Fail to understand basic financial concepts early in life and you might be suffering the effects for years to come – no matter how much you earn.

You’ll blame your parents for telling you that saving money in biscuit tins was a good choice, and spend the final years of your life slogging it out, wondering what happened to your youthful days of wanderlusting.

TLDR; if your financial knowledge is zero, then chances of you enjoying life when you’re 50 (or even 40) will probably be limited without money set aside.

So you have two options:

You can take the easy way to boost your knowledge by watching this video of Sylvia from NOC and Joshua Tan (from ABTM) having their financial know-how put to the test...

" width="560" height="315" frameborder="0" allowfullscreen="allowfullscreen">

Or you can read our explanation of five financial concepts as a start...

Still with us? Great.

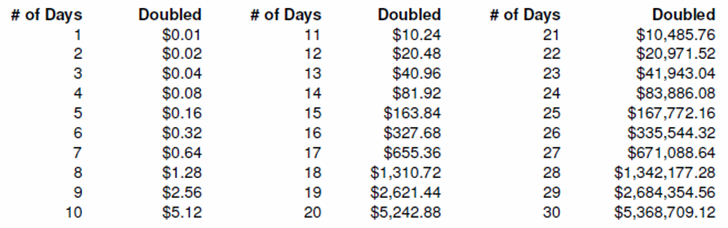

1. One a penny, two a penny ... Save with Penny Doubling

What it is: The term comes from the idea that if you double 10 cents every day for 30 days, you would get approximately $5.3 million at the end. That means a 100% growth rate every day – super unrealistic in real life.

A more realistic growth rate would be like 4% a YEAR in the stock market. This seems miserable compared to doubling your money every day, but hey, if you save a thousand bucks monthly for the next 40 years, you would have a whopping million bucks when you reach 65 years of age.

Of course, the stock market carries many risks.

Real-life implications: Now here’s the thing you really need to know: dollars saved in your teens/20s are worth much more than those saved in your later years (further reading: Why saving when you are young always helps).

The more time you have to save, the more you stand to earn at the end.

So here’s what you need to do: If you, like many Singaporeans, can only afford to save a few hundred dollars each month, then start saving early. Oh, but pay off your debt first...which brings us to:

2. Make Compound Interest work for you, not against you

Image from here

Image from here

You’ve probably heard about simple/compound interest before – we used to learn about it in primary school. Turns out it’s more important than most of what we learnt later on in school (I’m talking about you, Differentiation.)

What it is: The addition of interest to the principal sum of a loan or deposit.

In simple English? Compound interest can be thought of as “interest on interest,” and will make a sum of money grow at a faster rate than simple interest, which is interest calculated only on the initial amount. Good for you if it’s a deposit. Bad for you if it’s a loan.

Real-life implications: Singaporeans who contribute to their CPF accounts will experience the effect of this compound interest.

Let’s say you are a 25 year old working adult contributing $130 to $250 per month to your CPF Special Account (SA) over the course of your working years. If you stash this amount in a biscuit tin, you would have saved around $55,000 by the time you hit 65. But with compound interest, the amount in your CPF SA would have grown to $165,000.

On the flip side, if you take out a loan without paying the sum off early, compound interest can cause your loan amount to balloon.

For example, some credit card companies charge a daily interest amounting to 24% per annum of the outstanding balance, as well as late payment charges. These quickly add up, and you could be dealing with a five-figure debt before you know it! Don’t believe us? Read about one writer’s painful lesson.

So here’s what you need to do: Take a break from grumbling about the CPF and pay off your credit card debts as soon as you can.

3. Social Norming - What you see may not be what you get

What it is: Remember when you didn’t study for your math paper in secondary school, but were chill about it because everyone apparently did not either?

First, there were your ‘friends’ who wanted you to fail with them. Then there were those annoying kids that claimed to ‘never study’, but always scored amazing grades in the end.

The lesson? Never blindly follow the herd.

Real-life implications: Will you not save money just because every mother son says they don’t? Are you going to shell out money for a fancy drink/car/condominium just because all your friends have one and get into unnecessary debt?

So here’s what you need to do: Learn to care less about what people think about you. Do what’s best for yourself. You’re not 16 anymore.

4. Leaving the best for last with Delayed Gratification

Image from here

Image from here

What it means: You’ve probably heard of delayed gratification’s more impulsive cousin, instant gratification. The latter just means putting now before tomorrow. In other words, YOLO.

Now, YOLO is great and all, but it’s not a justification for being irresponsible when it comes to money. Our school teachers got it right when they went on and on about “Study hard, enjoy later.”

Real-life implications: If you accumulate $100,000 in savings before you’re 30, you could potentially earn a passive income of $4,000 a year if you invest in a financial product that gives you 4% in interest. That’s like not having to work for a month each year.

Sounds good? Well, if you travel to Europe regularly, eat frozen yogurt, drink atas coffee every day and own multiple designer bags, then it’s highly unlikely a typical Singaporean will ever achieve that.

So here’s what you need to do: Don’t anyhow spend all your money now. Save up regular amounts of money early on in life, so you can have the option of slacking off later in life.

5. Divide and conquer with Diversification

Image from Gettyimages

Image from Gettyimages

What it is: Basically, don’t put all your eggs into one basket.

Real-life implications: Baskets break, companies go bankrupt and people can fail you.

So here’s what you need to do: Stocks and investment products are great, but they carry different risks. Reduce your risk spreading your money around stuff like insurance, bonds and CPF.

And because we’re magnanimous folks who want you to be financially secure, here’s a whole bunch of helpful articles for further reading:

Buying a home? Things you need to do beforehand.

Thinking of having kids? What you need to know before starting a family.

Want to invest in the stock market? Read this first.

Get inspired to having 100k before 30 here. And use this to calculate if you can do it.

The Singapore Savings Bonds are probably the next safest thing compared to CPF. Find out more about them here.

In case you missed it in 2014, this girl went viral for saving $20,000 a year. Find out how she did it.

Not investing? If you’re accumulating the bulk of your wealth in a savings account, at least pick a good one.

This post helps fuel Mothership.sg so that our writers can practice delayed graitfication now by putting money aside to earn compound interest. (And hopefully retire by 65.)

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.