining the bank in 1975.

His first role had him manually tabulating shareholdings, monitoring relevant transactions and recompiling shareholding data.

Tan describes how each department would have its own large room, with desks arranged in straight lines, almost classroom-style, with the boss at the front of the room facing the staff.

“It's like someone watching over you lah,” remarks Tan.

Needless to say, the old offices, with each department in its own room, were very different from the open setup many of today's workers might be accustomed to.

Tan pointing out the landmarks that predate OCBC Centre — such as the old City Hall and former Supreme Court buildings, now the National Gallery. Photo by Nigel Chua.

Tan pointing out the landmarks that predate OCBC Centre — such as the old City Hall and former Supreme Court buildings, now the National Gallery. Photo by Nigel Chua.

Then, Tan was called to join the original ATM unit in OCBC, and has worked on ATMs ever since.

At the time he joined the ATM unit in 1986, there were just around 20 OCBC ATMs across Singapore.

Then, the goal was to expand the network, and add 100 new ATMs each year.

Today, OCBC has over 600 ATMs, including its latest model which supports large withdrawals of up to S$200,000, as well as deposits in notes and coins. Photo by OCBC.

Today, OCBC has over 600 ATMs, including its latest model which supports large withdrawals of up to S$200,000, as well as deposits in notes and coins. Photo by OCBC.

He’s personally worked on some of the changes that were revolutionary then, and seen them become commonplace today.

One example is paring down the security features surrounding the ATM machine itself. In the 1980s, it was not uncommon for ATMs to be placed within walled booths, with a wooden door that could be locked to secure the machine. With most ATMs simply placed out in the open today, this may seem silly in hindsight. But to do away with the ATM booth was a radical suggestion then, as ATMs were viewed as valuable cash-containing assets and potential targets for crooks.

Another example is how the ATM swallows the user’s card in certain situations. This was introduced as a way to counter theft, and would be triggered when the ATM detected suspicious behaviour like someone keying in an incorrect PIN multiple times. The swallowed ATM card would then be fingerprinted by police, and used together with the machine’s logs and CCTV footage to track down the perpetrator.

But Tan is quickly done regaling us with his “grandfather stories” and puts things into perspective by soberly saying that ATMs as cash machines will eventually take their place in history books, as the banking industry evolves to meet their increasingly-sophisticated customers’ increasingly-sophisticated needs.

This includes the innovations his team worked on back in the day.

Take ATM card swallowing, for instance.

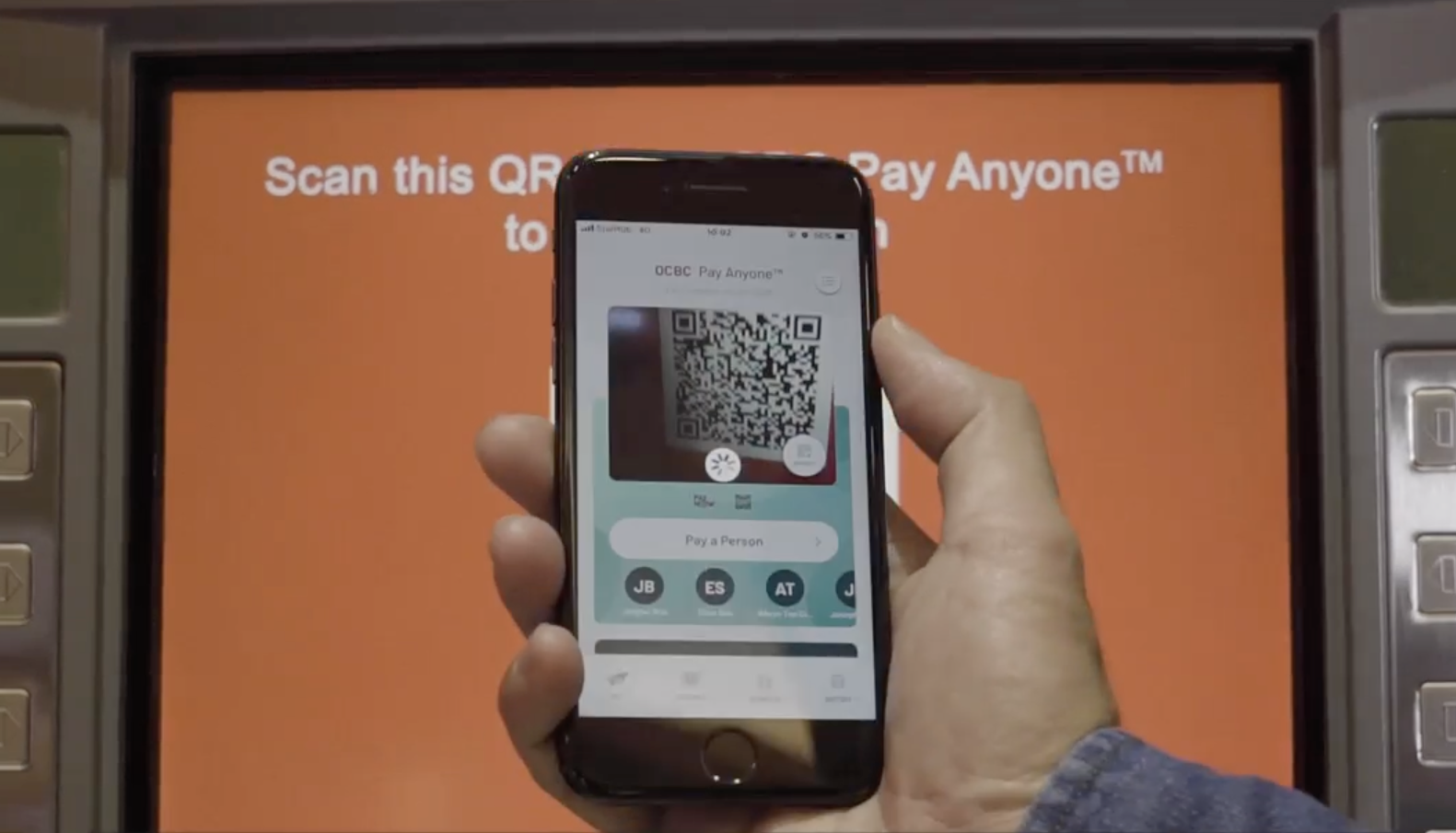

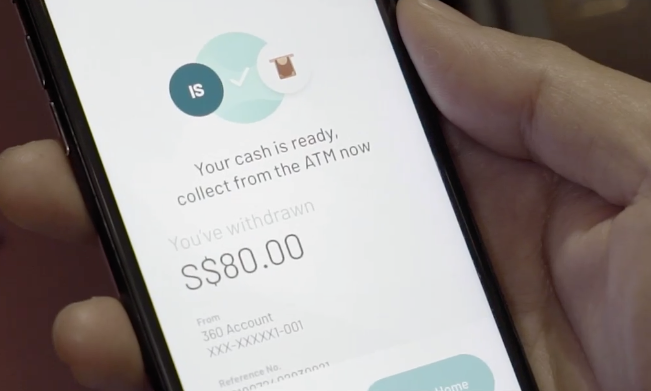

With OCBC ATM users now able to withdraw cash by logging into their bank app and scanning a QR code, ATM cards and their remarkably low-tech six-digit PIN codes may rightly become a thing of the past.

Screenshot from video by OCBC.

Screenshot from video by OCBC.

Screenshot from video by OCBC.

Screenshot from video by OCBC.

Tan doesn’t seem sentimental about his past work fading into history. If anything, he’s keen to keep abreast of new developments and proudly says that OCBC is “always the first” to roll out new innovations.

Today, Tan’s department is known as Electronic Banking Operations.

“What you find in an ATM today — it’s no longer just purely cash,” he says. In Tan’s view, banks may soon streamline their branch operations in favour of an “e-lobby concept” with much reduced headcounts.

There’s increasing demand for electronic banking, and with that in mind, it’s no surprise that OCBC’s ATMs support much more than just cash-related transactions. Forex, remittance, trade financing are just some of the functions that Tan’s team deals with.

“So when we talk about ATMs, you cannot look at it purely as a cash machine anymore. In time to come, it’s got to become more of this e-banking [machine].”

Growing with the times

Over the years, Tan has had to keep himself updated even as ATMs got updated.

One of the major “updates” Tan himself went through was in the area of working with younger colleagues — something Tan confesses he’s had some difficulties with in the past.

At one point, Tan formed an impression that younger people saw themselves as bringers of new ideas, while people of his vintage were viewed as "dinosaurs".

“As Singaporean Chinese, we all know that we’re brought up in a culture where we pay respect to someone older than us,” says Tan, who remembers that he “gave a lot of respect” to his seniors, even those just two or three years older.

Tan now believes that teammates, regardless of age, should treat each other as equals.

And Tan knows not to expect others to kowtow to his age, position, or status.

“Today, a younger guy will not call you uncle. He will call you Richard.”

It’s a change to what he experienced as a younger employee, but he now sees the importance of being able to “unwind and rewind” his mindset over time.

His attitude, drawn from his Christian faith, is humility.

“Humility does not mean that you allow yourself to be trampled. Humility is about how you carry yourself… And humility does not mean that I [always] agree with you.”

He emphasises the importance of mutual respect, and always thinking about “what we can offer to the other person, not what the person can offer to us.”

Reasons to keep going

As it stands, Tan, well past retirement age, has already extended his employment multiple times.

He credits it to his current and past bosses, with whom he shared good working relationships, and who encouraged him to continue on in the company.

As to why he accepted, when asked to extend his service, Tan says it is “very simple”.

“To keep my mind going. It’s not about the money. We cannot be sitting down, watching TV, look at Google… I want to be engaged.”

He’s also been glad to see that his presence, and his experience, is of help to the younger generation of Singaporeans.

“Whatever skillsets I can pass, I’ll pass down to them,” he says.

This sponsored article by OCBC Bank made the author rethink his views on job-hopping.Top image by Nigel Chua

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.