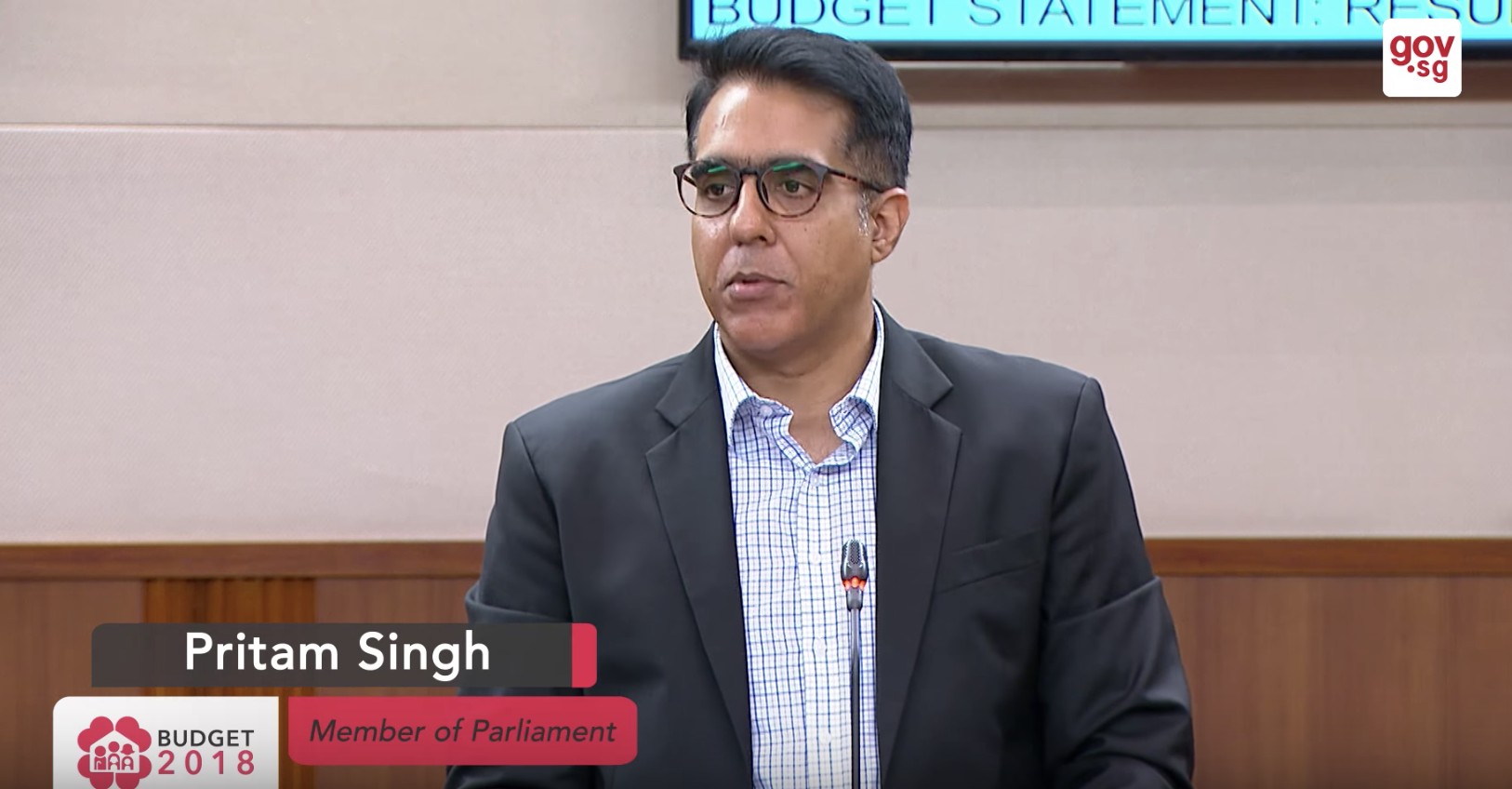

Workers' Party MP for Aljunied Pritam Singh is no stranger to public criticism.

On Feb. 27, he participated in the Budget debate in Parliament.

He said the WP would not be supporting the government's proposed hike in the Goods and Services Tax (GST) and he proposed alternatives for raising revenue.

Opposing the opposition

Facebook page, Fabrications About The PAP posted the following picture and caption, also on Feb. 27:

In case you can't see it, here's what the caption said:

"Pritam Singh accuses hawkers and taxi drivers of under paying taxes.

In his speech he said that with smart nation, and going cashless, the prospect of taxi drivers and hawkers under declaring their income becomes less probable. This will result in a rise in tax revenue collected by the government.

Taxi Drivers & Hawkers so very de huat. WP thinks collect their evaded tax is enough to cover for GST."

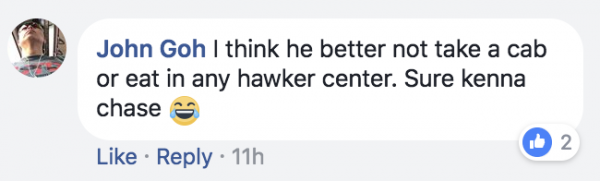

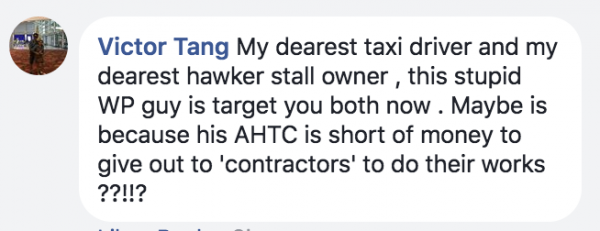

This prompted some passionate comments decrying Singh's speech:

Screen shot from Facebook.

Screen shot from Facebook.

Screen shot from Facebook.

Screen shot from Facebook.

Screen shot from Facebook.

Screen shot from Facebook.

Singh replies

Singh fired back, putting up a Facebook post of his own, also on Feb. 27.

You can see it below:

And in case you can't read it, here's what the caption says:

Fake News Alert!

-----------------------

There have been a few inaccurate posts from our kawans at Fabrications About The PAP, FLOP amongst others, about some remarks I allegedly said about taxi-drivers. Such posts even have me quoted - " ?"!

This is one aspect of the fake news landscape. It is not the first, nor will it be the last time such fake news will be circulated to malign the reputation of the Workers' Party. This is what I actually said:

"26. In addition, the journey to become a smart nation - another plank of this year’s budget - is likely to make Singapore more efficient in tax collection. There is also the question on the move to become a cashless society and the impact this will have on sectors which have traditionally been thought to under-declare their income such as the self-employed, hawkers and taxi drivers. This prospect will become less probable with the advent of more electronic transactions and in turn, is likely to have a positive impact on tax revenues. Furthermore, with borrowing backed by a Government guarantees proposed for large infrastructure projects, more spending for such projects can potentially be allocated elsewhere for recurrent spending."

The context of my remarks were in relation to the WP's stand not to support the proposed GST hike at this moment in time because of the lack of clarity surrounding projected expenditure when the Government raises GST in future, the relative lack of information on whether there is scope for the reserves to better support Singaporeans and the absence of any information on the Government's GST offset package for the low and middle income.

For those who are interested, the window to submit feedback to the Select Committee on Fake News is still open!"

You can also hear what Singh said for yourself by watching the video of his speech below.

The relevant part begins at 17:10:

Back and forth

So, what to make of it all?

FAP said that Singh "accused" hawkers and taxi-drivers of under-paying their taxes. With the smart nation initiatives, under-declaring income will become less probable and result in a rise in tax revenue.

If you view Singh's speech, he described sectors such as the self-employed, hawkers and taxi drivers as those who have "traditionally been thought to under-declare their income".

He added that electronic transactions will make this less probable, which is likely to have a "positive effect on tax revenues."

Compensation?

But Singh did not suggest anywhere in his speech that this measure alone would be enough to make up for stopping the two percent hike in the GST, as FAP implied.

Instead, the stated reasons for why the WP opposed the GST hike was that they believed:

- There was a lack of clarity around projected expenditure when the government raises the GST.

- There is a lack of information about whether there is scope for the reserves to better support Singaporeans.

- And there is a lack of information on the GST offset package for the lower and middle-income Singaporeans.

Double down

Still, FAP ran with it, putting up a couple more Facebook posts doubling down on the claim that the WP wants to do away with the GST altogether and replace it with collecting taxes from "traditional tax evaders".

Caption reads:

"WP says no need GST, just need to collect the taxes from traditional tax evaders who under-declared their income like taxi Drivers & Hawkers.

We thank Pritam Singh for viraling what he actually said in parliament."

The caption for the above video reads:

"The Workers' Party argues no need for GST hike, just need to collect the taxes from traditional tax evaders who under-declared their income like Self employed, Taxi Drivers & Hawkers.

We thank Pritam Singh for viraling what he actually said in parliament."

FAP also responded directly to Singh's own Facebook post with another one, this time unrelated to GST but on a laundry list of issues FAP is dissatisfied with, on Feb. 28:

Singh has yet to respond to that last post.

Select Committee member

Singh happens to be the WP's representative on the Select Committee on Fake News.

In his post, he mentioned that the window to submit feedback to the Select Committee is still open.

Recently, The Straits Times reported that the deadline to hand in written submissions to the Committee had been extended to March 7, 4.30pm.

Related story:

Top image from Gov.sg's YouTube channel

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.