There's been a lot of talk about how the malls in Orchard Road are on metaphorical "life support", what with many undergoing a range of tenant renewal, upgrading works and/or renovation at the same time.

Many reasons have been cited for these changes — high rent, "cookie-cutter" malls carrying all the same big name brands, smaller players being muscled out by larger ones, and the rise of heartland malls that eliminate a real need to travel to Orchard to shop, among the key ones.

But is that really the case? We were contacted by Raymond Chong, who owns and runs a Spanish restaurant at Orchard Central, who explains his take on the shopping situation in Orchard:

1) Is rent on Orchard Road the main push factor?

Chong says rent is "definitely not" the reason shops are leaving Orchard Road.

For one thing, he hears from other tenants and receives rent offers for sites in Orchard ranging from as low as $5 to $8 per square foot — to his knowledge, rent at malls like Westgate or JEM average $20 and up per square foot, while comparable spaces at crowded malls like NEX, for instance, cost a minimum of $50 per square foot.

A search on Property Guru shows similar findings:

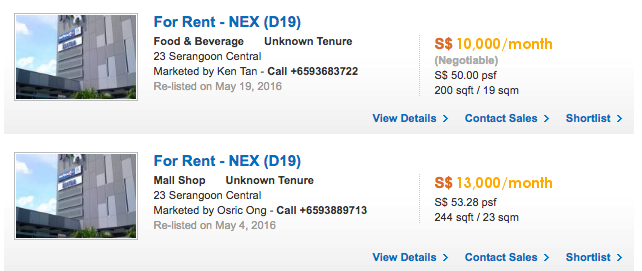

1. These were the only two listings for NEX:

Screenshot from propertyguru.com.sg

Screenshot from propertyguru.com.sg

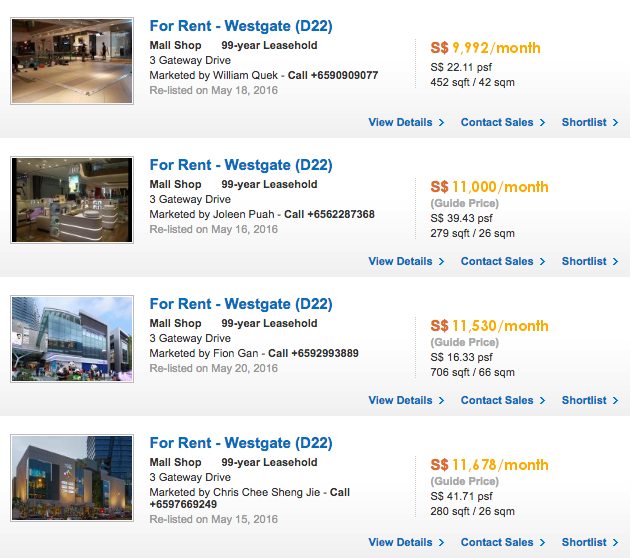

2. A sampling of listings at Westgate:

Screenshot from propertyguru.com.sg

Screenshot from propertyguru.com.sg

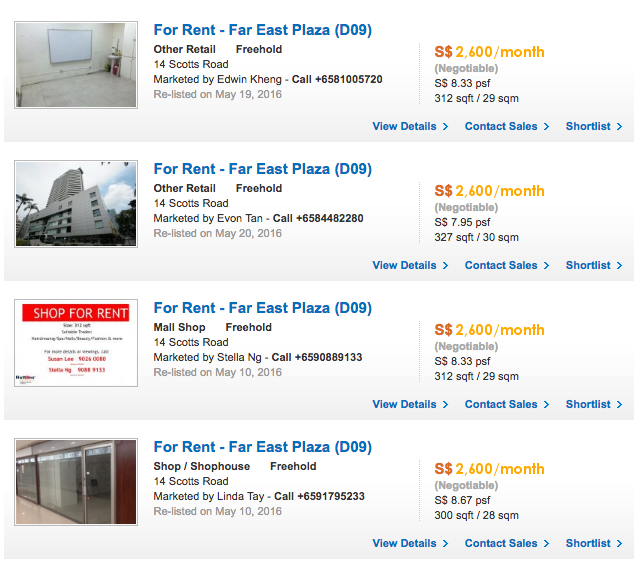

3. Some of the rates for Far East Plaza:

Screenshot from propertyguru.com.sg

Screenshot from propertyguru.com.sg

Chong tells us from his experience that very often, rent negotiations are a subjective and opaque process, where a shop unit of the same size as his and just opposite can be going for 20 per cent lower, while remaining vacant for over a year, for instance.

Sometimes, landlords call to offer spaces with attractive-sounding rents — he once heard of $3 per square foot at a "really ulu lot". Also, larger players like Uniqlo (which will be opening at Orchard Central over multiple floors later this year) enjoy even lower per square foot rent.

Perhaps the strongest evidence for rent not being a factor is the case of iwanna, a cupcake shop whose owner has decided it is more financially viable to keep his store closed, because it's more expensive to have it open than to leave it closed and pay rent.

"Even if rent is zero, the shop cannot find enough daily sales to cover its variable operating costs. Otherwise a rational owner would have continued its business even if it cannot recover its fixed costs."

2) Tenants are being pushed around.

Photo by Lim Weixiang for Mothership.sg

Photo by Lim Weixiang for Mothership.sg

Chong feels strongly that mall landlords have a big part to play in the ongoing crisis — their strategies and decisions affect the number and types of shops, stalls and restaurants that remain open, and the foot traffic that follows.

After all, it isn't at all that pleasant to walk around a mall that is mostly boarded up.

And if many malls choose to do upgrading work or tenant renewals at the same time (which is what's happening now) it generally isn't as exciting for a customer or diner to explore them as a whole anymore.

In Orchard Central, for instance, he observes that more shops have moved out since the beginning of this year than large incoming players like Uniqlo were going to occupy. These folks did not choose to do this, says Chong: in majority of the cases, the landlords, Far East Organisation, chose not to renew their lease or jacked up rent for new leases beyond their willingness to pay.

With regards to the move of bringing in Uniqlo and displacing tenants, a Far East Organisation spokesperson told The New Paper in Dec 2015 it was all part of enhancement works and that "those affected, which is less than 15 per cent of the tenants, were offered to relocate within Orchard Central or to an alternative Far East Organization malls to ensure business continuity ... Majority of the tenants are positive about the change and anticipate the new opportunities this brings."

Why are they doing this? Chong reckons it's to make way for large tenants to move in, since large spaces are deemed to be more desirable for large tenants. It's still empty now, though.

"One can keep arguing that the landlords are being irrational, (but) they can afford to be. These malls are owned by big conglomerates. Big organisations tend to be much slower in responding to trends. Regarding Uniqlo moving into Orchard Central as an “anchor tenant”, or the makeover, the landlord has never so much as informed us the details of their plans, much less involved tenants in their decision-making."

3) The rent situation actually makes stuff better in Orchard than in the heartlands.

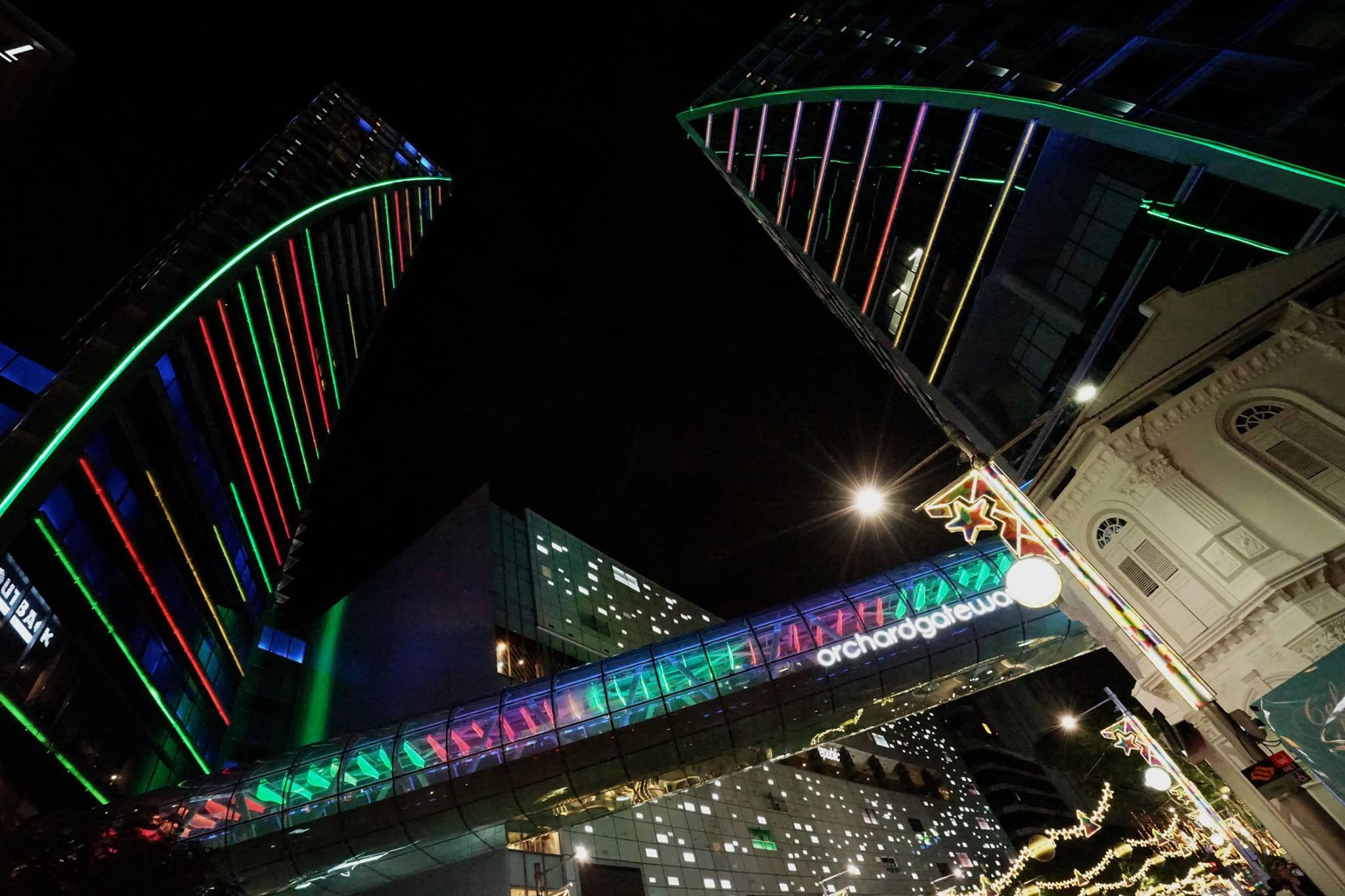

Photo by Francis Yeo L. T.

Photo by Francis Yeo L. T.

People who say Orchard Road malls are "cookie cutter" are looking solely at the big players who are duplicated across nearby malls, says Chong.

The truth is, he argues, lower rent in Orchard allows smaller indie businesses to enter the market, and larger players to experiment.

Take Orchard Gateway, for instance, which features plenty of indie labels in its offerings, while also hosting big players like Crate & Barrel and the Orchard Library. Chong notes that part of their strategy in differentiating themselves is to engage blog shops to set up pop-up stores for a brick-and-mortar presence to their online businesses.

In F&B, he adds, lower rent allows restaurants to focus more on quality, comfort and one's dining experience, as they can afford to spend more on these things per dollar that is paid by a customer.

He explains:

"Rent accounts for the majority of difference in margins. At heartland malls rent is a huge challenge but there is typically no shortage of customers. So the focus is on turnovers and cost savings. Quick-serve meals and uncomfortable seating are the norm. Downtown, quality and value matters much more. In other words, customers are getting *convenience* to shop in the heartlands, whereas customers are getting *variety* and *quality* to shop downtown."

So in some sense, Chong argues, you can still look to Orchard malls for "unique" products and food offerings that you won't be able to find in heartland malls that tend to price out these players.

All that said, the points made by shoppers in this recent article in Today are equally valid — have the Orchard malls made themselves more accessible and family-friendly? Is it still a good destination for people who want to spend their weekends out on the town?

Will you still give Orchard Road a chance?

Related articles:

Photos: Just how empty are Orchard Road malls these days?

Online shopping will kill off many retailers in Singapore, but that is a good thing.

Uniqlo to open biggest outlet at Orchard Central because S’pore doesn’t have enough Uniqlos

EwF apparently told to GTFO by Orchard Central

Roof collapses at Hilton Hotel driveway proves Orchard Road is breaking down

Top image from Thinkstock.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.