Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Ministry of Health (MOH) has announced that a new common subsidy framework for inpatients at acute hospitals (AH) will be implemented from mid-2022.

Changes to the means-testing subsidy framework, said Senior Minister of State for Health Koh Poh Koon during the Committee of Supply debate (Mar. 5), come as the government aims to better target subsidies towards those who need it more.

The changes to the subsidy framework are expected to distribute resources to those who need greater support, while providing patients access to care at the most appropriate healthcare settings.

New common subsidy framework for B2 and C wards

Koh said that MOH will "unify B2 and C subsidies into a common framework".

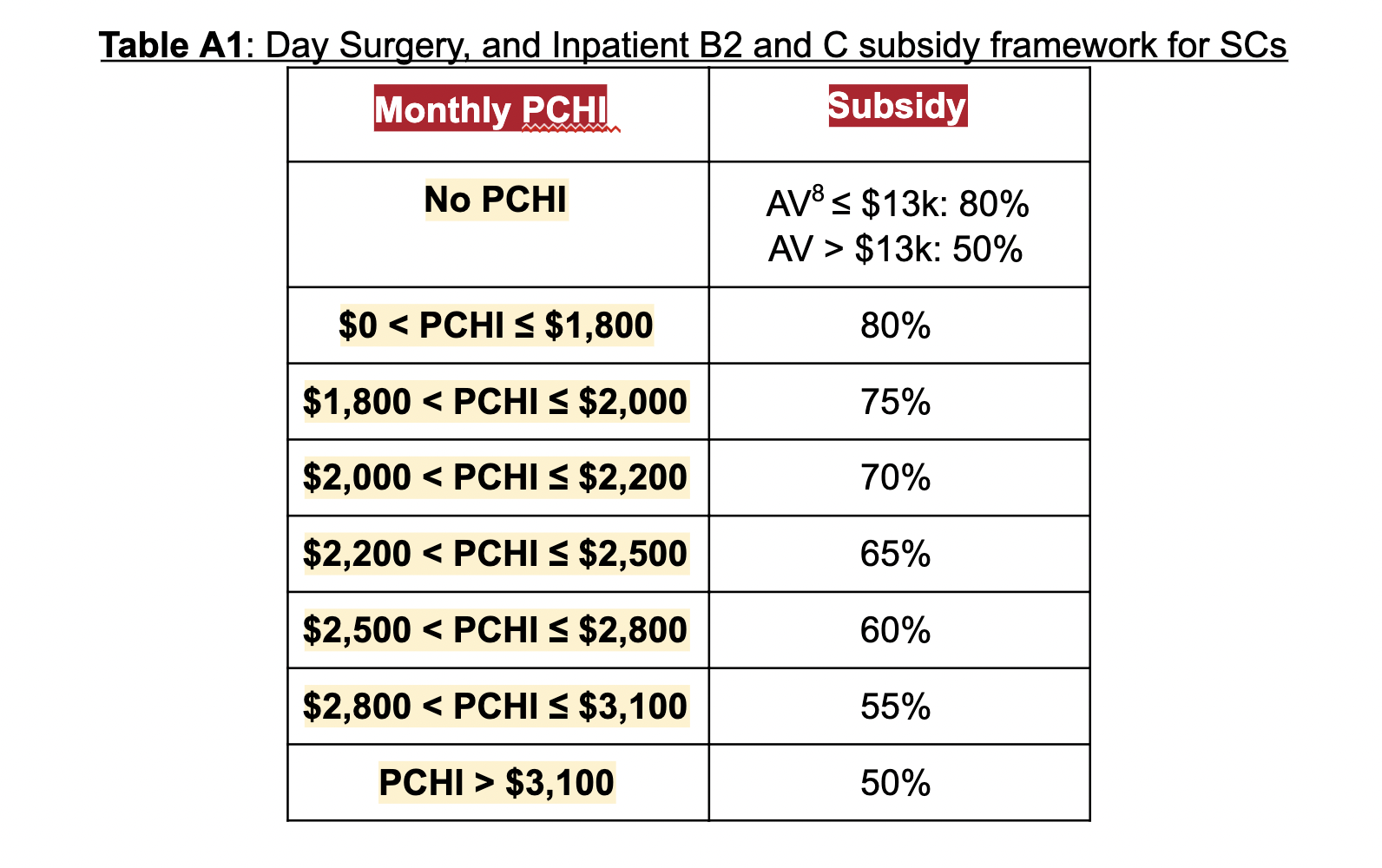

This means that both the B2 and C wards will be subsidised from a range of 50 per cent to 80 per cent, based on per capita household income (PCHI). PCHI will be computed as the gross household monthly income, divided by the total number of family members living in the household.

Today, B2 wards are currently subsidised at 50 per cent to 65 per cent of the hospitalisation bill, while C wards are subsidised at 65 per cent to 80 per cent.

The new framework, said Koh, will also be applied to day surgeries, where subsidies are 65 per cent today.

This will increase subsidies for 70 per cent of day surgery bills and encourage day surgeries instead of inpatient admission when appropriate, he said.

Image courtesy of MOH

Image courtesy of MOH

No change will be made to the maximum and minimum subsidy levels, and patients can continue to choose between B2 and C wards.

With the daily treatment fees being different between wards, this means that C ward charges would continue to be lower than B2 ward charges.

The change comes as MOH intends to move away from a legacy system that uses ward choice as a "proxy of means" for subsidy level differentiation.

The majority of individuals subject to the new subsidy framework are not expected to see changes to Out-Of-Pocket payments (OOPs).

About 30 per cent of households will see lower OOPs while 15 per cent will see higher OOPs respectively.

Increasing MediSave (MSV) limits review for outpatient expenses

To better support elderly patients, Koh also explained that MOH would increase the Flexi-MediSave limit from S$200 to S$300 from Jun. 1, 2021.

This was in response to NCMP Hazel Poa's and WP MP Gerald Giam's concerns about how MediSave coverage could be expanded to alleviate increasing healthcare costs for the elderly, especially with chronic conditions, in the outpatient setting.

The Flexi-MediSave scheme was introduced in 2015 to that allow patients aged 60 and above to withdraw from their own, or their spouse’s MediSave Accounts to pay for outpatient expenses. It can be used in conjunction with other schemes, such as MediSave500 and MediSave700.

Koh said that on top of the top up in Flexi-MediSave limit, the government had already raised annual MediSave limits from S$500 to S$700 for patients with complex chronic conditions earlier this year, in January 2021.

The chronic conditions covered under the Chronic Disease Management Programme (CDMP), mentioned in last year's Committee of Supply debate, would be regularly reviewed.

Koh also added that they would continue to review the MediSave schemes regularly, to ensure that they remain relevant and adequate for all Singaporeans.

Top image via TTSH/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.