Clarence Teo is your average working Singaporean.

Like the average working Singaporean, he occasionally heads abroad on work trips, like the one in December last year to Vietnam.

And like an average working Singaporean on a month-long work trip, Teo hung out in places he liked, such as Tom's Bar, for dinner and the occasional nightcap.

In total, he claimed he made about 10 visits to the bar, mostly alone and on occasion with colleagues, and spent about $100 (about 1,600,000 Vietnamese Dong) on each visit.

He paid for these using a UOB PRVI Miles MasterCard, enabled for overseas use.

So about $100 multiplied by 10 visits, Teo estimated that his expenses should have come up to somewhere in excess of $1,000.

Imagine his surprise, then, when he returned to Singapore to discover that his bills coming from Tom's Bar came up to more than 10 times that.

Teo sent us photos of the forms he submitted to UOB detailing the transactions he was disputing — a total of $5,247.57.

Teo told us that as soon as he discovered the questionable transactions, he called UOB's customer service, who initially directed him to report his case to the police — in Singapore. He said:

"I was told there was no need to raise a credit card dispute as it was a police matter. I went down to a branch and filled up the dispute forms anyway, because I wanted to be thorough."

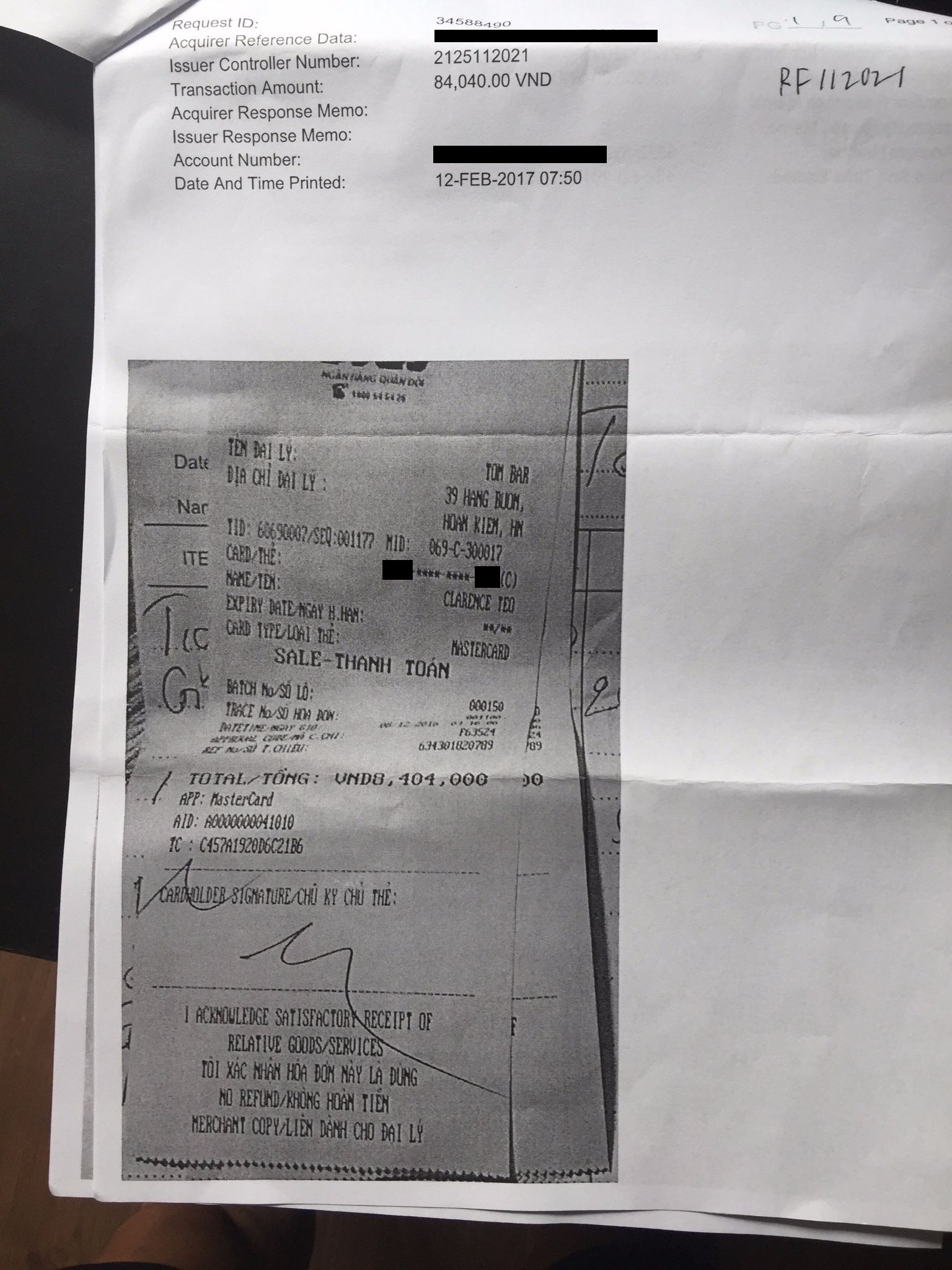

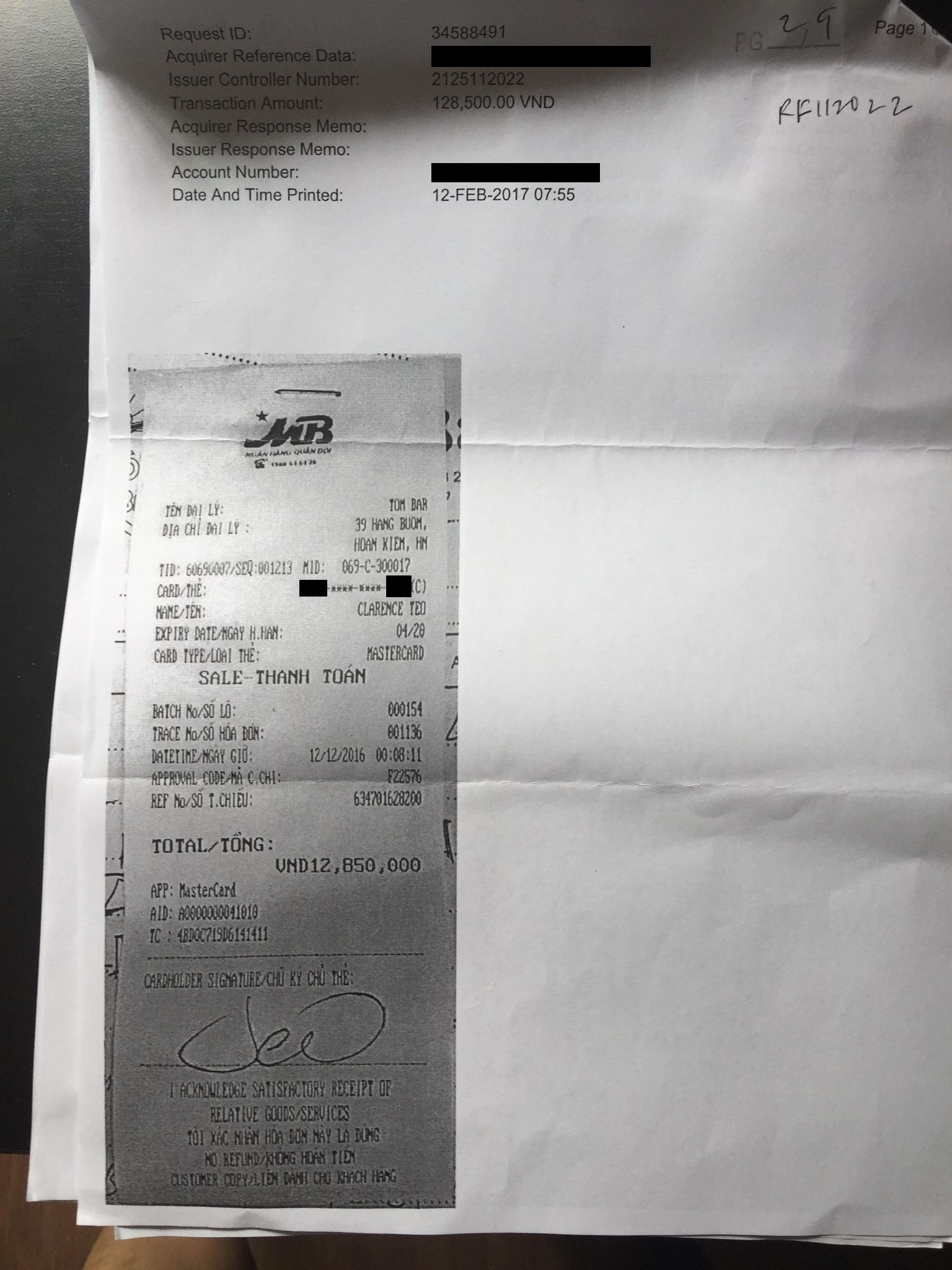

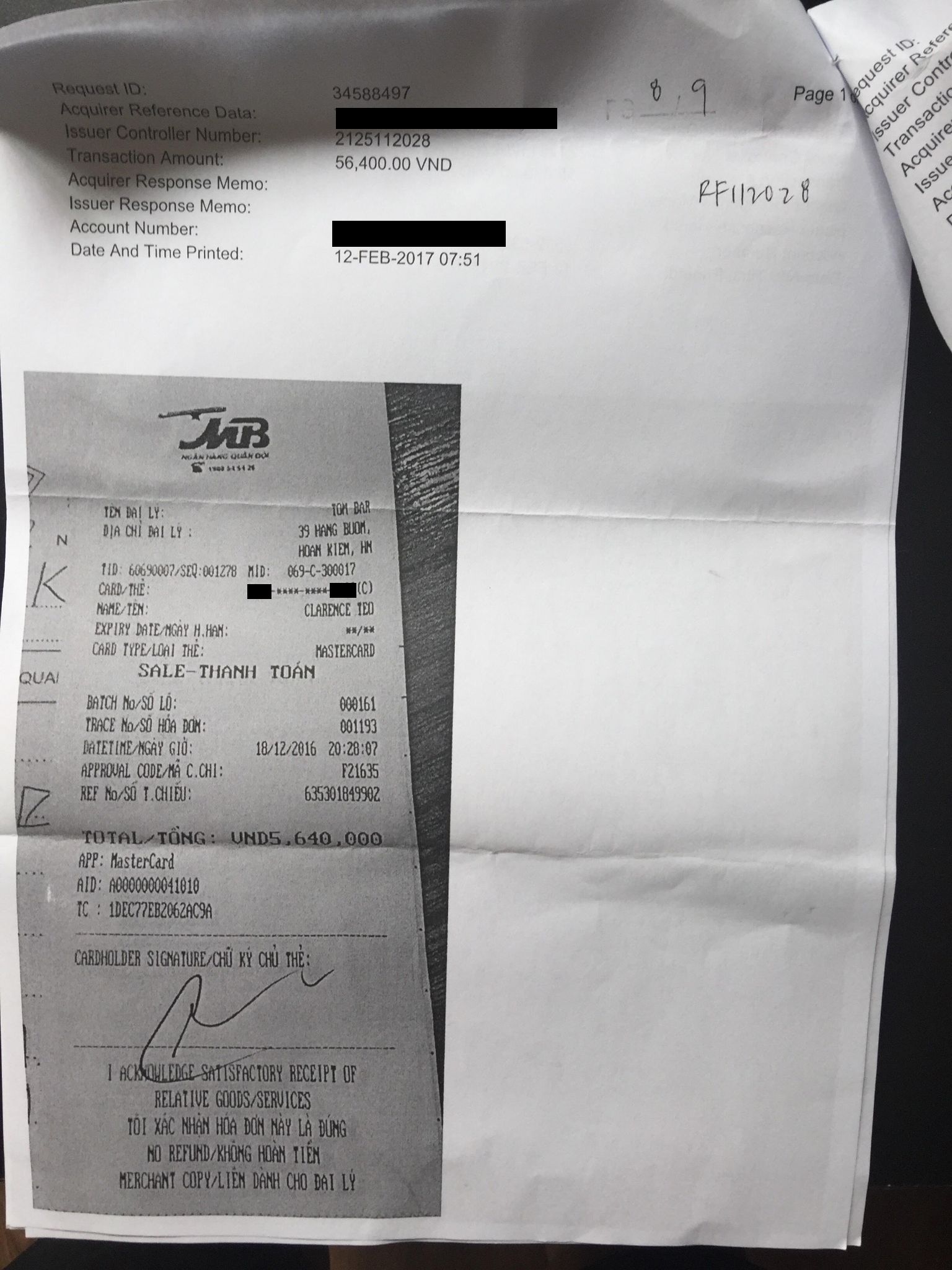

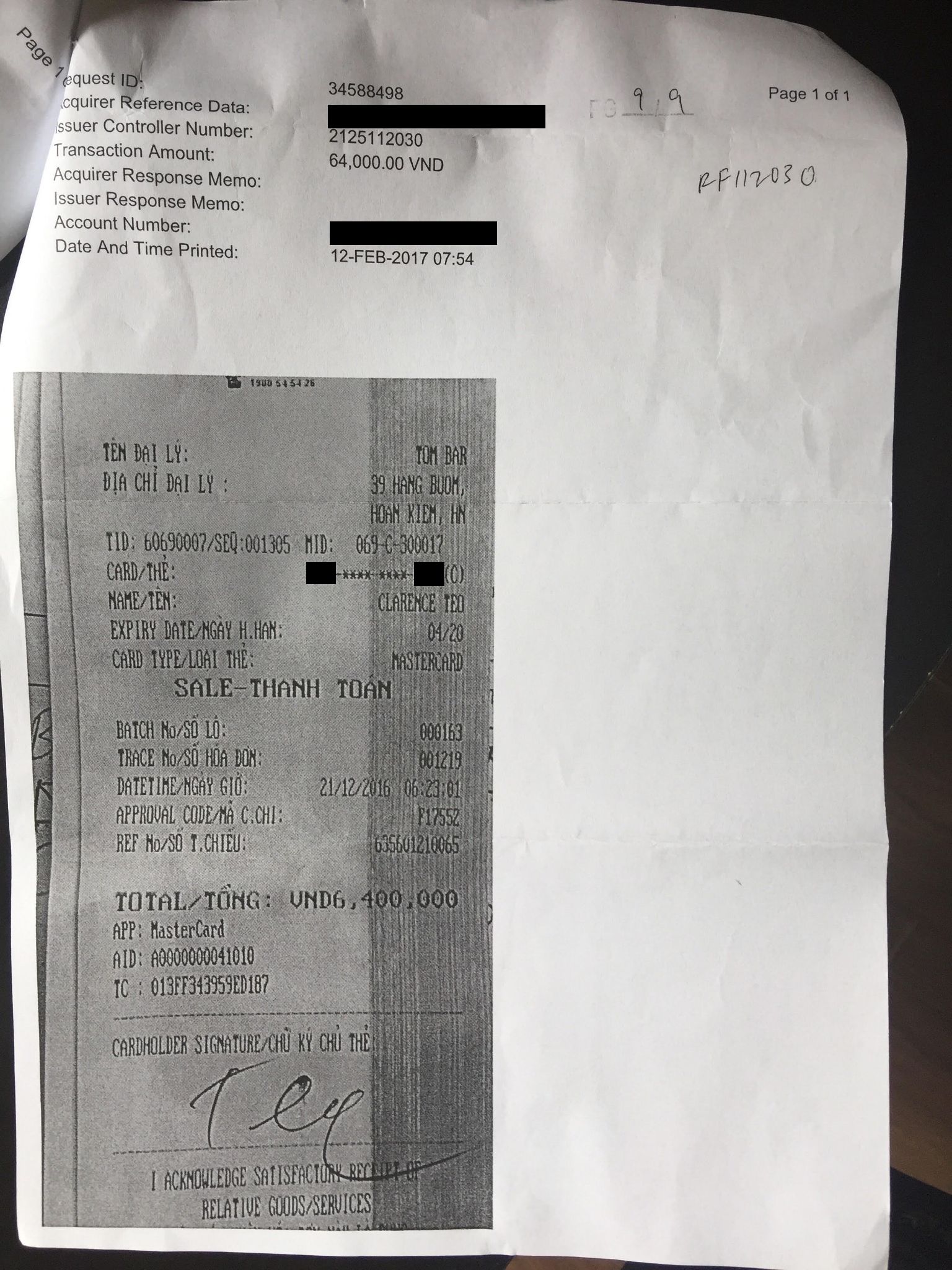

Teo says two months passed before he received a letter from UOB, with pages of scanned receipts from Tom's Bar. These were some of them:

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

He found that not only do the signatures above look significantly different from one another, only one out of the list of signatures looks even vaguely like his original card sample signature, which he showed to us but which we won't publish in the interests of security.

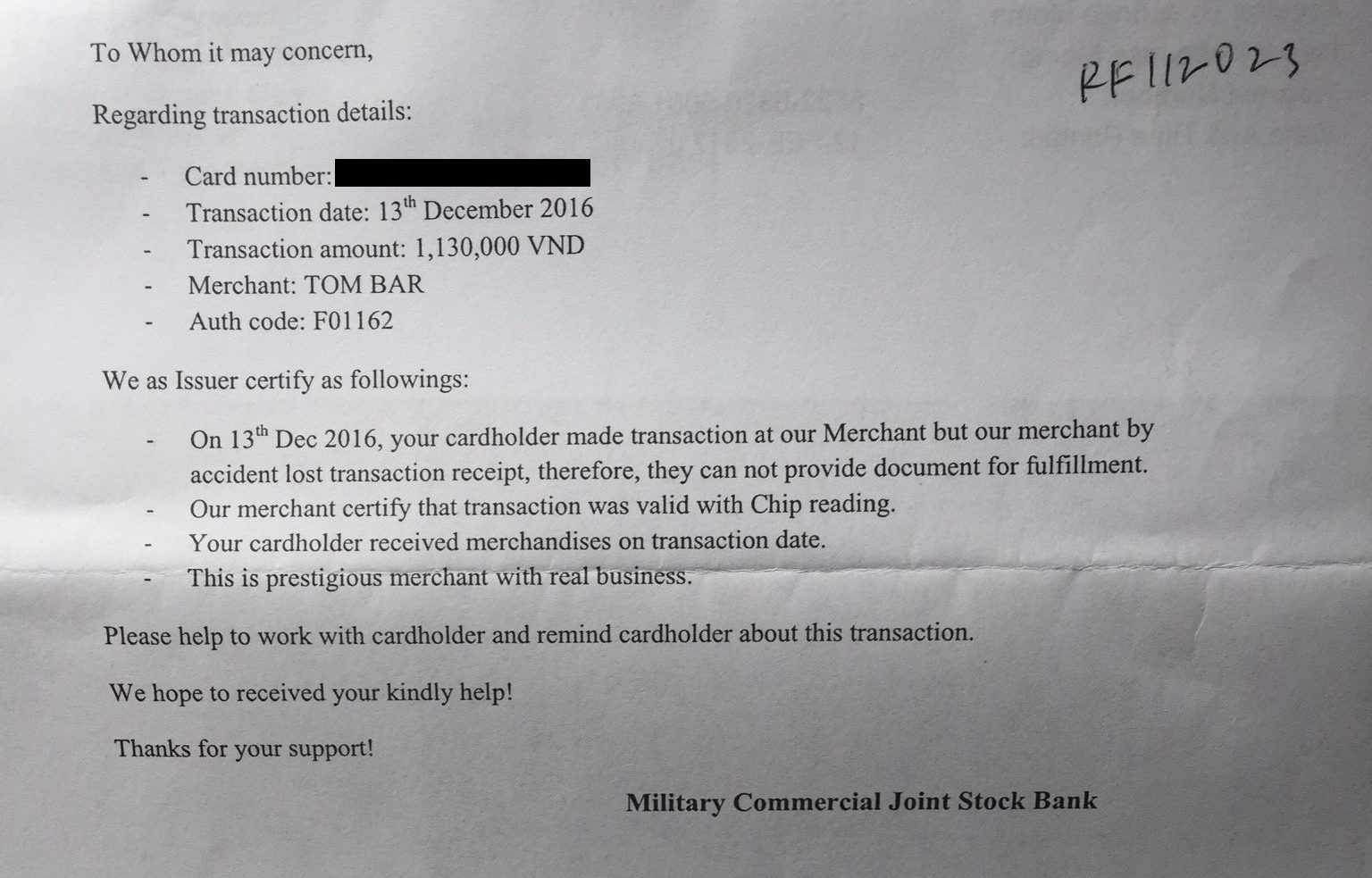

There was also another declaration where apparently some receipts were "by accident lost":

Photo courtesy of Clarence Teo

Photo courtesy of Clarence Teo

And all this was topped off by a computer-generated letter that informed him that the matter was deemed to be "resolved".

And here's where this story becomes especially important: Teo tells us that on all the occasions he visited Tom's Bar, he was only presented with sales receipts from the merchant to sign.

On no occasion, he added, did he ever sign a receipt printed from a credit card machine — a fact he didn't feel the need to raise suspicion over because the amounts he signed off on were always, to his mind, insignificant. All his bills from the restaurant came up to two digit-Singapore dollar sums, the receipts of which he threw away.

"Card-present transactions"

The following month after being shown the aforementioned allegedly-signed receipts saw Teo being shuttled back and forth between various departments and customer service officers at the bank:

"When they finally got back to me, all that was repeatedly told to me was that it was a 'card present transaction', and that the bank doesn't have any chargeback rights, just because I was present at the restaurant. Oh, and one guy even suggested I go to the Vietnamese Tourism Board, which sounded just slightly more ridiculous than (their) Singapore Police Force idea."

The important thing to note from the above paragraph Teo shared with us is the section we bolded: all the disputed transactions were "card present transactions".

There are two possibilities how credit card fraud could have happened, given the context of Teo's specific case: double-dipping, or card-not-present transactions.

In the case of double-dipping, the merchant swipes your card strip or inserts its chip into the machine twice — once to bill you for your actual amount, and the second time for a second inflated amount, which they plan to steal from you. They then mimic your signature, and it's done.

For card-not-present transactions, the merchant takes note of your credit card details, including your three-digit security code, and uses them for fraudulent payments — for instance online shopping.

In Teo's case, neither of these happened. He was at Tom's Bar when the disputed transactions took place, and they also took place using his card's chip — the printed credit card receipts stated as much.

Consequently, the bank defined them as "card present transactions", taking into account the fact that its rightful owner was present when the transactions occurred, and also that there was no double-dipping. Therefore, they conclude, fraud didn't happen.

So here's Teo's theory of what happened:

It appears to Teo that the amounts on all the receipts he signed at the store varied widely (perhaps the term exponentially is applicable here) from the amounts actually charged to his card.

Unfortunately, because he did not have sight of the credit card machine-printed receipts, he did not know how much was actually being charged to it.

He recognises on hindsight that he was too trusting, by assuming that there was a different system, or that payments under $100, for instance, can be done without a signature (using PayWave or PayPass, for instance), perhaps.

In terms of avenues to get his money back, though, taking it up with the card issuing bank is tricky for Teo, as his experience above has shown thus far.

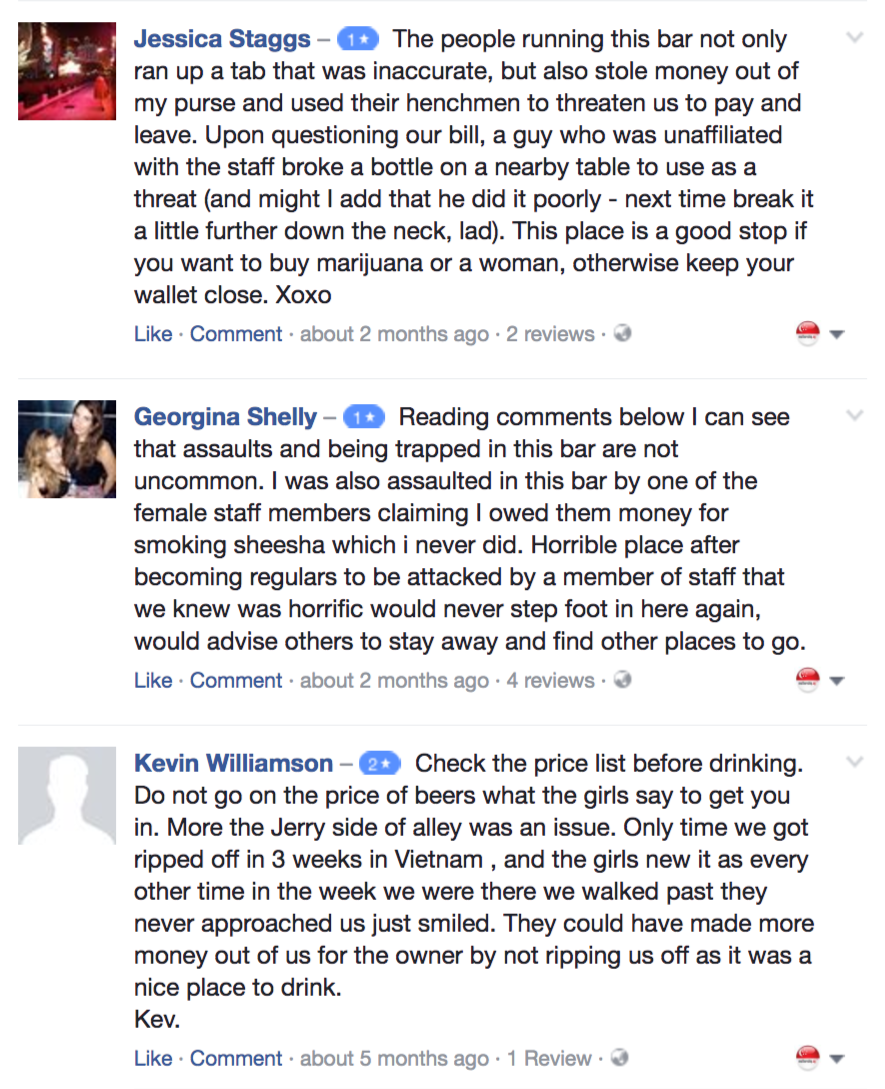

By the way, Tom's Bar seems to be a fairly popular restaurant-bar in Hanoi. It has an unofficial Facebook page with some good reviews and even has listings on sites like TripAdvisor and is recommended on a couple of travel blogs.

However, there are also reviews like these:

Screenshot from Tom's Bar unofficial Facebook page

Screenshot from Tom's Bar unofficial Facebook page

UOB's response

Here's what UOB said in response to our queries on Teo's case:

We are unable to comment publicly on any customer’s case. Instead, we liaise directly with the customer to render assistance. We would like to take this opportunity to remind cardholders to remain vigilant when using their cards.

To help ensure cardholders do not fall victim to fraudulent practices, there are a number of precautions they should take, such as:

· Set SMS alerts based on your regular spending habits and risk threshold. Always ensure that your mobile phone can receive the SMS alerts sent for transactions made above the threshold you have set.

· When using your card, always keep it in sight. Do not leave it in the possession of the merchant.

· Keep your card transaction receipts and check them against your monthly statement.

So here's the TL;DR of this entire episode/lesson:

1) When you present your credit card to pay for something you purchase, keep an eye on what the cashier staff does with it.

Make sure he or she swipes the magnetic strip, or inserts the chip into the machine, only once. If possible (and if you are extra kiasu), you can also check to ensure that they are entering the right amount that was initially shown to you.

If watching the staff's actions isn't possible, make sure you do the following:

- First, check the bill that is brought to you and confirm it is the right amount for what you purchased.

- Second, make sure you sign on the credit card machine-printed receipt. Check the amount charged against the amount you were shown on the initial merchant's receipt or bill.

- Third, if there is a line on the credit card receipt for "Tip", draw a line diagonally across it so no one can add on the amount for you — well, unless you actually do want to issue a tip, but we'd suggest you do that in cash instead.

If you see any suspicious behaviour or can't observe what they do with your card, for safety, keep the receipts (both the merchant's and the credit card machine-printed ones) in case you need to dispute the transactions later on.

2) Before patronising an establishment overseas, it might be a good idea to first check out customer reviews on various sources.

That way, you'll know if they have a reputation for inaccurate billing, or any other things to be careful and watch out for, if you still choose to visit the place.

There are of course many honest businesses overseas, but it never hurts to be careful when travelling, especially where credit cards and large sums of cash are concerned.

Here's a great discount you should check out.

One of these destinations is the perfect post-tax filing vacay because 99% off

Top photo from Huyen Luong's Facebook page

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.