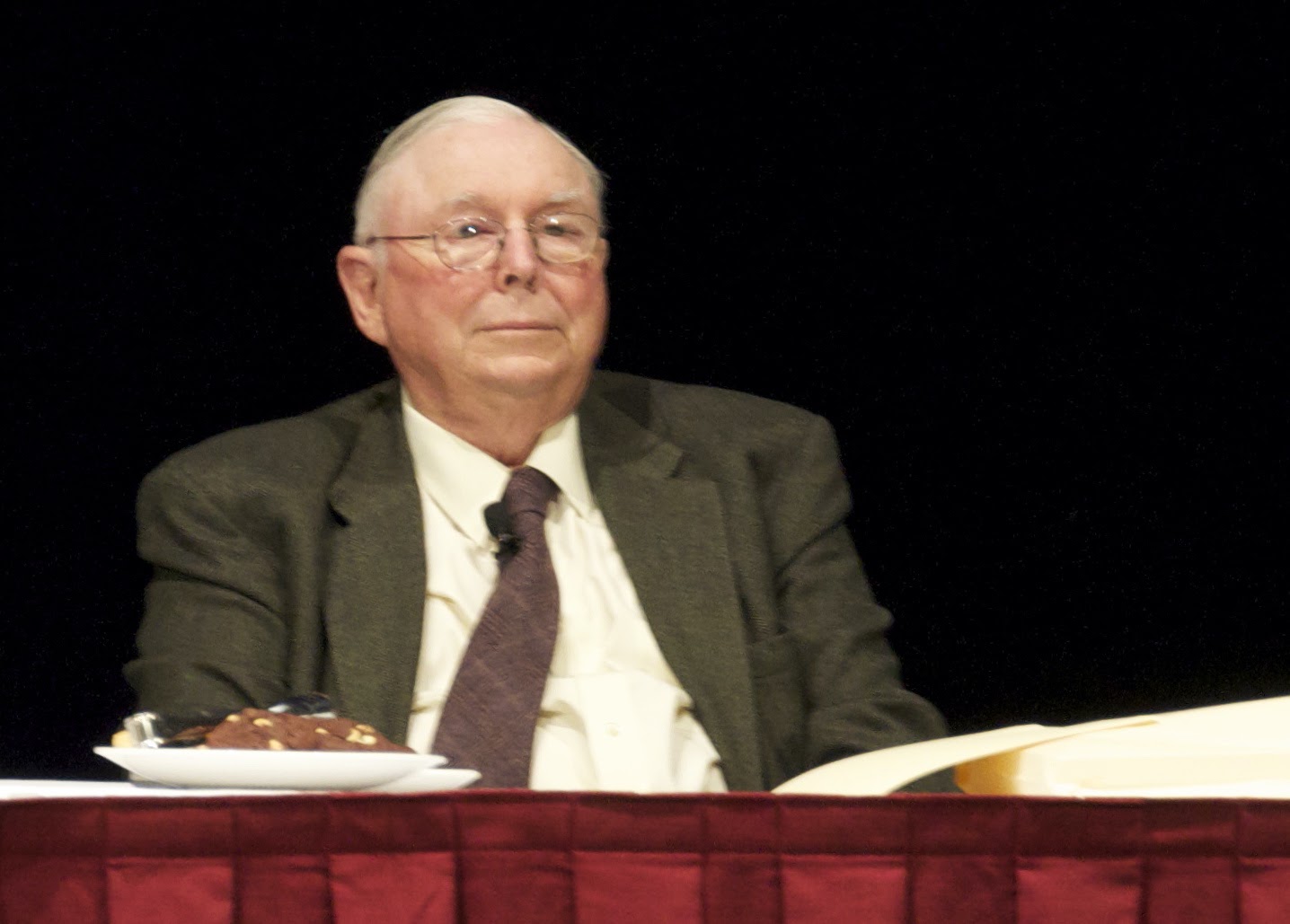

In a Berkshire Hathaway shareholders meeting on May 1, 2021, 97-year-old vice-chairman Charlie Munger blasted Bitcoin for being “disgusting and contrary to the interests of civilisation”.

Munger’s scathing comments gave many Bitcoin owners like me pause. After all, Munger is the right hand man of the legendary financial guru, Warren Buffett. To doubt his wisdom, surely, would be ill-advised.

Charlie Munger at a Berkshire shareholder meeting (Image credit: Nick, via Wikimedia Commons)

Charlie Munger at a Berkshire shareholder meeting (Image credit: Nick, via Wikimedia Commons)

Munger is not the only fierce critic of Bitcoin. In 2017, J.P. Morgan CEO Jamie Dimon, 65, characterised Bitcoin as a fraud that “will eventually blow up”.

Nevermind that, fast forward to 2021, J.P. Morgan is reportedly planning to launch an actively managed Bitcoin fund. Or that its close competitor, Goldman Sachs, has formed a cryptocurrency trading team.

But more on that next time.

The basics

For ease of understanding, I shall avoid going into the differences between cryptocurrencies, crypto-asset networks, and crypto-application networks. (Crypto purists, please give chance.)

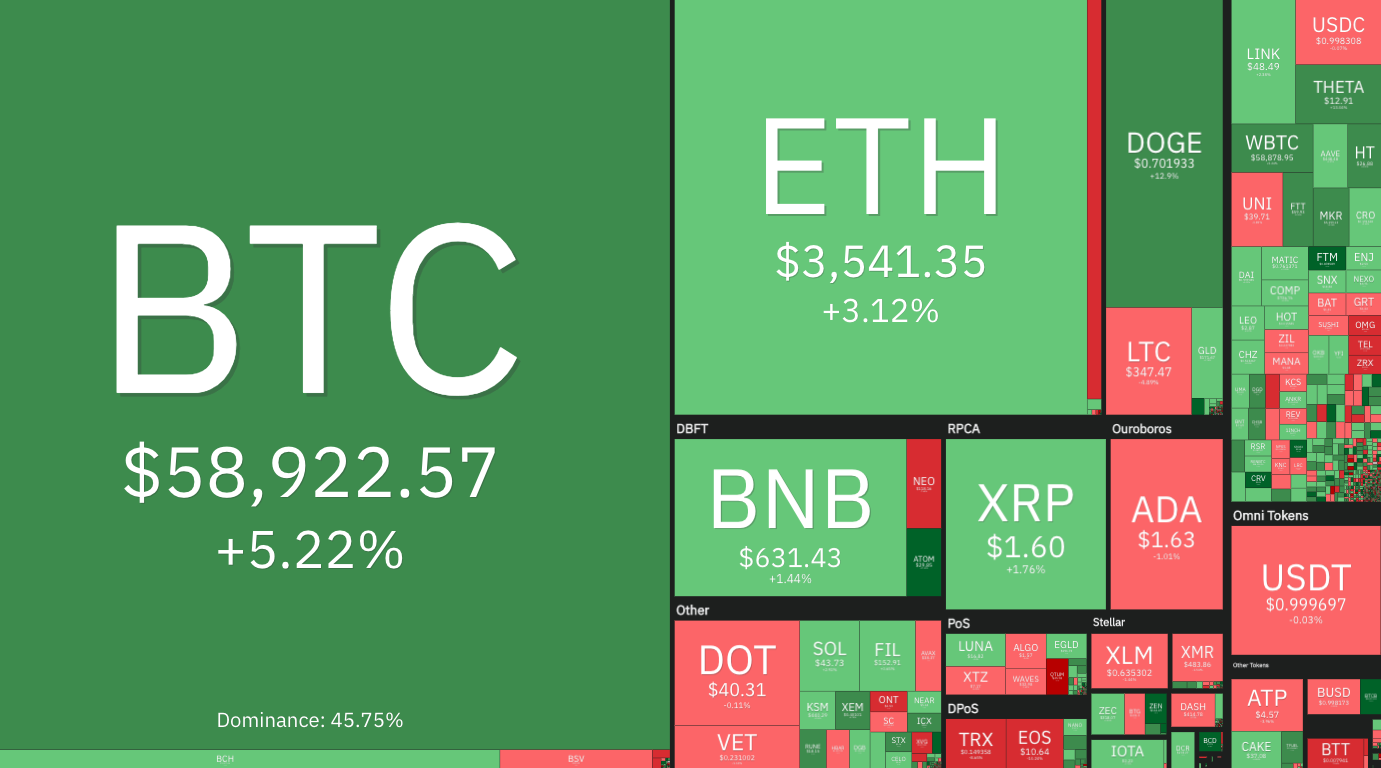

When we speak of the cryptocurrency (or ‘crypto’) market, we are referring to the broader range of individual cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Crypto market distribution, May 2021 (Image credit: COIN360)

Crypto market distribution, May 2021 (Image credit: COIN360)

While cash, stocks, bonds, real estate, and precious metals have been around for generations, cryptocurrency is the ‘new kid on the block’ in the financial markets - having only come into existence in 2009 with the creation of the first decentralised crypto, Bitcoin.

Considering this, it is amazing how much noise cryptocurrencies have made in recent years, and how they have captured the imagination and interest of the global youth in such a short time.

At present, the total market capitalisation of crypto stands over US$2 trillion, larger than many valuable companies in the world.

The digitalisation and decentralisation of the world has certainly played a part.

How I got into crypto

I first came to know of crypto in 2017 through a video on YouTube. It was quite the wild west back then, coinciding with the Initial Coin Offering (ICO) craze which saw the ICO market ballooning nearly hundredfold.

ICOs are sort of the crypto equivalent of Initial Public Offerings (IPOs), but with barely any regulation or oversight at the time. Any tom, dick, or harry could put together a whitepaper, launch a new cryptocurrency, and put it up for sale.

As a novice observing from the sidelines, that scared the living bejeebers out of me.

No way was I prepared to turn my hard-earned Singapore dollars into a Selfiecoin, Pizzacoin, Trumpcoin or, for that matter, any “shitcoin” with no fundamental value or use case.

Pizzacoin. Seriously wow. (Image credit: Pizzacoin)

Pizzacoin. Seriously wow. (Image credit: Pizzacoin)

The allure of many cryptos going “to the moon”, however, was undeniably hard to resist. For far too long had I sat gaping on the sidelines as crypto tokens like ETH rocketed 50x in value.

In typical kiasu fashion, I told myself to try nothing overly adventurous but start with the most established player in the space: Bitcoin (BTC). The selfish logic was that if for any reason even the most widely-adopted cryptocurrency in the world were to be obliterated, it would not just be me feeling the pain.

BTC being the most established crypto also meant that, relative to its peers, there was plenty more material on BTC with which I could educate myself.

Buying and trading crypto does not have to be complicated

I knew little about how crypto exchanges and wallets worked, so choosing one on which to purchase BTC turned out unexpectedly straightforward.

All I needed was an uncomplicated registration process, and a platform that allowed small transaction sizes. Ideally, it had to be locally-owned, locally-run, and have a physical presence in Singapore, so if anything were to (touch wood) go south, I know I will be able to seek help from local regulators.

And because crypto prices are already so volatile, I did not require fancy features like margin or leverage.

In other words, my platform-of-choice had to be one that suited the ‘small-time, newbie trader’ like me.

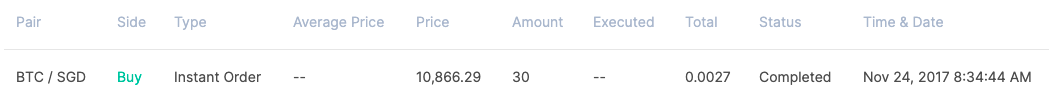

That, my friends, is how it all began. A modest 0.0027 BTC, purchased with S$30 on homegrown crypto platform Coinhako.

My first $30 worth of BTC, when BTC was at S$11,000. Shoutout to Coinhako, one of the OGs in the space. (Image credit: Daniel Ho)

My first $30 worth of BTC, when BTC was at S$11,000. Shoutout to Coinhako, one of the OGs in the space. (Image credit: Daniel Ho)

Coinhako founders Yusho Liu and Gerry Eng. Pioneers in the Singapore crypto space, who founded the largest and one of the earliest homegrown platforms. (Image credit: Coinhako)

Coinhako founders Yusho Liu and Gerry Eng. Pioneers in the Singapore crypto space, who founded the largest and one of the earliest homegrown platforms. (Image credit: Coinhako)

Periods of massive decline and despair are par for the course

It was an exciting tail end of 2017 for crypto holders.

Looks like the only way this goes is up, I thought. My initial capital of S$1,000, which I had spread over a series of purchases, nearly doubled in three weeks.

But boy was I in for a rude awakening, because after peaking on Dec. 17, 2017, BTC entered a massive decline, losing almost 80% of its value by the end of 2018. (For comparison, the 2007 and 2020 stock market crashes saw 50% and 34% declines respectively.)

2018 Bitcoin weekly chart, y-axis in USD. Heart attack-inducing 35% drops every few weeks, with no end in sight. (Image credit: TradingView)

2018 Bitcoin weekly chart, y-axis in USD. Heart attack-inducing 35% drops every few weeks, with no end in sight. (Image credit: TradingView)

My BTC holding (remember to S$1,000 that grew to S$2,000?) shrank to S$400, and it would not be till another two years after that the price of BTC finally revisited its 2017 all-time high of S$26,000.

Three weeks of euphoria, followed by three years of fear, uncertainty, and doubt.

Do your own due diligence

I always get asked why I continued to HODL. Truth is, the volatility of the crypto markets is not for everyone.

My conviction in owning Bitcoin gradually grew the more I understood its properties and appeal, as well as its strengths and weaknesses vis-à-vis other assets.

Former Google engineer Vijay Boyapati’s March 2018 piece, “The Bullish Case for Bitcoin”, is an excellent primer to Bitcoin and cryptocurrencies.

Boyapati outlines a series of attributes that define what a good store of value is, and objectively evaluates Bitcoin in relation to its traditional monetary counterparts, gold and fiat. He then offers a compelling take on where each of these monetary assets exists in their respective evolutionary cycles.

If you have an hour to spare, also watch this video interview with Michael Saylor, whose company MicroStrategy has in the past year made a strategic choice to convert over US$2 billion of cash into BTC.

[embed]

Doubt and criticism

As with anything new or that poses disruption to the prevailing system or structure, brace yourself for plenty of skepticism and opposition.

In 2017, the primary reaction I got from those around me was, “Really? Has to be a scam.”

In 2018, “See? Told you it’s going to zero.”

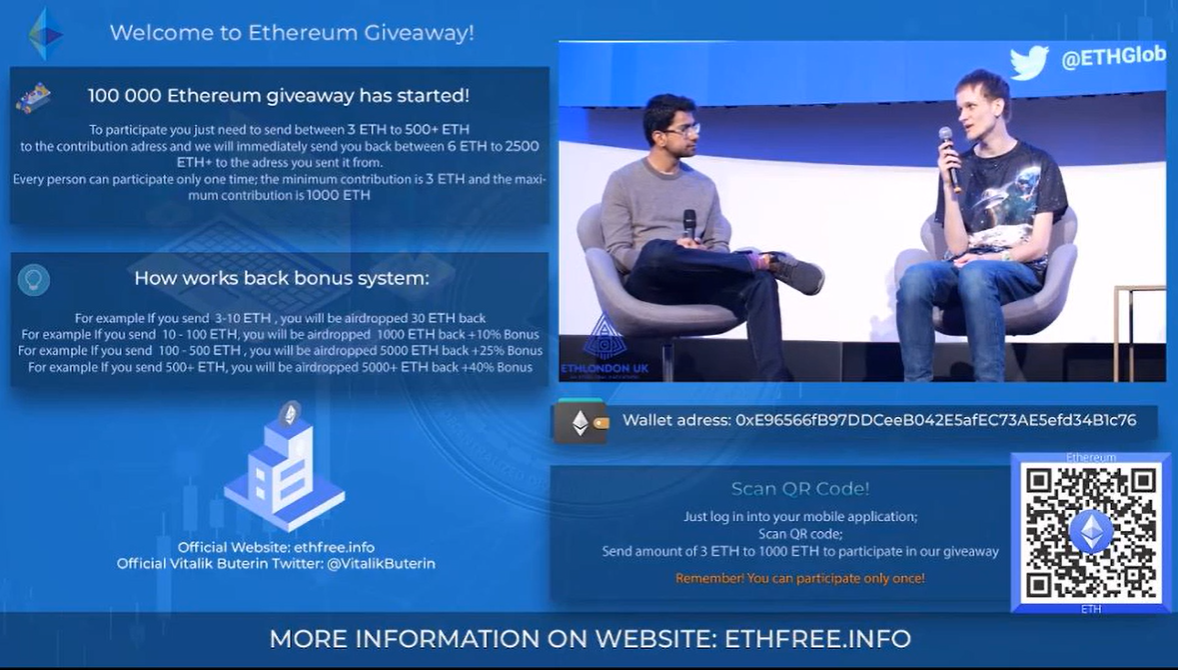

ETH giveaway ad on YouTube. Doesn’t help that scams like these are still rampant. (Image credit: CoinDesk)

ETH giveaway ad on YouTube. Doesn’t help that scams like these are still rampant. (Image credit: CoinDesk)

Fast forward even to 2020, it became “The success of crypto won’t go on forever. Governments are sure to crack down on it,” or that BTC is “not a viable or widely-accepted means of exchange”.

I accept that it is not the job of incumbents to make life easy for any emerging challenger, but “not a widely-accepted means of exchange”?

Sorry to disappoint, but it hardly bothers me that I am unable to use BTC to buy cai png from the cafeteria near my workplace.

Can stocks or real estate buy me cai png? Is it practical for the cai png uncle to accept a 0.8-gram bar speck of gold smaller than the size of his pinky toenail, in exchange for 2 meat 1 veg with rice?

Enough said, though - fun fact - Kopitiam at Funan does accept payments in BTC and ETH.

Anyway, do your own research and arrive at your own decision. The Coinhako blog also provides plenty of research, commentary, and insights into the crypto space.

The Coinhako blog is regularly updated with useful content. (Image credit: Coinhako blog)

The Coinhako blog is regularly updated with useful content. (Image credit: Coinhako blog)

What makes crypto attractive to millennials and zoomers?

The unstoppable force of digitalisation is plainly seen and felt, not least in commerce and communications. Crypto is but a logical response to the changing face of society and of our way of life.

For the four billion millennials and zoomers who grew up in a paperless world in which the ones and zeros of cyberspace form the default means of living - of getting everyday tasks done - it is only a matter of time before the traditional monetary and banking system, with all its known limitations, diminishes in utility and relevance and the “internet of money”, as technologist Andreas Antonopoulos puts it, takes centrestage.

In terms of generational value and wealth, a cryptocurrency like Bitcoin - designed specifically to function as a deflationary store of value and long-term, asymmetric hedge against the devaluation of fiat money - presents a significantly more attractive risk-reward potential as compared to the already saturated and overvalued real estate and stock markets.

The numbers hardly lie. A 2021 survey by financial group Charles Schwab found that 51% of UK investors under 37 now trade cryptocurrencies - double the proportion who trade stocks.

How much farther this trend will run, nobody knows. What is for sure is that about 20% of my net worth is in crypto, and I plan to increase this proportion in the coming years.

--

Start your crypto journey with Coinhako, a beginner-friendly cryptocurrency wallet service based in Singapore that enables users to buy, sell, and trade cryptocurrencies.

This sponsored article by Coinhako hopes to help readers gain a better understanding and appreciation of cryptocurrency. We hope you’re reading this, Mr Munger.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.