Covid-19 sucks.

Now with the Omicron variant floating around, there just seems to be no end in sight.

What does one do about this situation then?

Well, I work.

And work.

And work.

And look at where we are now: almost two years into the pandemic.

Apart from the limited places we can travel to for holiday, the only time I can stop working is probably when I’m dead or retired.

I don’t have a retirement plan but I do know what I want to do in retirement: reading a book by a beach while sipping some whiskey or something.

I do enjoy these activities now; I just don’t have the luxury to enjoy time like that often enough.

Ah… Sounds like just the kind of retirement life for me.

I digress. Back to the daily grind.

Hang on, since I won’t be traveling any time soon and have some extra time on hand, isn’t it a good opportunity for me to do some retirement planning?

One thing leads to the other: if I really want to enjoy books about the meaning of life (or the lack thereof) and have a tipple at the same time, I really need to have a real plan (all the dollars and cents).

As someone without a sound retirement plan in place, where should I start?

Well, the only savings I have for retirement (admittedly, not of my own choosing) are in my CPF — so I figured to start from there.

Be Ready with CPF Quiz

No offence to CPF but I don’t really visit the website except when I need to check on my CPF statements.

Financial planning is hard – even more so for retirement, which feels like a lifetime away.

It’s just a lot of information for me to take in.

Plus, I’m not all that great with numbers.

But I was pleasantly surprised when I landed on the Be Ready with CPF website to embark on some kind of retirement planning, only to find this rather entertaining and informational quiz.

I’m about to discover my life purpose.

I’m about to discover my life purpose.

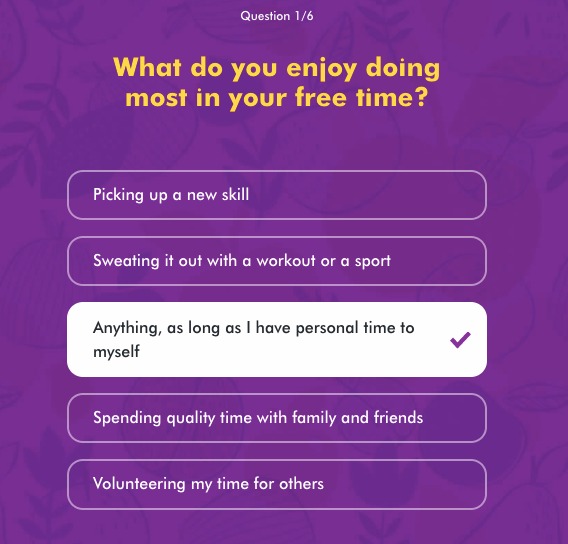

Then a series of six light-hearted questions popped up.

I answered them as truthfully as possible.

I consider reading and drinking by the beach me-time.

I consider reading and drinking by the beach me-time.

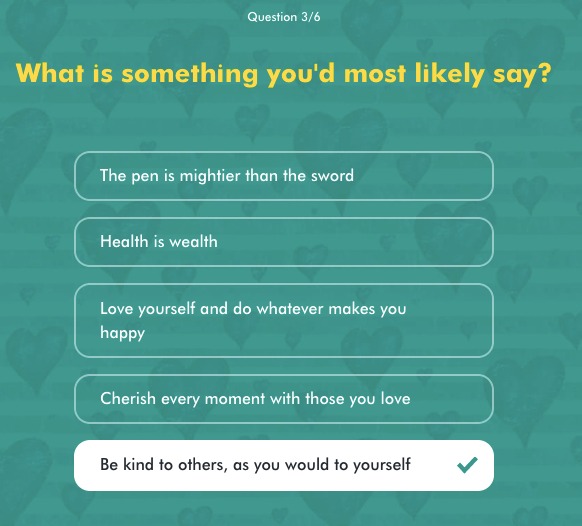

Om.

Om.

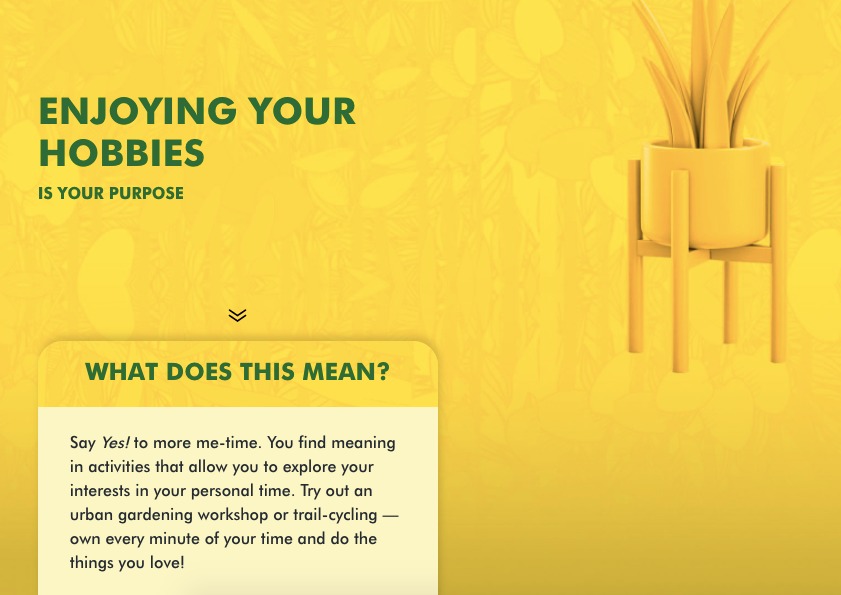

After entering my birth year and month, I found my purpose.

Me-time. So far so accurate.

Me-time. So far so accurate.

Then I saw this prompt: Get personalised tips to help with your financial health, so you can worry less and spend more time pursuing your hobbies with peace of mind.

Yes, give me the tips, I muttered to myself while trying to anticipate how much money I’d need for retirement.

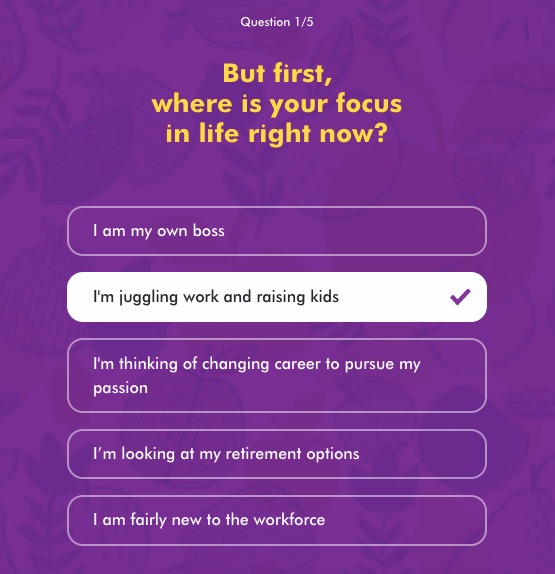

But before that, I was confronted by another set of questions asking, “Where is my focus in life right now?”

I’m the circus clown.

I’m the circus clown.

*I believe I can touch the sky*

*I believe I can touch the sky*

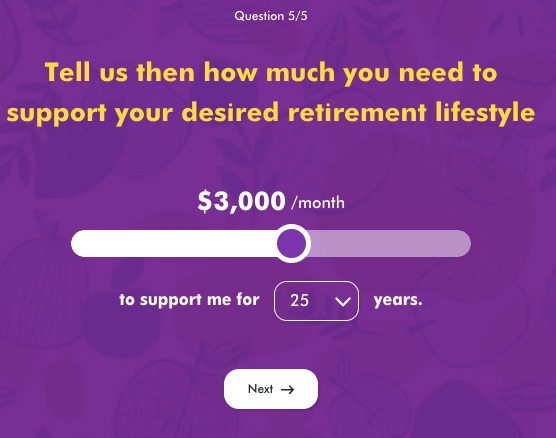

Ah then this question:

To be honest, I wasn’t sure. So I just slid the slider somewhere right of the middle.

S$3,000 per month it is.

I waited with bated breath for my results.

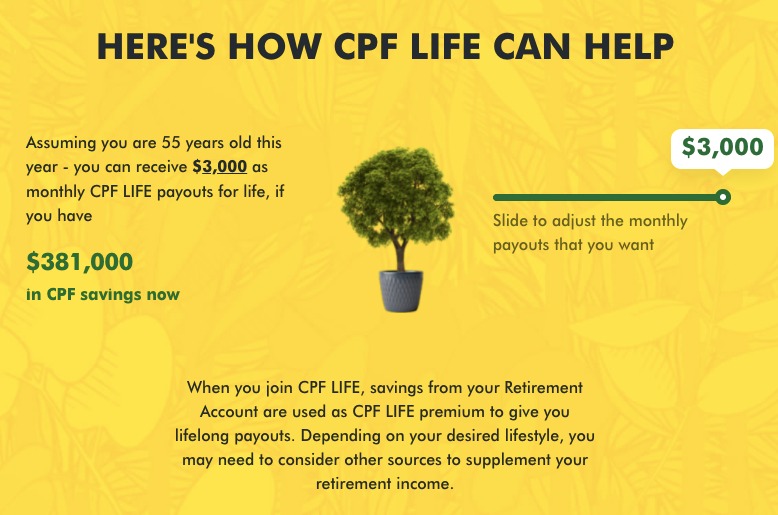

So there’s this portion about CPF LIFE: “When you join CPF LIFE, savings from your Retirement Account are used as CPF LIFE premium to give you lifelong payouts. Depending on your desired lifestyle, you may need to consider other sources to supplement your retirement income.”

Wait. What is CPF LIFE?

Short for CPF Lifelong Income For the Elderly, CPF LIFE is a national longevity insurance annuity scheme that insures you against running out of your retirement savings, by providing you with a monthly payout no matter how long you live.

Sounds like a good plan.

So how do I join this?

According to CPF, you’ll be automatically included in CPF LIFE if you’re:

-

A Singapore Citizen or Permanent Resident;

-

Born in 1958 or after; and

-

Have at least $60,000 in your retirement savings before you reach 65

In our working years, we accumulate savings in our CPF through monthly contributions by our employer and from our salary.

This amount grows with attractive interest rates of up to 5% p.a.*.

So even when we’re doing nothing and may not notice it, our CPF is helping us prepare for our golden years.

When we turn 55 years old, a Retirement Account (RA) will be created for us.

This is in addition to the 3 CPF accounts that we have – the Ordinary Account (OA), MediSave Account (MA) and Special Account (SA).

The savings in our SA and OA, up to our Full Retirement Sum (FRS), will be transferred to our RA.

We can then use our RA savings to join CPF LIFE and receive monthly payouts anytime from age 65.

What I’ve learnt so far

45 minutes later, I learnt that It’s important to build up my CPF savings.

The more CPF savings I set aside for retirement, the higher my monthly CPF LIFE payouts would be – this means more funds for the books and drinks in retirement.

One way to have more CPF savings is of course to keep working, but we can also top up our SA to give our savings a boost.

With the power of compound interest, our savings can grow significantly over time.

The earlier we start saving, the more we can accumulate.

To make things easier, you can consider small and regular top-ups to your SA.

Here’s an example of how a monthly top-up of $50 can grow to over $12,000 in 15 years^:

S$50 a month is totally doable.

S$50 a month is totally doable.

With more CPF savings, I can totally chill by the beach during the day when I retire.

I also read some tips from CPF members on how they planned for their retirement.

It’s always good to learn from experienced folks, who have been there, done that.

After this retirement planning activity, I conclude that planning for retirement is an active process and we all should plan for retirement way ahead of time.

And I’d encourage you to do the same.

If you are not sure about your retirement goal, you can always take the quiz first.

It’s often easier to plan for retirement if you have a purpose in mind.

It’s almost like preparing for a party; you wouldn’t want your party to be lifeless right?

And since Covid-19 is not going away anytime soon, we can do our planning so that our lives do not suck as much.

Better for my life to suck now than suck later, I guess.

*Includes extra interest on the first $60,000 of a member’s combined balances. Terms and conditions apply.

^Based on base interest rates of 4% p.a. in the SA.

Top photo by Chen Mizrach on Unsplash

This is a sponsored article by CPF Board.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.