Follow us on Telegram for the latest updates: https://t.me/mothershipsg

National Development Minister Desmond Lee announced on Mar. 4 during the Budget debate that the HDB Flat Portal, recently launched in January 2021, will be introducing new features progressively.

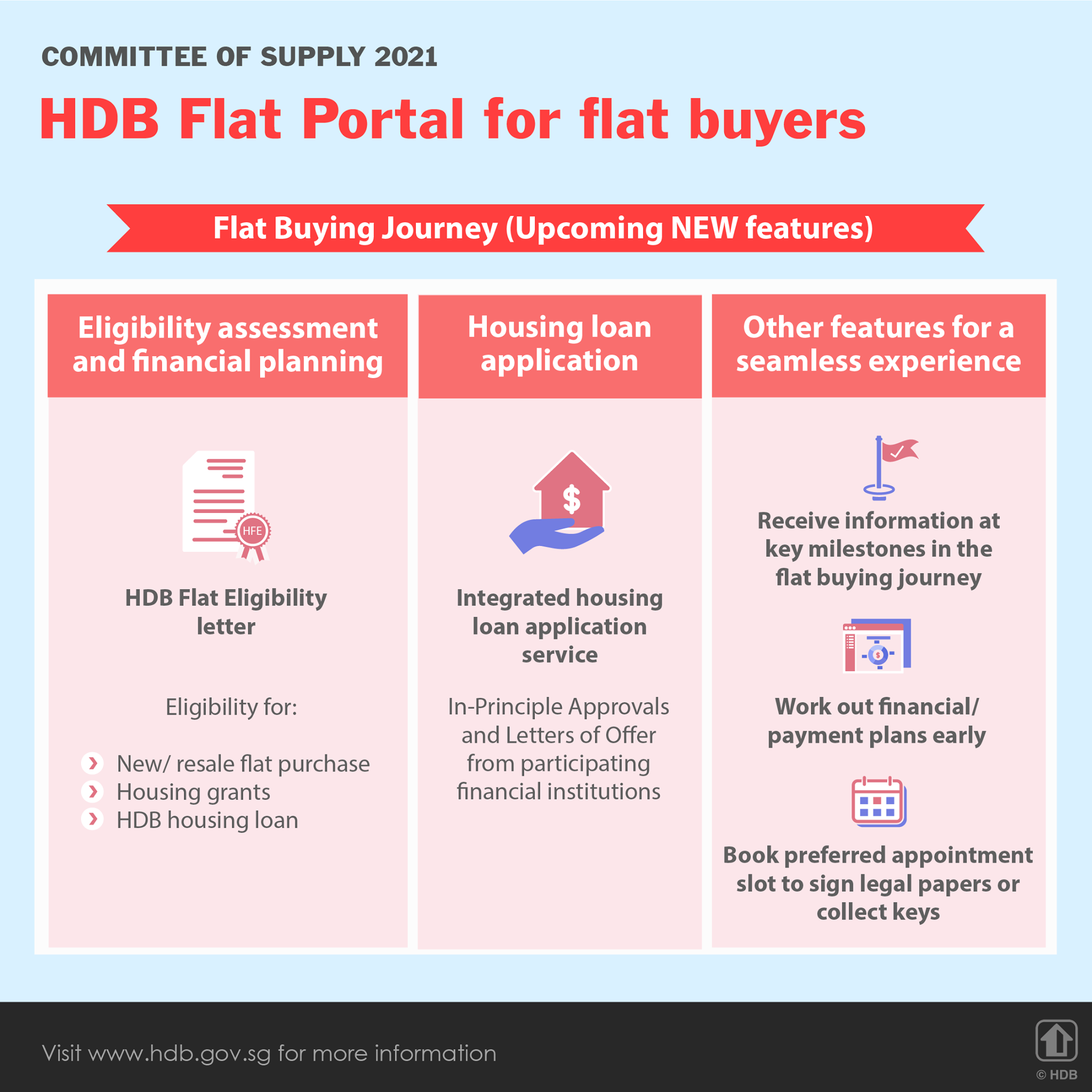

These features include:

- HDB Flat Eligibility (HFE) letter

- Integrated housing loan application service with participating financial institutions (FIs)

- Digital platform to guide new flat buyers

The HDB Flat Eligibility letter is a new single document that will consolidate outcomes on buyers' eligibility for a new or resale flat purchase, and the amount of housing grants and HDB loans they qualify for will be rolled out, HDB in its release on the same day.

HFE letter

Currently, eligibility for a flat purchase, CPF housing grants and HDB housing loans are assessed at different stages of a flat buyers' journey.

Through the HDB Flat Portal, the eligibility assessment for HDB flats, grants and loans will be via a single application.

This will provide flat buyers greater clarity on their total housing budget and financing options in one document.

It will also inform flat buyers of their eligibility for a new or resale flat purchase, and how much housing grants and HDB housing loan they can qualify for.

The feature will also allow for back-end link-ups with other government agencies to retrieve applicants' particulars required for HDB's assessments with the applicants' permission.

This reduces the need for applicants to manually enter their particulars or submit supporting documents repeatedly.

Integrated housing loan application

Currently, flat buyers who want to apply for a housing loan from financial institutions (FIs) to buy an HDB flat are required to submit separate applications to the various FIs.

The new feature will enable home seekers to apply for housing loans from participating financial institutions directly on the portal.

According to HDB, this new feature will also help flat buyers apply for In-Principal Approvals and Letters of Offer from participating FIs at relevant touchpoints.

Photo via HDB on Facebook

Photo via HDB on Facebook

As a result, flat buyers need not separately submit housing loan applications and documents to the various FIs, as well as the loan application outcome to HDB.

New digital platform

A new digital platform in the HDB Flat Portal will also be rolled out to guide new flat buyers.

The platform will:

- Consolidate and present information to flat buyers at relevant milestones during the flat purchase process

- Facilitate flat buyers in planning ahead by working out their financial/ payment plans

- Allow flat buyers to reserve their appointment slot to sign legal papers or collect keys to their booked flat

HDB flat portal

The HDB flat portal was launched in January 2021 for home buyers and sellers to gather information on the purchase or sale of a flat on a single integrated platform.

It currently offers features such as customised financial calculators, one-stop loan listing service and a flat-listing service for new HDB flats.

Top photos by Shermin Ng via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.