Insurance.

One of the more bothersome adult responsibilities we all have to face, at some point or another.

I remember when I first got mine, right after university.

I had to take over all the insurance policies my parents had gotten for me since I was a baby (yes, I was one of the lucky ones).

Still, the official handover of the insurance premiums, and all the terms I suddenly had to know, had me seriously thinking about insurance (perhaps for the first time ever), in ways being approached by random agents outside of MRT stations never did.

Maybe because I was also finally able to afford it, I began to actively evaluate my basic insurance coverage, and started thinking about filling in the possible gaps with additional purchases.

I did this mainly, by toggling between multiple advisory sites, and consulting various financial advisers for their advice.

Educating myself

I remember buying insurance then felt like a test on how well I could comprehend chunks of English, and if I was good with numbers.

Reading up on buzz words like “Premium” and “Benefits” and “Deductibles” felt like a necessary pre-text to understanding any policy.

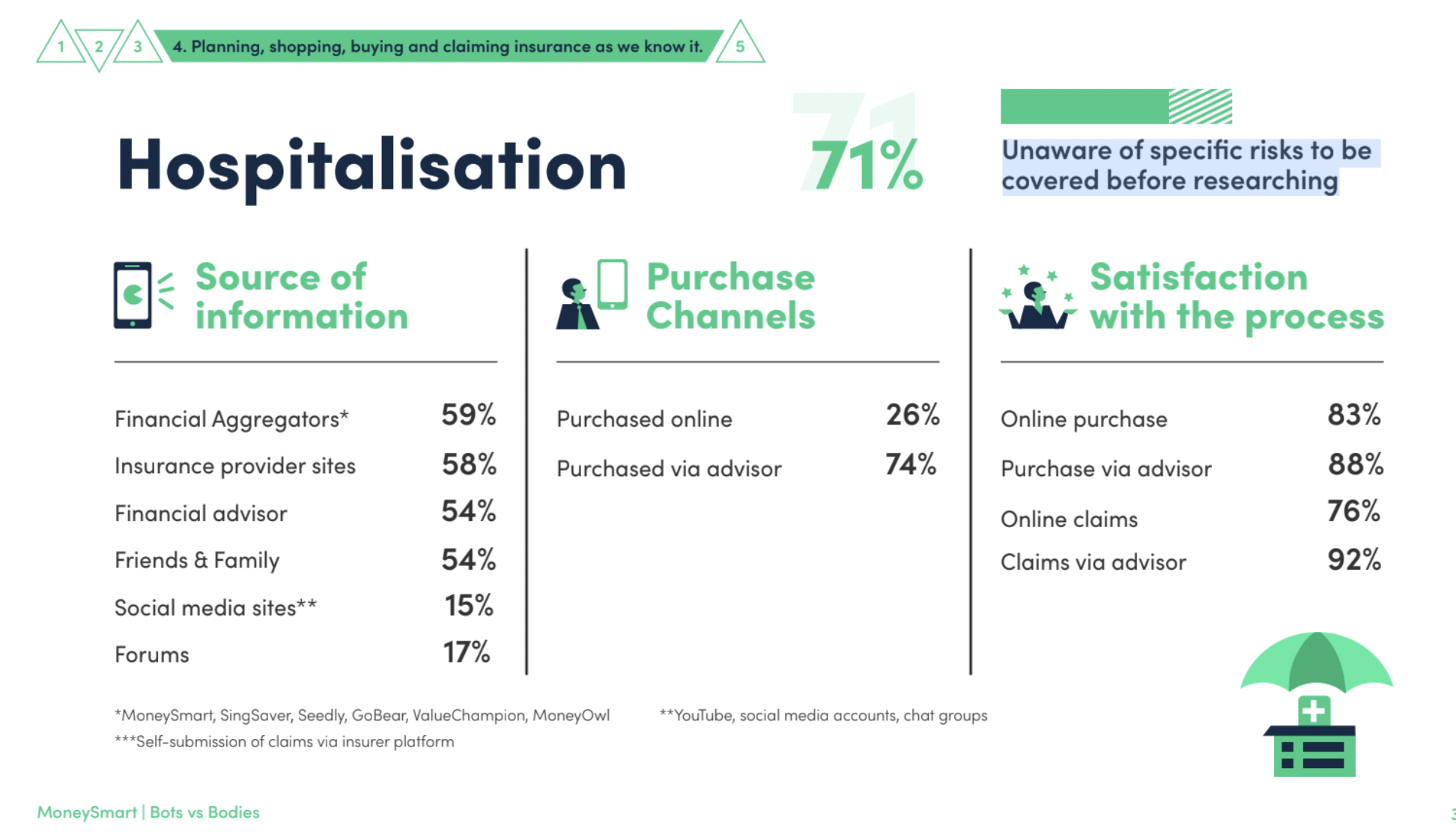

The more conditions tagged on, such as for hospitalisation insurance, which includes knowing one’s pre-existing conditions, choosing between public versus private hospital, and the type of ward, the more complex and full of jargon it seemed.

It was at this point that I’d usually turn to a financial advisor for help – to navigate the cheem-ology, and reassure any doubts I had pertaining to a policy.

Case in point: It was while reviewing the need for a critical illness (CI) policy that I learnt most life insurance policies do already cover major critical illnesses (like cancer, heart attack) as an optional rider or add-on.

However, older life insurance policies often only offer payouts for late-stage critical illness, so depending on your budget, if you want to cover early stage critical illness too, you might need a standalone CI policy, switch to a new life insurance policy, or simply forgo it for now.

Preference for human interaction?

While Google was a good friend, a trusted financial adviser thus felt like a best friend.

An adviser felt especially prudent to have in cases where it’s crucial to check on policy wording (e.g. whether getting paid out for one policy aspect affects other features under the same policy).

As my friend explains it, “Robots and digital resources can aid humans bah, but at the end of the day, financial planning is quite complex? So I’d go to a human so I can ask questions.”

This is true, at least according to a White Paper published by MoneySmart, a local financial aggregator site.

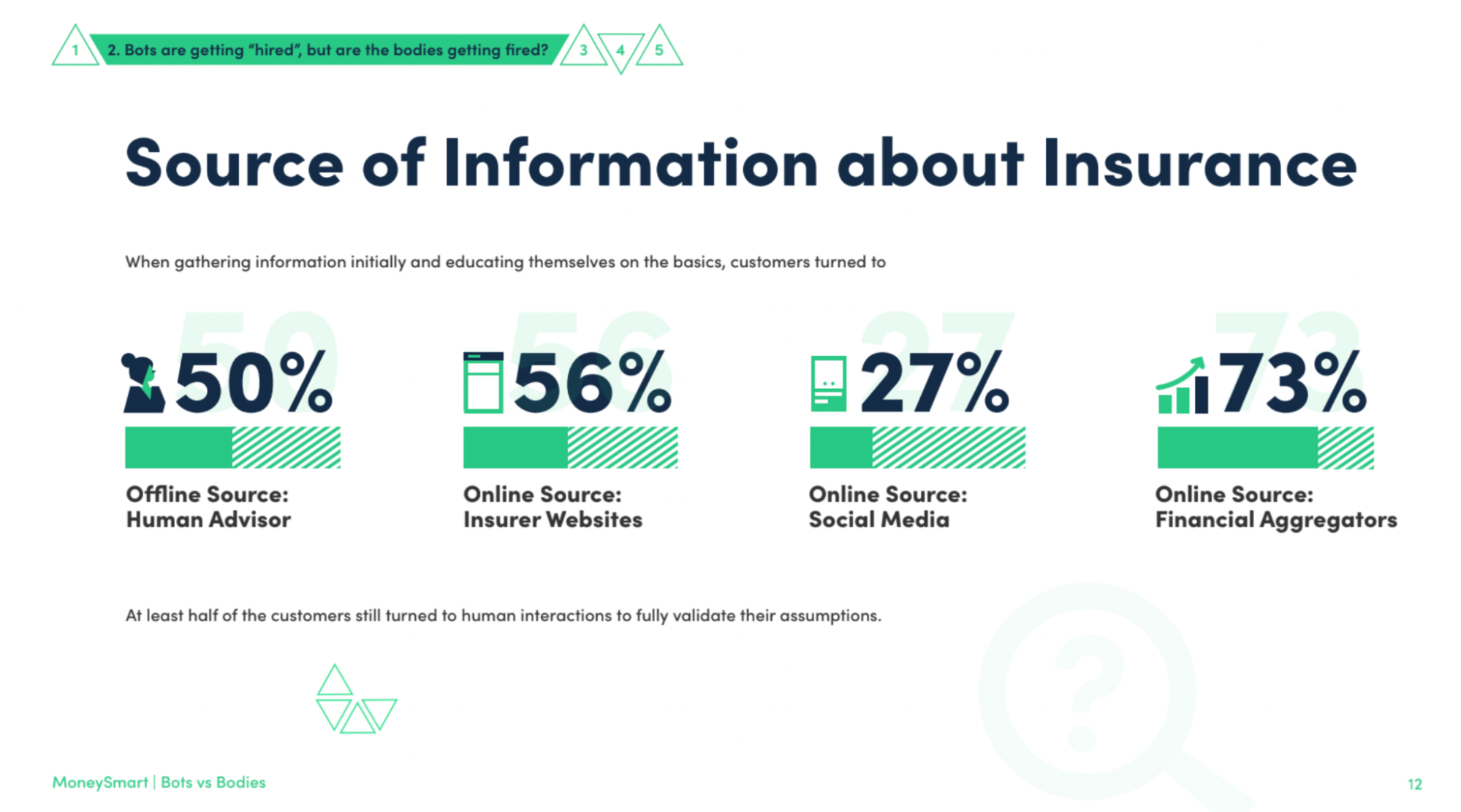

When surveyed, at least half of the customers indicated they would still turn to human interactions when buying insurance to validate their assumptions.

Interestingly, the 562 persons surveyed by MoneySmart also shared that more than 50 per cent would visit an insurer’s website, or financial aggregator sites, to source for information as well.

A key determinant appeared to be the perceived complexity of an insurance policy, as the more complex an insurance seemed, the greater a need for a human adviser was perceived.

The search for unbiased comparison

For me, being able to objectively compare between insurance policies then made all the difference when shopping for insurance.

Back then, it was the sites that I felt offered the most impartial analysis of insurance policies, presented in a simplistic way, that I’d gravitate to the most.

This also applied to the few financial advisors I spoke to, where I much preferred when an advisor recommended policies according to my needs, and not try to push another I hadn’t asked for.

Speaking to the people around me, most of whom began seriously thinking of insurance either in their final year of university, or when they began work, this was also widely agreed upon.

In fact, this quality in an insurance agent was something one friend placed above and beyond all other competencies in meet-ups with new agents.

According to the MoneySmart White Paper, most customers ultimately aim to seek unbiased opinions, and therefore prefer qualified advisers, whether human or digital, that can truly address their needs.

After all, you’re paying quite a lot of money for the off chance that something bad happens to you (protection against a rainy day, as agents would say). And it can be for several decades.

The very minimum should be someone who listens.

Convenience vs trustworthiness

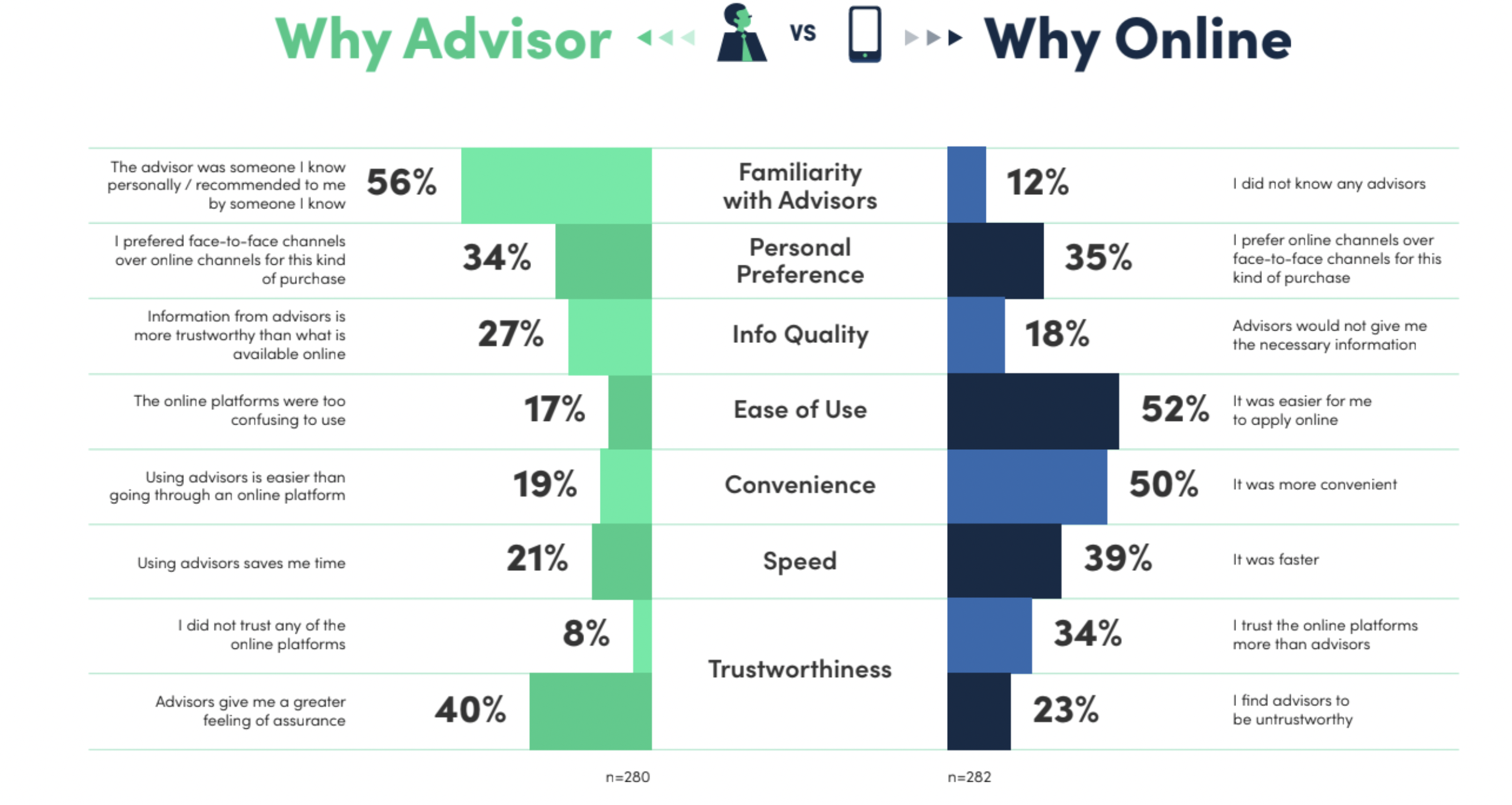

Aside from the basic need for objectivity and simplicity, however, whether one might go for “bots” (i.e. digital advisers/automated service) vs “bodies” (i.e. financial advisers) appeared to boil down to the key benefits that each offers.

That is, ease of use and convenience for “bots”, as compared to familiarity and trustworthiness with financial advisers.

For example, I personally relied on an adviser during my insurance buying process, because a) I already knew the adviser from my parents, and b) There was some degree of trust already established as a result.

A friend who has multiple close friends in the industry had a similar experience, explaining her process as: “Friend is an insurance agent, friend approached me, and I understood the arguments ‘cause I was already exposed, buy."

However, for someone else with no contacts in the industry, it might make more sense to opt for the most convenient option (buying for oneself online), especially as more digital adviser options have appeared on the scene recently (think Singlife, for example).

According to MoneySmart, the data also does point to the decision to use digital advisers in purchasing insurance versus via an adviser being relatively evenly split, with the only difference observed pertaining to one’s subsequent satisfaction levels.

“Significantly higher satisfaction levels were obtained through advisor based purchases compared to those made via online channels.”

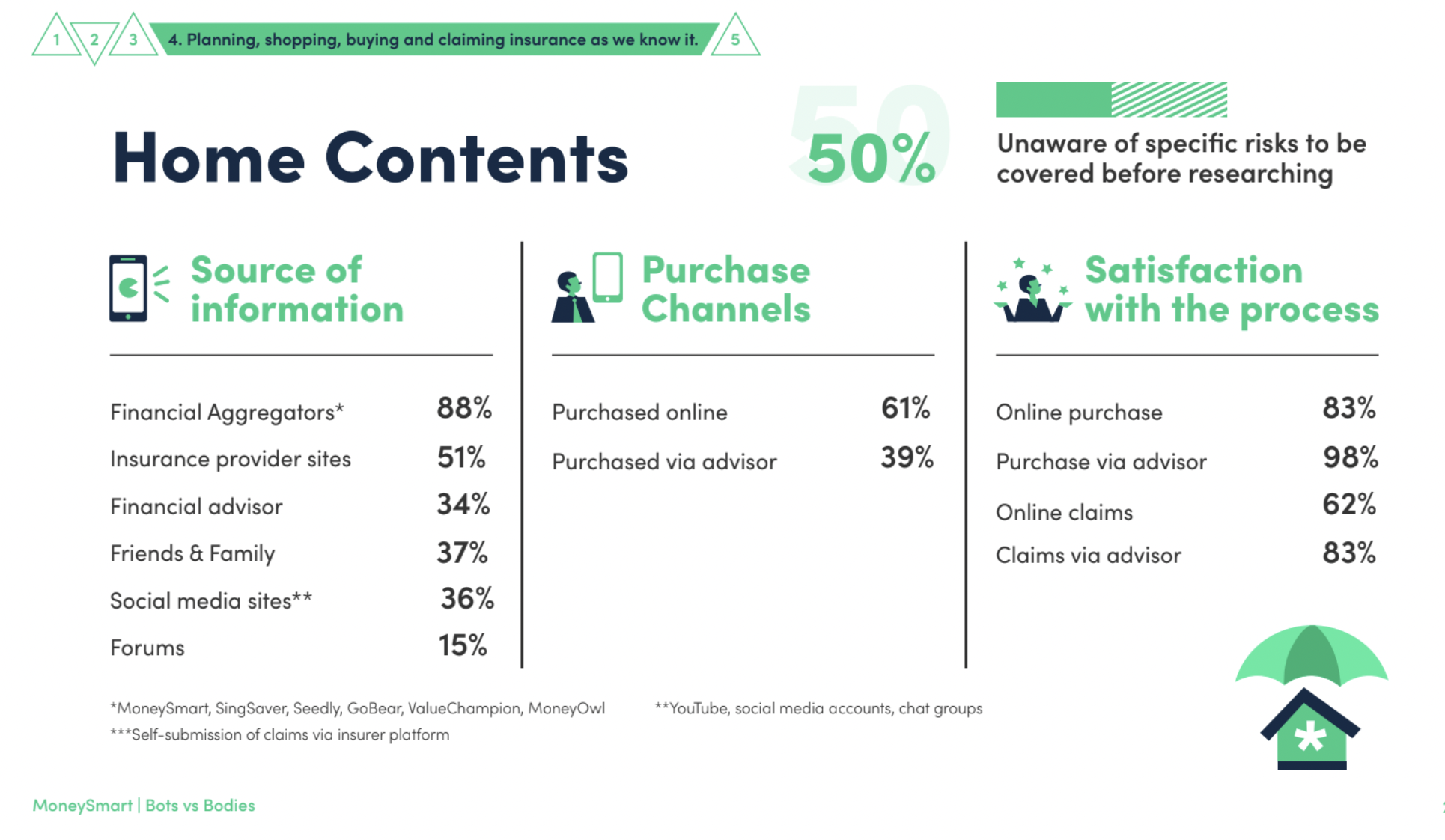

However, it is important to note that this disparity only becomes more pronounced if the product being bought is also complex (like for home contents insurance or hospitalisation insurance).

MoneySmart’s 2021 White Paper

Which brings us to the point of this article – MoneySmart’s 2021 White Paper.

According to MoneySmart, the insurance industry at large is “in the midst of its own evolution”, as Covid-19 restrictions have forced many insurers towards embracing digital transformation, such as chat bots, self-serve portals, and video conferencing.

Even so, most customers still appear to desire the services of a trusted adviser, which give them higher levels of trust and satisfaction.

Thus, in its Insurance White Paper 2021, MoneySmart took a closer look at where the balance lies “between bots and bodies”, to put forth the best customer experience for buyers of insurance.

562 insurance customers were surveyed, aged between 25 and 45 years old, from July 16 to Aug. 8, 2021, for the study.

Deep dives into four insurance products – car insurance, critical illness insurance, home contents insurance, and hospitalisation insurance – were also carried out, and subsequent breakdowns on the insurance buying process and considerations were provided for each type of product.

You can find out more about the White Paper here.

Top image via Pexels

This sponsored article by MoneySmart made the writer read a lot.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.