Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Proposed amendments to the Retirement and Re-Employment Act and the Central Provident Fund (CPF) Act have been passed by Parliament on Nov. 2.

The amendments were tabled to "support older Singaporeans who wish to continue working to do so and better prepare them for retirement", said the Ministry of Manpower (MOM).

Retirement Age and Re-Employment age be raised to 65 and 70 by 2030

Giving the Minister for Manpower the power to prescribe a Retirement Age and Re-Employment Age of up to 65 and 70 respectively is in line with the recommendations made by the Tripartite Workgroup on Older Workers in 2019.

These recommendations, covering a range of retirement and re-employment matters, were all accepted by the government.

Among the recommendations was that the Retirement Age and Re-Employment age should be raised to 65 and 70 by 2030, after taking into account the following factors:

- Improvements in health and life expectancy

- Better-educated and higher-skilled workers today

- Enhanced organisational capacity to manage senior workers well

Following the Workgroup's recommendations, Prime Minister Lee Hsien Loong said in his 2019 National Day Rally speech that the retirement and re-employment ages would be raised in gradual steps.

The first of these steps will come on July 1, 2022, where the Retirement Age and Re-Employment age will be raised to 63 and 68 respectively, up from 62 and 67 currently.

Employers can move faster if they wish

In his second reading speech on the amendments to both acts, Manpower Minister Tan See Leng said on Nov. 1 that "employers who wish to move faster are free to do so", and pointed to the example of the public sector.

Tan stressed that older workers are not compelled to work longer, saying:

"Raising the retirement and re-employment ages provides flexibility for older workers to work longer, but does not compel them to do so. Those who do not wish to continue working need not do so, and can enjoy their retirement."

CPF rates for senior workers to increase

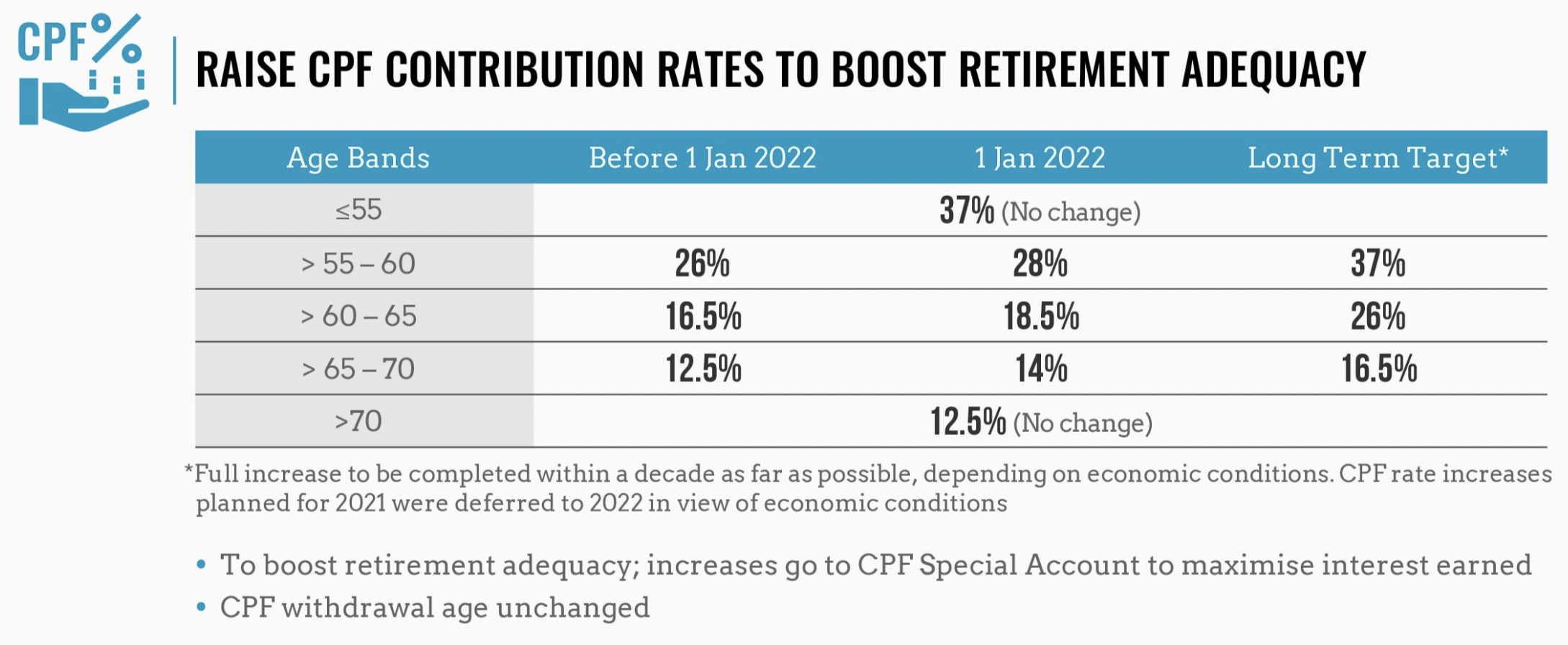

Tan also spoke about boosting retirement adequacy for seniors by increasing senior workers' CPF contribution rates, in line with another recommendation of the Workgroup.

Screenshot via infographic by MOM, NTUC, and SNEF.

Screenshot via infographic by MOM, NTUC, and SNEF.

The rates will start to gradually increase from Jan. 1, 2022, when employees aged 55 to 70 will see an increase in total CPF contribution rates of up to two percentage points, said Tan.

The increase was originally planned to take place on Jan. 1, 2021, but was deferred by a year to help employers manage costs amid the Covid-19 pandemic.

Tan also added that these changes do not affect the existing CPF withdrawal policies and ages.

Government support for employers adjusting to the changes

Tan said that the government is doing its part to help employers adjust to the changes, such as through S$1.5 billion of support in the form of the Senior Worker Support Package which was introduced in 2020.

The package includes offsets for senior workers' wages, and the additional employer CPF contributions.

There are also grants to encourage employers to raise their internal retirement and re-employment ages higher than required, and to provide part-time work options for seniors.

CPF system to be simplified

Changes were also made to the CPF Act, to make it easier for members to receive retirement payouts, to simplify the rules under the Retirement Sum Topping-Up (RSTU) and Voluntary Contributions to MediSave Account (VC-MA) schemes, and to streamline the administration of CPF schemes so that disbursement of assets can happen more quickly.

Tan said that these changes would help members build up their retirement nest eggs and receive retirement payouts smoothly, while at the same time streamlining administration of CPF schemes.

Does Singapore still need a statutory retirement age?

A number of Members of Parliament (MPs) raised the question of whether a statutory retirement age is still needed, including Workers' Party MPs Sylvia Lim and Jamus Lim, as well as PAP MP Yip Hon Weng.

Tan addressed this point in his round-up speech on Nov. 2, saying that the Workgroup had "considered this very carefully".

He said:

"[The Workgroup] looked at the experiences of other countries, and found that countries without the equivalent of a statutory retirement age do not necessarily have better employment rates for senior workers, despite some of them having anti-discrimination legislation already in place.

Some progressive employers may take the initiative to abolish their internal retirement ages and allow workers to work for as long as they wish, and we wholeheartedly applaud them. But as [Jalan Besar GRC MP] Mr Heng Chee How emphasised, the statutory retirement and re-employment age is still important as a floor and safeguard against employers who might not be as progressive.

The continued relevance of this approach is borne out by facts – Singapore’s average effective retirement age has risen faster than the OECD average."

"Legislation is not everything"

Tan also acknowledged speeches by MPs on the need to adjust culture and mindsets as a society, and as businesses.

"There is a need to invest in re-training and employment facilitation not only for our senior workers, but also for the future cohorts of senior workers," said Tan, acknowledging Heng's suggestion that strengthening the employability of our senior workers cannot start only when they are near retirement age.

Tan also made reference to "the various ways that the Government is supporting upskilling and employment opportunities for senior workers", and highlighted similar efforts by tripartite partners NTUC and the Singapore National Employers Federation (SNEF).

"Continuing education and training (or, CET), is just as important as pre-employment training (PET), as a means for our workers to upgrade their skills, remain relevant, and keep pace with global trends and developments," said Tan.

More about retirement and re-employment policy in Singapore:

Top photo screenshot via MCI on YouTube

Follow and listen to our podcast here

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.