In the age of online shopping and credit cards, working millennials often find themselves tempted at every turn to spend their hard-earned money.

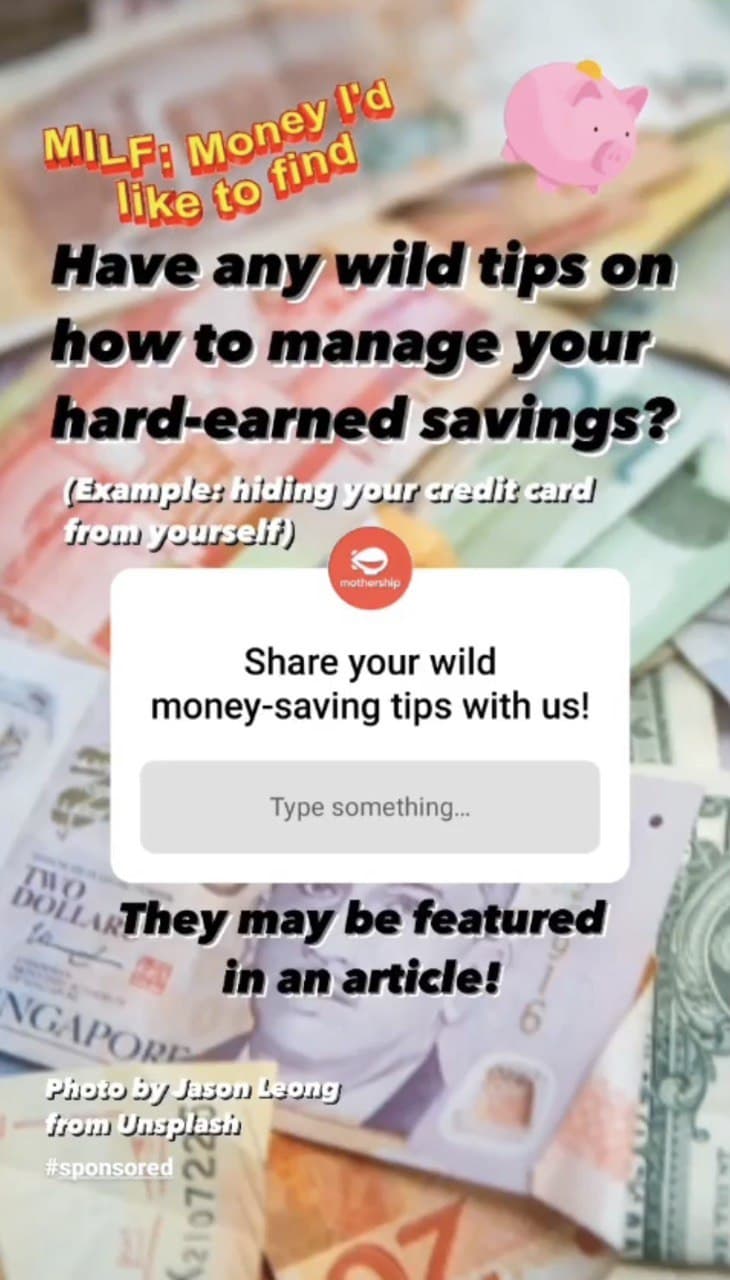

I, for one, have refused to deposit my angbao money over the last few years, out of fear that I’ll get tempted to spend it once I see the money in my bank account.

My solution? Keeping all my angbao money in a locked drawer in my room.

Photo by Low Jia Ying.

Photo by Low Jia Ying.

For sure, this works. But I’m also keenly aware that my drawer doesn’t pay out any sort of interest, and it makes my money smell a little weird.

Curious to know what strange methods of saving money that other working millennials resort to, we decided to ask our readers to share with us their wild money-saving tips.

Here are the strangest ones.

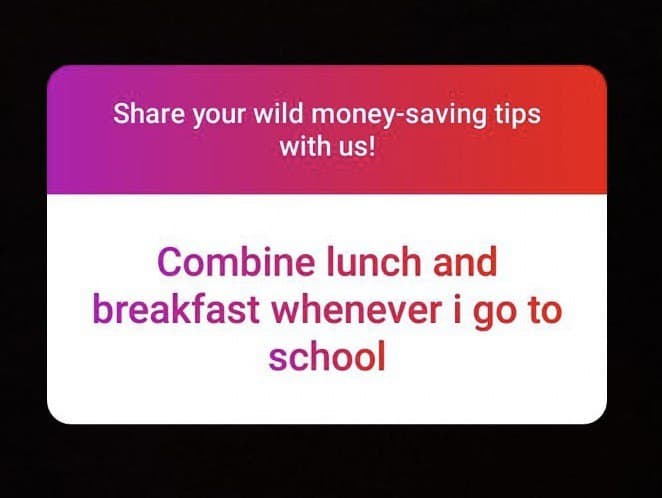

Helps with weight loss too

Some readers choose to sacrifice a good meal to save money.

The temptations of online shopping

Other readers don’t let themselves fall prey to online shopping.

Playing hide and seek with your money

These are some strange hiding places.

Some mental gymnastics required

Parents know best

Try the Tiq 3-Year Endowment Plan by Etiqa Insurance, a short-term insurance savings plan with guaranteed returns

Saving money doesn’t always come easy, and some of our readers have resorted to some wild tactics to protect their hard-earned savings.

But worrying about all the money you hide around the house may not be the best solution.

There might be an easier way.

If you want to park your savings somewhere without having to think about it, and to also see some sweet returns, consider signing up for the Tiq 3-Year Endowment Plan by Etiqa Insurance.

The endowment plan has guaranteed maturity returns of 1.62 per cent per annum, which is paid out in full after three years.

For example, if you pay a premium of S$20,000, you will receive a guaranteed benefit of S$20,986 after the three-year maturity period. This is 104.9 per cent of your initial premium.

The short time frame is perfect for those who are looking for a safe and short-term savings plan.

This means that you can easily plan for those bigger financial purchases that are coming up in your life — that BTO downpayment, the dream wedding, or a home renovation.

What’s simple about this endowment plan is that it is a single premium plan, meaning that you only have to make one payment when you sign up.

You can choose to pay a premium from as low as S$10,000, or up to S$200,000.

Signing up is easy as well, Etiqa offers immediate online acceptance, so you can sign up from the comfort of your home.

Find out more about the Tiq 3-Year Endowment Plan with guaranteed maturity returns of 1.62 per cent p.a. here.

This sponsored article by Etiqa Insurance helps us earn more to save more.

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Terms apply. Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

Information is accurate as at 14 Oct 2021. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Top photos via Low Jia Ying and screenshots from Instagram

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.