Congratulations to all civil servants — you will have received 2.15 months of bonus in total for 2015.

In the government's official press release on the matter, Singapore’s Gross Domestic Product (GDP) growth rates were quoted as the reason for this year's bonus quantum. Of course, this has been the practice of the government for years now – benchmarking civil service bonuses to our GDP growth.

As with many things, we would then ask – are they really?

We decided to do a bit of digging, but found fairly fast that the quick answer is YES.

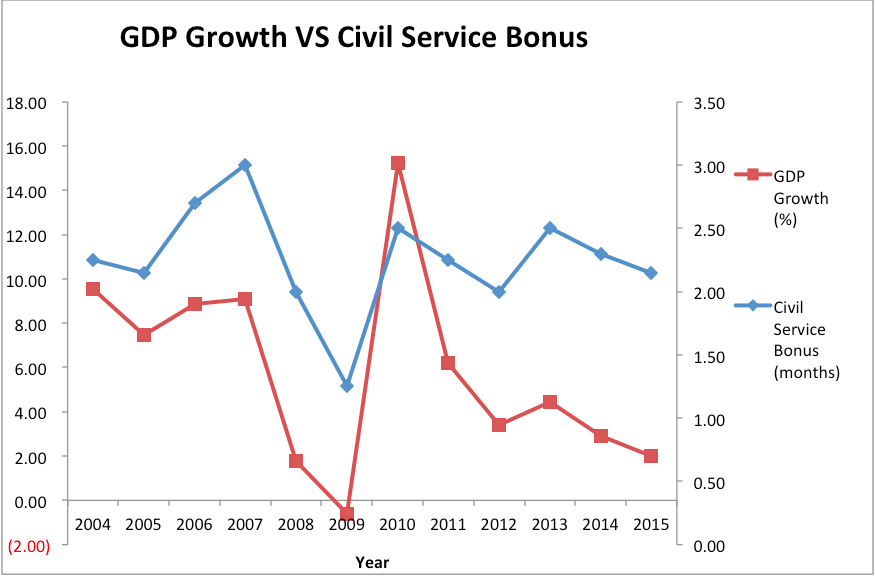

A quick look at the chart below suggests that since 2004, civil service bonus in Singapore has had a strong correlation with GDP growth. The best civil service bonus of 2006 (2.70 months), 2007 (3.0) and 2010 (2.5) were paid on years which recorded near double-digit growths (and beyond). Statistically speaking, the correlation co-efficient over the past decade or so has been +0.67, suggesting an extremely positive relationship (1 being perfectly positively correlated).

Chart by Damon Yeo

Chart by Damon Yeo

So now that's sorted out, here's the next question – is there logic to pegging civil service bonuses in this manner?

Financial incentive is usually defined as some form of material reward (often money) given to an agent, (who, in this case, would be a civil servant) in exchange for acting in a particular way. Bonuses, as we all know by now, should be used to incentivise civil servants to work hard and perform good work.

Based on this argument, it is perhaps a bit random to peg bonuses to GDP growth. GDP of a country grows (and at times shrinks) due to whole lot of reasons, most of which cannot be directly influenced by normal citizens. Yes, there is no doubt that a hardworking civil service (and labour force at large) will have a positive impact to GDP, but year-on-year GDP movements are snapshots and are affected by global events beyond anyone’s control.

Take 2009 for example. Singapore GDP shrank (like most other developed countries) as the world reeled from the spill-over effects of the sub-prime crisis. Not many Singaporeans (and definitely not many local civil servants) had a hand in that crisis. It is unfair to penalise civil servants by handing out less bonuses.

With that in mind, what else can the government benchmark civil service bonuses to?

1. Inflation

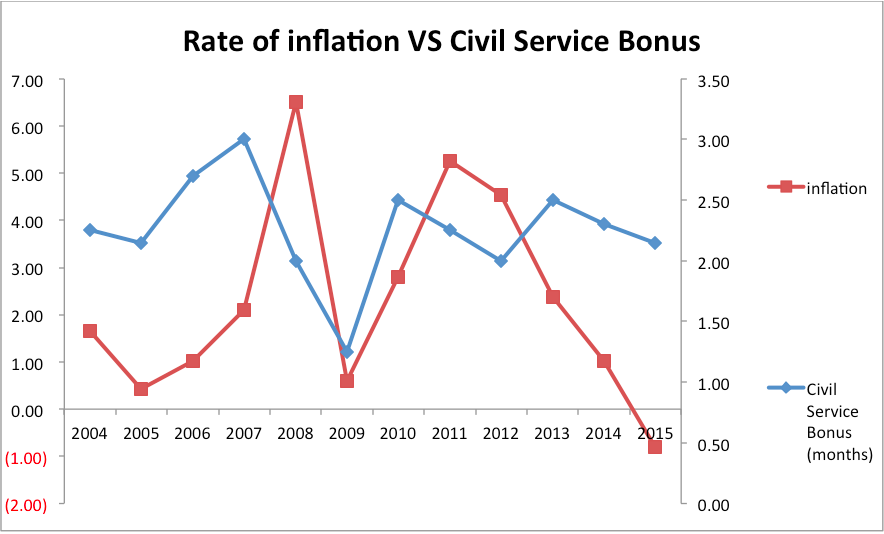

Currently, the rate of inflation in Singapore has no correlation relationship with civil service bonuses at all (coefficient =-0.01). Perhaps it makes sense to establish a more direct link between inflation and civil service bonuses going forward.

Chart by Damon Yeo

Chart by Damon Yeo

The reason to do so is simple – to help a large percentage of the workforce cope with higher prices.

Simply put, in a year where prices of goods have gone up, civil servants should receive a larger bonus at the year-end to be able to afford the same amount of goods and services as the year before. Civil servants at the lower pay scale will particularly benefit from this.

2. Budget Surplus (after excluding infrastructure investments)

Every year, the government maintains a budget. Generally, Singapore has maintained a policy of budget surplus in the long term. It will make sense to peg civil service bonuses to our budget surplus (or deficits) because all civil servants can play a part, however small, to influence this throughout a year.

To be fair, many different government bodies have schemes and rewards for civil servants who come up with cost saving measures all the time, but on the whole, if policies can be tweaked to incorporate all cost savings into eventual bonus pay-outs then a cost-efficient culture can be nurtured.

That said, additional data and calculations are required to ensure that infrastructure investments are adjusted out of budget calculations to give a fair view on this.

3. House Price Index

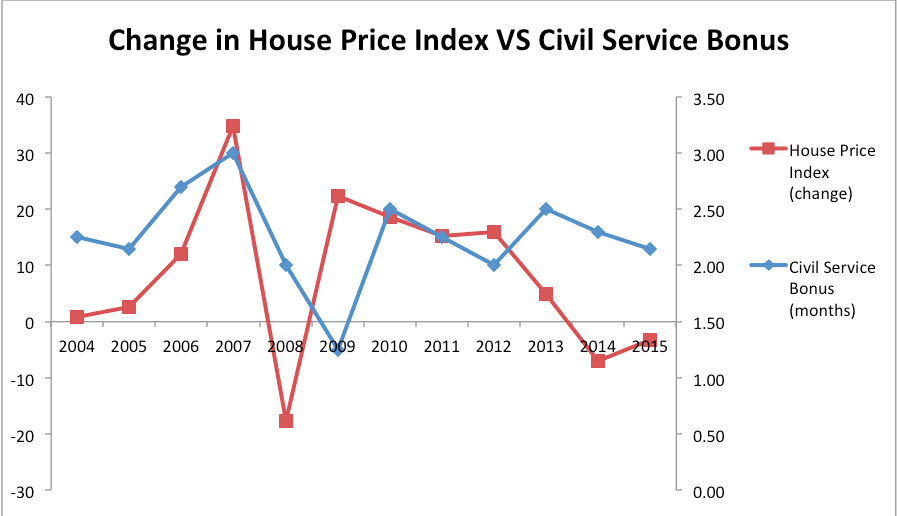

There is currently only a slight positive correlation between the change of House Price Index and Civil Service Bonus (coefficient = 0.22)

Chart by Damon Yeo

Chart by Damon Yeo

The cost of home ownership in Singapore has been a hot topic for a while now, so benchmarking civil service bonuses to the change in the House Price Index can go a long way in helping the population afford houses more readily.

Many Singaporeans rely on saving their bonuses to build enough cash to afford down-payments for properties nowadays so it makes sense for civil servants to be paid more bonuses on a year when house prices have gone up.

However, the House Price Index is volatile in nature and is by no means influenced by civil service performance, so it will not be wise to benchmark bonuses entirely on this index.

A Scorecard

All in all, it is apparent that basing civil service bonuses on GDP growth alone is insufficient.

In this day and age where data are readily available, a civil service scorecard should be tabulated to give the government a better indicator on how much bonuses to pay. It is also paramount to make this scorecard transparent to all so that every civil servant can have the sense of ownership that their everyday work contributes somewhat to their bonuses.

Related article:

0.65 month year-end bonus for civil servants

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.