For many of us, the world of online banking is a familiar one.

All one really needs is a phone and a working Internet connection.

But despite the convenience online banking brings, some admittedly find it difficult to jump on the digital bandwagon.

This includes some close to our hearts – like our parents or grandparents.

We spoke to a few senior Singaporeans to get their thoughts on why online banking remains difficult for them.

Here’s what they said.

Difficult to find basic banking functions

A 56-year-old parent of a colleague raised a practical concern – that it was difficult to find all the relevant “basic functions” for online banking on the mobile app.

He lamented that it was easier to navigate and find the most common banking services on the desktop version instead, such as PayNow and local transfer, as compared to on mobile.

He elaborated: “It’s not that difficult, but I only use a few functions. More user friendly would be good - it’d be easier if they put the important things on the main screen so it’s easier to access, like for scheduled payments.”

Fear of making erroneous transactions

Another 72-year-old grandparent elaborated on her fear of making a wrong transaction, by accidentally pressing the wrong button or making other mis-steps without knowing.

This fear in turn outweighed the perceived benefits to online banking; while she expressed regret at only being able to pay her friends back in cash or in person, she also stated that for her, the risk was “just not worth it”.

This sentiment was echoed by a friend’s 86-year-old grandparent, who uses the online banking web platform, but not the apps.

He shared that he rarely carries out any transactions online as well, or if he does, it is with the help of his relatives.

“The only transaction I have made was with my granddaughter. I go online [web platform] to check my account balance, but I do not make any transactions”.

Fear of “getting hacked”

One 65-year-old parent of a colleague also shared that he generally doesn’t trust the security of online banking networks, because of “too much hacking”.

He feared that one day, a hacker might get into his account, resulting in him waking up with all his money gone.

To prevent that from happening, he preferred to make his transactions in person, such as via signing forms for standing instructions personally (the old school way, by going down to the bank), or using cold hard cash.

Forgetting one’s password

An 86-year-old grandparent also expressed an understandable worry – that he’d accidentally forget his password, and be locked out of his account.

These difficulties in navigating the tech of online banking apps (e.g. how does one even print online bank statements from your phone?) make him less confident to venture into the world of online banking.

When asked how difficult he’d rate a (hypothetical) online banking experience, he gave it a 7/10.

Online banking tips

So, the question is: Can online banking be made simpler for our seniors?

After all, it appears that most senior Singaporeans are aware of the option, and have the tools to use it (smartphone/ mobile phone) but are still held back by a variety of reasons.

To address the needs and fears of those who might want to try online banking, but just don’t know how, here are some tips and tricks to help navigate the platform.

Entering the educational part of the story:

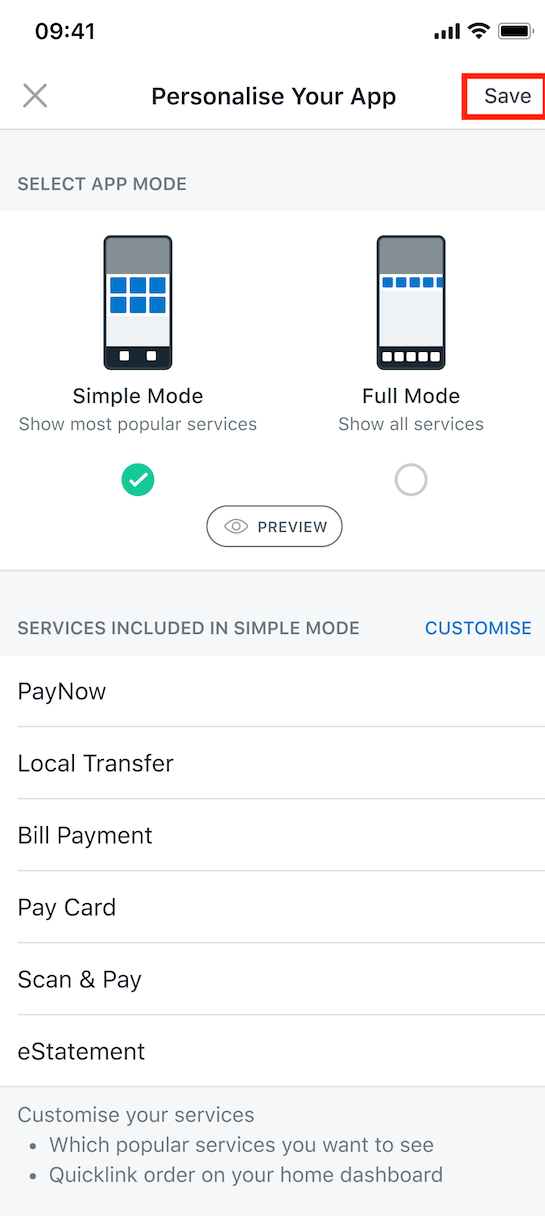

1. POSB Simple Mode

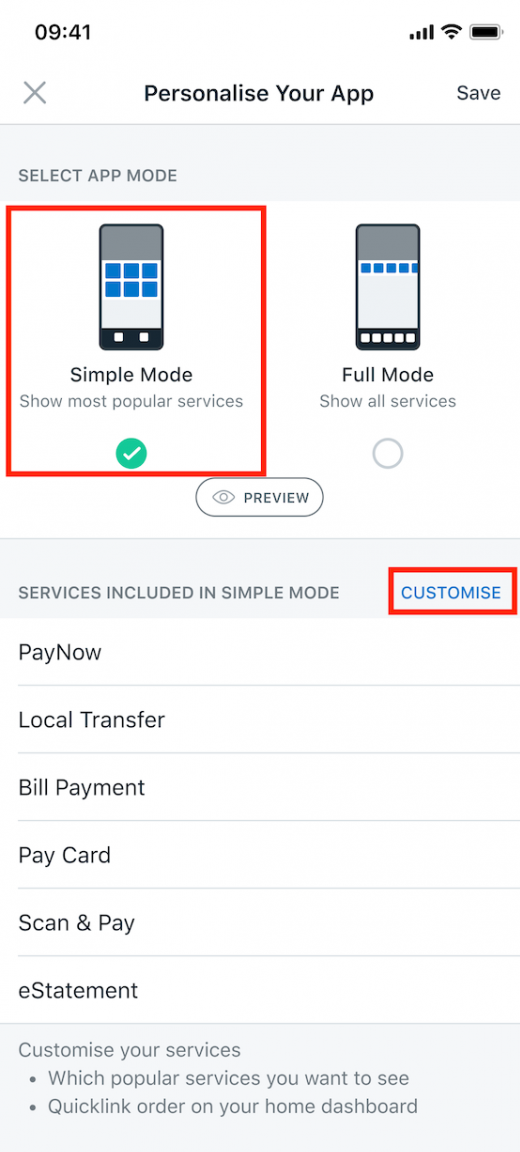

For the pesky problem of having too many functions, too much confusion, POSB Simple Mode can help.

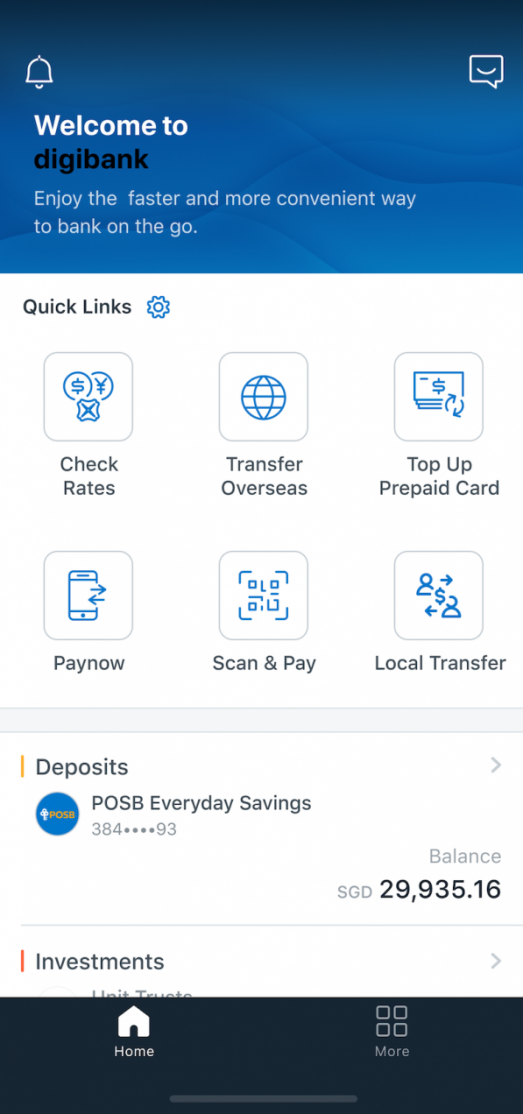

Simple Mode allows customers to add their six most commonly used online banking services directly to their app homepage, enabling for quicker navigation.

The text and icons are also enlarged for easier readability.

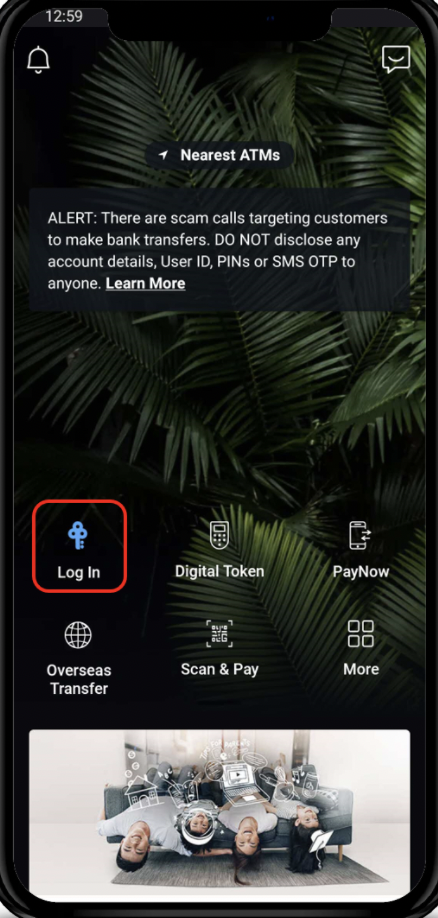

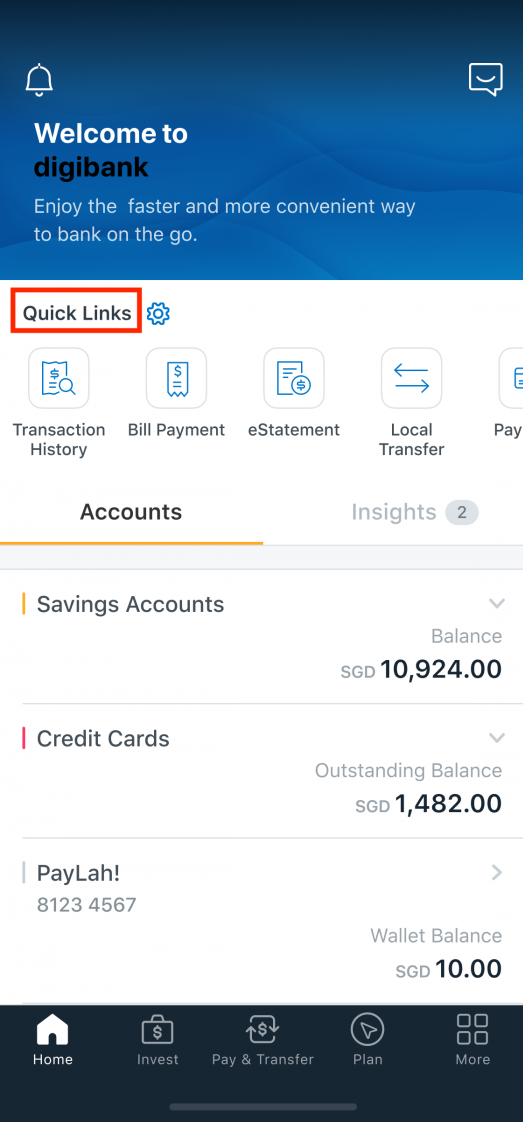

To switch from “Full Mode” to “Simple Mode”, simply Log In to your POSB Digibank app, and select “Quick Links” on the Homepage.

You’ll be prompted to “personalise your app” by selecting “Simple Mode”.

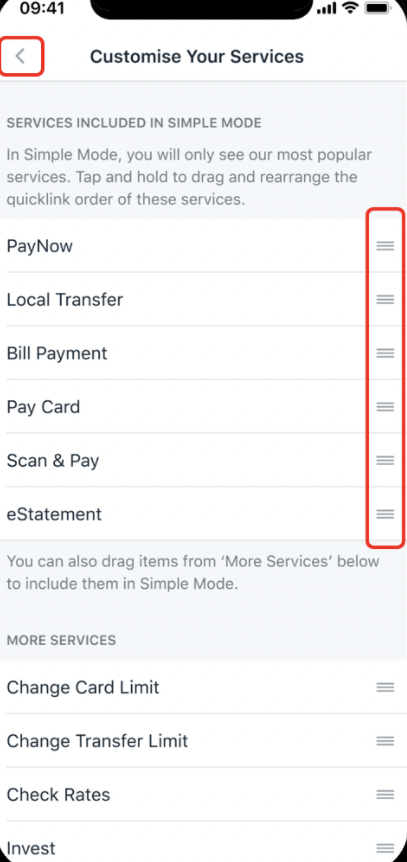

If you want, you can click “Customise” to rearrange the six services in your preferred order.

Tap “Save” to complete the personalisation.

And voila, you’re working off a simplified version of the mobile online banking experience.

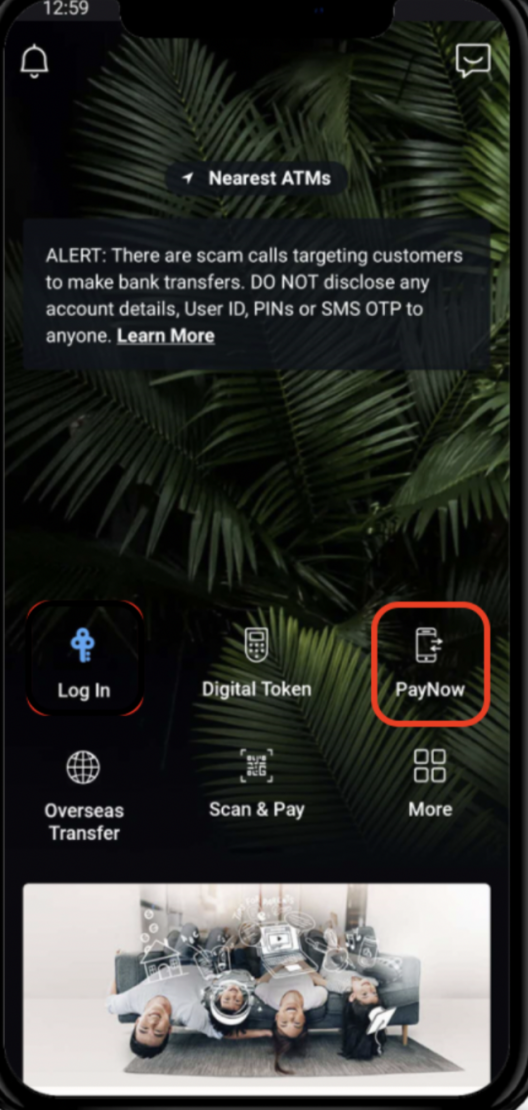

2. Using PayNow

This brings us to the next point – how to use perhaps the most useful feature of online banking – PayNow.

PayNow allows users to transfer money directly and immediately to friends and family, and if you go through the motions step-by-step, it’s a lot less intimidating to navigate.

You can find the option on the Homepage of the POSB Digibank app.

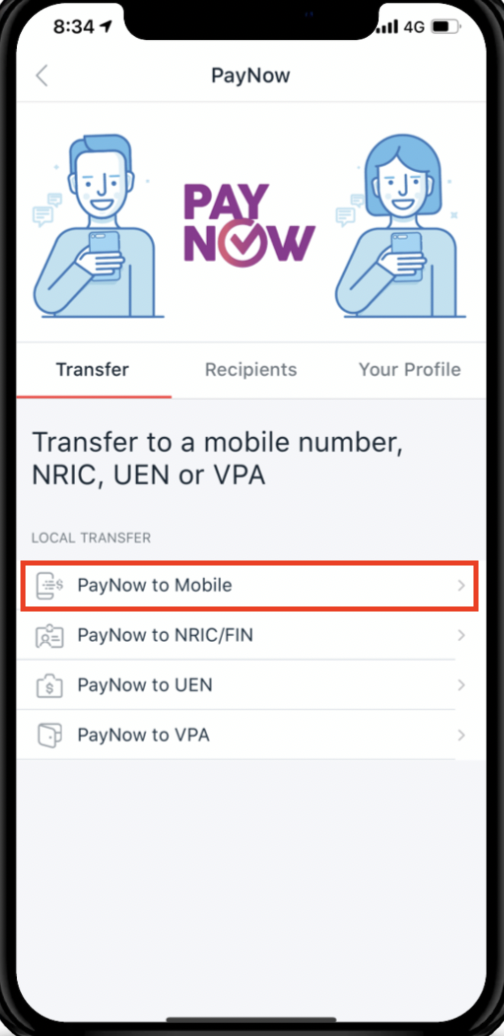

And once you click in, you’ll be guided to a page that displays one of four modes to transfer your money.

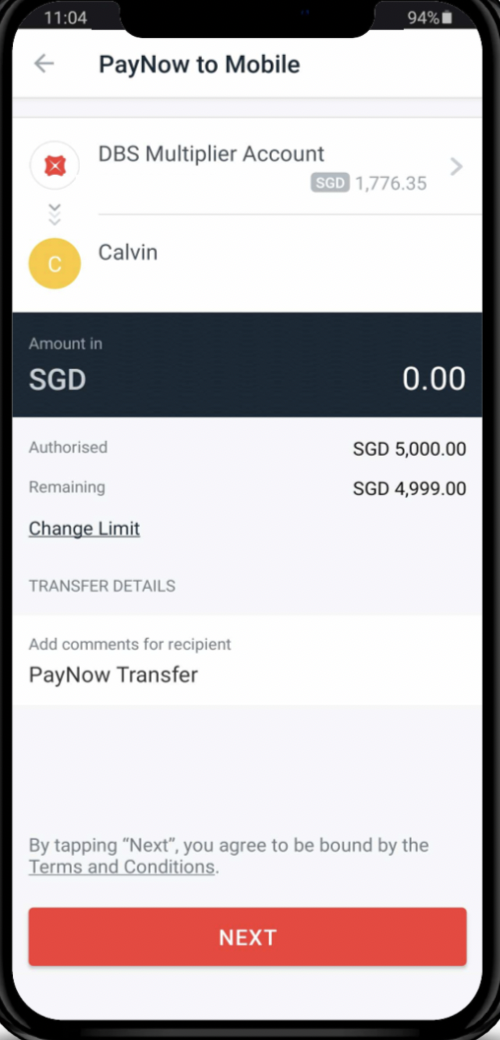

To minimise chances of making an erroneous transfer, a simple rule of thumb is to always select the “PayNow to Mobile” option, because that prompts you to always choose a recipient from your contact list.

All you have to do then is select the bank account you want to transfer money from, the amount you wish to transfer, and tap “Next”.

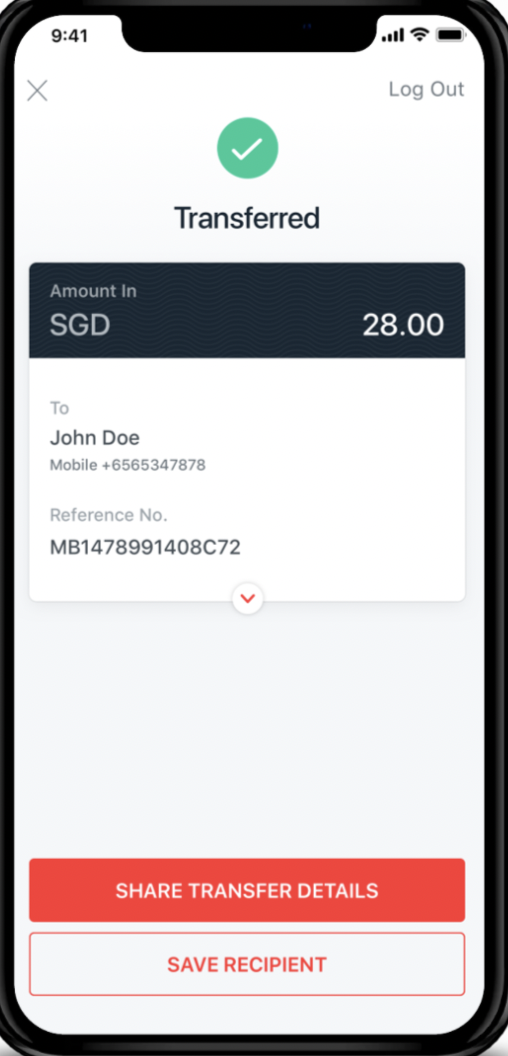

Check if the details of the transfer are correct (you’ll be able to see who you’re giving money to), then click “Transfer Now”.

The final page will show a record of your entire transaction.

3. Password protection and account security

For account security, or the problem of remembering one’s password, it becomes a little trickier.

For the former, POSB recommends using a unique mix of numbers (six to nine digits) when forming one’s password – e.g. 122822 – in order to mitigate against hacking.

Understandably, this still might be too complicated for the less savvy senior to remember, let alone navigate, so an easier alternative would be to get the kids (or grandkids) to help with doing a one-time set up of Face ID verification, or fingerprint verification for login and transactions.

That’s how most of us get past having to remember our passwords too.

This would also be more secure, as it’s harder for the bad guys to impersonate one’s face or fingerprint to a T. Remember to only save biometrics on personal devices.

If all else fails, you can always check out this site for more information.

Top image via POSB Facebook

This sponsored article by POSB made the writer order bubble tea.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.