Recently, National Development Minister Lawrence Wong blogged about how leasehold HDB flats would return to the state once its lease was up.

It's not very surprising, because that's the definition of leasehold.

The larger point Wong made was that not all flats would be guaranteed to be picked as part of the Selective En bloc Redevelopment Scheme (SERS) when the lease runs out.

Wong also revealed that only 4 per cent of HDB flats have been part of SERS since it was introduced in 1995.

The possible reason behind his comments? He wanted to remind Singaporeans to consider the consequences of overpaying for expensive resale flats in mature estates such as Tiong Bahru and Queensway.

Some of these buyers may be "encouraged" to buy such flats by property agents who suggest and assume that flats with leases that are ending will definitely undergo redevelopment via SERS.

HDB flats "provide a good store of asset value"

In a new Facebook post (Apr. 12), Wong said he wanted to provide additional perspective following his first post. He said that HDB flats were a good store of asset value as long as buyers planned ahead and made prudent housing decisions.

He used the example of a 30-year-old couple who could buy a resale 4-room flat in Woodlands with a lease of 90 years. He said they could enjoy subsidies of up to $75,000. And when the couple is ready to sell their flat in 35 years when they reach 65 (with 55 years left on the flat's lease), they could possibly "get quite a lot of money from the sale proceeds – around $100,000 upfront in cash, plus $500 per month of additional income for their retirement."

He said that should the couple wish to continue staying in their current home, they could "apply for the Lease Buyback Scheme or LBS. This means they continue living in the flat for 30 years and sell the remaining 25 years back to HDB. They can enjoy a cash bonus of $10,000. In addition, they will get $47,000 in cash plus $400 a month for retirement."

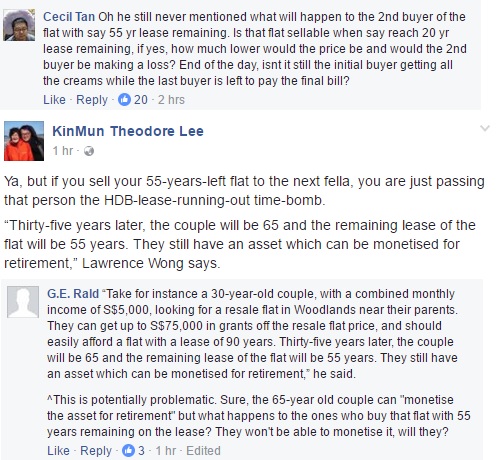

What about the second couple who bought the first couple's flat that has 55 years left on the lease?

Netizens pointed out that while it sounds rosy to be the first couple, things may be a little uncertain for the second couple who bought the resale flat from the first.

Wong ended his post by saying that "your HDB leasehold flat is not only a good home, but also a nest-egg for future retirement needs. That's what we have achieved and that's what we will continue to ensure -- both now and in the future."

Singaporeans who are planning to buy resale flats should exercise prudence as Wong suggested and "choose wisely" for their flats to remain a nest-egg for retirement needs.

If they didn't exercise caution, they are putting all their nest eggs in one SERS basket.

Related article:

The 99-year time bomb some Singaporeans are sitting on

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.