In his speech during the Budget 2021 debate on Feb. 25, Workers' Party Member of Parliament Jamus Lim said that we should exercise caution in any decision to taper financial assistance to families and companies.

He explained that despite the appearance of recovery, the economy might not have returned to its long-run potential.

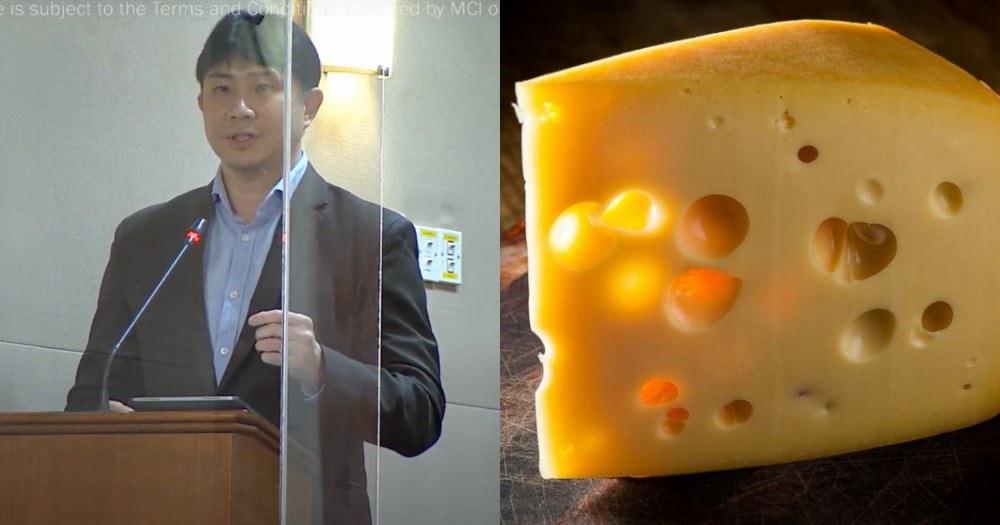

"We must bear in mind that at the moment, the economy is very much like Swiss cheese. By which I mean that while it may look solid, it is in reality, still riddled with holes," said Lim.

Lim explained that the economy contracted by 5.4 per cent in 2020.

He added that if the Singapore economy manages to grow at the upper limit of what MTI has forecasted, it would still be below the level that the economy would be at, if it had grown at 2019's rate through to 2021.

Be wary of austerity

Lim cited what happened in Europe as a cautionary tale for Singapore.

He said that the decision made by a number of countries in Europe to embark on austerity measures in 2010 led to those economies going "into a double-dip recession, prolonging economic pain, just as households and firms were in the process of pulling themselves out of a massive hole".

"To be clear, there are those who will argue the opposite, that if we take too long, we run the risk of overstimulation, stoking the flames of inflation. But I, for one, would err on the side of overextending, rather than undershooting, short-term support for our beleaguered economy," he said, cautioning against causing "real economic pain for thousands of workers and businesses".

Opportune time to borrow

Lim also explained that this period might be a particularly good time for the government to incur debt, in part to fund some of the government's fiscal support.

He said:

"If real interest rates are low, as they are today, incurring additional debt, especially when directed toward investment, could give rise to higher growth, and potentially improve national welfare."

Lim suggested that one way to do this is to extend the maturity of debt to 50 or even 100 years. He added that other economies, including Belgium, Israel, and South Korea, have done something similar by issuing bonds at current interest rates.

However, Lim also said that the government can simply choose when to extinguish this debt when the expected returns from the investments no longer exceeds the interest repayments.

Top image from YouTube/MCI.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.